News

Original content

Brazil’s 2025/26 coffee harvest has progressed swiftly, with Safras & Mercado, a leading Brazilian agribusiness consultancy, reporting 84% overall completion as of July 23–96% for Robusta and 76% for Arabica–exceeding both last year’s pace and five-year averages. This robust processing supports the National Supply Company’s (Conab) forecast of a 2.7% year-on-year (YoY) increase in output to 55.7 million 60-kilogram (kg) bags, highlighting a resilient supply base even in a negative biennial cycle.

Brazilian growers are increasingly concerned about the 50% United States (US) tariff, effective August 1, which threatens to erode export competitiveness and create domestic oversupply. With a significant portion of Brazil’s Arabica bound for the US, the sector’s exposure to geopolitical risk is growing, highlighting the need for market diversification.

Colombia saw a production surge in Mar-25 to 1.06 million 60-kg bags (+23% YoY), the highest in a decade for that month, as favorable weather conditions aided recovery across key regions. Yet, for 2025/26 (Oct-25 to Sep-26), the United States Department of Agriculture (USDA) forecasts a 5.3% YoY drop in output to 12.5 million 60-kg bags, pointing to persistent rainfall disruptions and underinvestment in replanting and renovation.

Colombian coffee may benefit from reduced competition in the US, as Brazil faces steep new tariffs. Exporters note increased interest from US buyers for microlots and specialty Arabica, with Colombia now holding a tariff advantage over Brazil and Vietnam, which could strengthen its market position.

Vietnam has already met its 2025 export target with USD 5.45 billion earned from 953,900 metric tons (mt) shipped in H1-2025. This export growth is driven by a significant 59.1% increase in average export price, marking a strong premium demand from markets like Germany, Italy, Spain, and Mexico.

Vietnamese coffee production is forecast at 31 million 60-kg bags for 2025/26, up from 29 million the previous year, signalling potential oversupply. This production growth occurs despite steady export momentum. Ongoing record harvest volumes and rising farmer investment suggest growing supply pressure may limit price gains in the upcoming months.

.png)

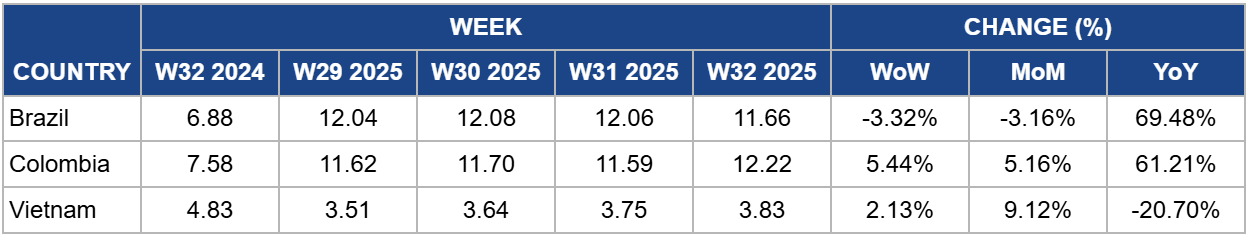

In W32, Brazil’s domestic wholesale coffee market dropped by 3.32% week-on-week (WoW) to USD 11.66/kg. The Center for Advanced Studies on Applied Economics (CEPEA) indicators showed modest day-to-day volatility but no large directional break as harvest throughput continues to release volume into the domestic pipeline. The CEPEA daily index shows small intramonth gains and dips consistent with harvest logistics and seasonal flows rather than demand shocks.

In W33, market players can expect Brazilian wholesale prices to remain stable with a bias to mild softness if harvest and crushing remain uninterrupted. The main near-term downside risk is continued heavy arrivals from Minas Gerais and Espírito Santo; upside would require either a sudden export lift or localized weather/transport disruption.

In W32, Colombian domestic wholesale coffee prices rose 5.44% WoW and 61.21% YoY at USD 12.22/kg. This bullish trend was supported by seasonal supply tightness and by currency effects that keep exporter returns acceptable even as some international premiums compress.

In W33, domestic wholesale prices in Colombia should stabilize. The balance of risks is mixed, peso volatility could provide small upside for exporters, while any renewed global premium erosion or larger-than-expected domestic arrivals would cap gains.

In W32, Vietnamese domestic coffee prices continued trending upward at USD 3.83/kg, up 2.13% WoW and 9.12% month-on-month (MoM). This trend reflects short-term demand pick-up and some speculative re-entry even as global Robusta futures have been volatile. Domestic trade remains reactive to port shipment activity and export contracts. Regional price feeds and Vietnam trade media show that local farmgate/wholesale rates can swing quickly as export bids are transacted.

In W33, Vietnamese wholesale prices are expected to trend upward, with upside limited unless large new export tenders emerge or Intercontinental Exchange (ICE) Robusta futures rally further. Coffee traders should monitor export booking flow, local offered volumes from the Central Highlands, and any exchange-rate moves that alter exporter netbacks.

Domestic wholesale Arabica prices in Brazil have remained relatively stable this week, but the market is under mild downward pressure due to strong harvest inflows and increased availability from cooperatives. For roasters and traders, this stability offers a window to secure forward contracts at favorable rates before potential disruptions occur later in the season. The upcoming weeks could see logistical slowdowns linked to port congestion or weather-related shipping delays, which would tighten available supply and trigger short-term price rebounds. Locking in volumes now would mitigate the risk of having to source at higher spot prices if these disruptions materialize.

In Colombia, wholesale prices for high-quality Arabica have held firm despite global market softness, underpinned by strong demand for certified and specialty-grade coffee. These premiums are unlikely to soften in the near term due to the limited availability of top-scoring lots and ongoing concerns about localized crop quality impacts from uneven rainfall. Exporters, specialty roasters, and boutique coffee chains should consider advancing purchase negotiations for these micro-lots before the seasonal tightening in late Aug-25–Sep-25. Acting early not only ensures access to high-quality products but also provides leverage in price discussions before selective scarcity drives premiums higher.

Vietnam’s domestic Robusta market remains sensitive to export booking flows and futures market sentiment, with prices moving quickly in response to large-scale tender announcements. This week’s firming trend suggests sellers are taking advantage of strong demand signals from Europe and the US. Buyers should closely track port shipment data and exporter tender schedules to time their purchases during temporary price pullbacks. Aligning procurement with these softer periods will help manage input costs while still ensuring timely shipment for downstream commitments.

Sources: Tridge, USDA, AP News, El Pais, Reuters, FNC, Rabobank, VN Express, CEPEA

Read more relevant content

Recommended suppliers for you

What to read next