Original content

Brazilian mills are ramping up sugarcane crushing, yet a recent revision by Wilmar International, a leading global agri company, indicates record-low Center-South sugar stocks at the start of the season, slashed from 4.3 million metric tons (mmt) to just 1.9 mmt, a staggering 2.4 mmt reduction. This suggests fewer buffer volumes heading into the harvest peak. While crushing remains strong, such low starting levels limit slack in the system and could bolster pricing if export demand picks up.

Despite the stock deficit, short-term volatility remains as supply outlooks become muddled. Reports indicate that excessive rainfall in late Apr-25 dragged down crush capacity by as much as 53% across key states, temporarily tightening supply and briefly supporting raw sugar futures. Yet broader projections remain bullish: the United States Department of Agriculture (USDA) forecasts a 2.3% year-on-year (YoY) rise in Brazil’s 2025/26 sugar output to 44.7 mmt, pending seasonal normalization.

India’s sugar production is on track for a substantial rebound: The Indian Sugar Mills Association (ISMA) projects a climb of 18% to 34.9 mmt for the 2025-26 season, up from 26.1 mmt this year. This surge is underpinned by an expected 42% rise in sugarcane output, especially in Maharashtra, Uttar Pradesh, and Karnataka, driven by improved rainfall and expanded planting areas. The surplus opens avenues for 2 mmt in exports and a strategically increased 5 mmt diversion to ethanol blending, up from 3.5 mmt currently. The government’s ethanol blending target of 20% (E20) by 2025/26 highlights the urgency of balancing domestic oversupply while pursuing energy and environmental objectives. Without timely policy action, particularly on pricing and ethanol procurement, there’s a growing risk of a domestic glut weighing on farmer incomes and miller liquidity.

Despite the upward trajectory, downside risks persist. A slight decline in cane acreage, reported at 5.31 million hectares (mha) versus 5.34 mha last year, signals that expansion may not be uniform across regions. Moreover, Uttar Pradesh, a key growing state, has launched a large-scale disease surveillance campaign targeting red rot, an infestation that significantly dented yield and recovery rates in the 2024/25 season. This proactive approach aims to pre-empt disease spread and preserve cane quality ahead of the new season. Meanwhile, ethanol blending gains, while strategically essential, face emerging consumer backlash, with reports citing reduced vehicle mileage and engine concerns. These performance anxieties could influence public sentiment, potentially complicating adoption or policy messaging around E20.

Though no significant weekly news emerged in W32, recent forecasts continue to highlight a gradual rebound in Mexico’s sugar output, expected to reach approximately 5.05 mmt over the coming season. Improvement is attributed to enhanced agronomic practices and incremental recovery from past drought-impacted production. However, export capacity remains limited due to legacy structural inefficiencies and logistical bottlenecks that hinder Mexico’s ability to fully utilize surplus volumes. This dynamic is keeping the domestic market comparatively insulated, reducing the likelihood of price shocks.

In response to lingering export constraints, Mexico’s sugar sector is increasingly focused on quality upgrades rather than volume expansion. Producers are embracing organic certifications and sustainable farming practices as differentiation levers to access premium markets. While this shift moves the industry toward a value-over-volume model, the immediate pricing impact remains modest due to slow adoption and persistent operational challenges. In the long term, however, such strategic premium positioning may create better margins and increased resilience.

Amid rising sugar prices, the Prime Minister of Pakistan has ordered the implementation of surveillance tech in mills, urged tighter anti-hoarding enforcement, and directed the Competition Commission of Pakistan (CCP) to tackle cartels. This strong stance aims to stabilize supply in an industry marked by entrenched political influence.

To alleviate the prolonged crisis, the government approved imports of 200,000 metric tons (mt) of sugar, backed by a promise of favorable procurement terms to minimize strain on public finances. But this policy has triggered significant backlash: the International Monetary Fund (IMF) criticized the tax-free import move as inconsistent with loan terms, and watchdogs argue that domestic stockpiling, rather than lack of supply, is a key driver of price spikes. Calls for a forensic audit of domestic reserves suggest that enforcement, not imports alone, may be crucial for market stabilization.

United States (US) sugar markets continue to hold up domestically, with Intercontinental Exchange (ICE) futures stabilized around US¢ 16.3 per pound (lb), thanks to restrictive Tariff Rate Quotas (TRQs). Though world sugar prices remain soft due to excess supply, the controlled US import mechanism has prevented domestic prices from tracking global weakness, acting as a buffer for wholesalers and processors.

The USDA forecasts record 2025/26 US sugar production, 9.42 million short tons, creating concerns over long-term margin pressure for domestic processors. While current market conditions are balanced, increased supply without proportional demand increases could challenge refiners, especially if TRQ volumes stay capped.

.png)

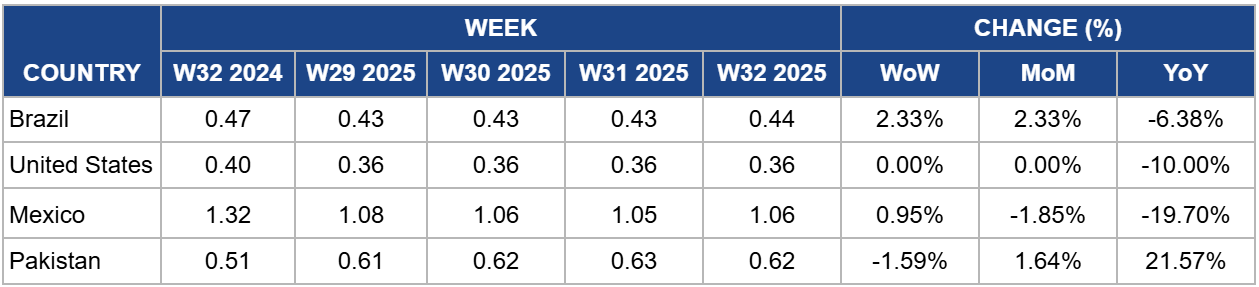

In W32, Brazilian wholesale sugar prices held steady at USD 0.44 per kilogram (kg), 2.33% higher week-on-week (WoW) and month-on-month (MoM). This reflects persistent supply from active milling operations. The domestic market remains resilient, buoyed by consistent production flows and muted demand fluctuations.

Wholesale prices are likely to remain stable in W33, unless unexpected weather disruptions or logistical issues arise. Any bearish global pressure, such as continued weak world sugar futures, will likely filter in only gradually. Traders should keep an eye on export bookings and regional crop reports for possible triggers of price direction changes.

In W32, US wholesale sugar prices remained flat for the fourth week in a row at USD 0.36/kg, supported by government import controls and strong institutional buying. This price band continues to hold despite soft global markets, driven by tight domestic supply and historical policy protections.

In W33, market players should expect these stable levels to persist, unless there are any major departures in trade policy or significant production disruptions. Any shift would likely need a substantial change in TRQ settings or supply dynamics to break the price equilibrium.

The price of Mexican wholesale white sugar in W32 was USD 1.06/kg, up 0.95% WoW but down 1.85% MoM. This stability reflects both seasonal supply consistency, with stocks from the tail end of the 2024/25 milling season still circulating, and moderate domestic demand from food and beverage processors. While global benchmark prices have shown volatility due to weather risks in Brazil and India, the Mexican market appears decoupled from immediate international price shocks due to current export limitations and a focus on satisfying domestic needs first.

Prices are expected to remain firm in W33. Unless there’s a sudden policy change affecting exports or imports or a supply shock on the domestic front, market stability is expected to continue. Market players should watch for potential volatility if there are any announcements of trade adjustments or crop issues.

In W32, wholesale prices averaged USD 0.62/kg, remaining relatively stable, down 1.59% WoW. Pakistan’s sugar market remains under severe strain, with government-fixed ex-mill prices set at USD 0.58/kg (PKR 165/kg), while actual wholesale and retail markets are seeing elevated levels around USD 0.63-69/kg (PKR 180–195/kg). This divergence highlights entrenched demand-supply gaps and ongoing distribution stress.

In W33, prices are expected to ease slightly, provided emergency imports begin to flow and warehousing improves. However, unless supply chain recovery accelerates and anti-hoarding enforcement proves effective, relief may be gradual and uneven across regions.

Brazil’s domestic sugar market has remained stable this week, supported by balanced supply and steady internal demand. This stability offers exporters a window of predictability in cost structures, which is not always available during the more volatile harvest months. Given the current price plateau, Brazilian mills and traders should move to secure forward contracts with international buyers, particularly in key markets such as the Middle East and Asia, where off-season demand tends to rise in Q4. Locking in these deals now could ensure better margins if global prices soften due to oversupply from other major producers.

To safeguard against downside risk, mills should deploy hedging tools such as ICE raw sugar futures or over-the-counter (OTC) options to set floor prices while leaving room to benefit from any potential upside. Additionally, exporters may consider adjusting shipping schedules to target periods of tighter availability in importing markets, further boosting per-ton revenues.

In the US, wholesale sugar prices remain well-supported by domestic price support programs and tariff protections, insulating the market from much of the global price softness. This creates an opportunity for refiners and distributors to prioritize domestic allocation of production rather than diverting sugar to export markets where prices are less favorable. The same applies in Mexico, where firm domestic demand and stable-to-firm wholesale rates make internal sales more profitable than exports at current world prices.

However, importers in Mexico face the challenge of potentially higher procurement costs later in the year if production falls short or if the US-Mexico supply dynamics shift due to weather-related disruptions. To mitigate this, buyers should negotiate early procurement agreements or fixed-supply contracts with domestic mills or cross-border suppliers. This not only locks in favorable prices but also ensures supply security during peak consumption months, particularly ahead of the holiday season when demand spikes.

Pakistan’s wholesale sugar prices are currently in a state of disconnection from the government’s fixed retail price due to ongoing supply constraints. With the government moving to facilitate emergency imports, market sentiment points towards potential downward pressure once imported volumes hit the market. This adjustment, however, is unlikely to be immediate or uniform across all provinces, given logistical and distribution inefficiencies.

Importers and distributors should act proactively by securing import quotas early before competition intensifies, allowing them to lock in lower costs for upcoming shipments. Building strategic inventories during the expected easing phase will position traders to capitalize on any short-term market corrections and sell into periods of localized shortages at a competitive advantage. Moreover, industry players should maintain flexibility in sourcing strategies, considering both regional imports and opportunistic spot purchases from international markets when price dips occur.

Sources: Tridge, Hamari Web, The Express Tribune, Wholesale Sugar Suppliers, Vesper, Dawn, Hellenic Shipping News, The Economic Times, Sweetener Users Association, The Tribune

Read more relevant content

Recommended suppliers for you

What to read next