News

Original content

Global sunflower production in 2025/26 is forecast at 59.3 million metric tons (mmt), up 4.2 mmt from the last season but still below early-year expectations for the Black Sea region. Russia and Ukraine are projected to produce 17.8 mmt and 13.5 mmt, respectively. However, extreme heat and drought in parts of Hungary, Bulgaria, Romania, Türkiye, and southern Ukraine may reduce yields and affect crop quality. With relatively low global opening stocks, sunflower processing is expected to reach 53.2 mmt, slightly below pre-season projections, indicating potential tightness in the vegetable oil market.

Sunflower oil prices in the Black Sea region rose by USD 25 to 45 per metric ton (mt) in Jul-25, driven by drought and high temperatures affecting key producers in Russia, Ukraine, Bulgaria, Romania, Hungary, and Türkiye. Supporting prices are weather-related yield concerns, particularly in Türkiye, Ukraine, and Russia, alongside strong European Union (EU) demand and uncertainties in the palm oil market. Despite forecasts for a record 17.55 mt harvest in Russia, ongoing dryness and a reduced EU yield outlook–a 1.94 mt per hectare (−8% MoM)–have prevented a price decline. Analysts expect prices to stabilize or ease slightly with the new harvest, but sustained global demand for vegetable oils and tight weather conditions will likely limit any significant drop.

Severe drought and extreme heat have destroyed nearly 50% of sunflower crops in southern Bulgaria, prompting an early harvest expected to yield significantly below average. Producers report that three intense heatwaves during the flowering stage halted plant development, resulting in small, low-quality seeds and reduced oil content. Additional hail damage further cut yields, with some farmers expecting only 100 kilograms (kg) per decare versus the typical 350 kg, leading to estimated losses of USD 59.87 to 71.85/decare (BGN 100 to 200/decare). The reduced supply is likely to pressure sunflower oil prices upward, though consumer impact may be mitigated by increased imports. Farmers are calling for improved irrigation infrastructure as climate change intensifies production risks.

Severe drought in southern Russia is threatening up to half of Rostov Oblast's sunflower crop, with southern, Priazov, and central zones most affected. Crop quality has also declined, with northern Krasnodar Krai reporting yields of only 3 to 7 quintal per ha and 6,000 ha lost entirely. Low soil moisture has rendered sowing and harvesting challenging, forcing some farms to abandon fields. In Krasnodar Krai, sunflower losses, alongside reductions in wheat and other grains, are significantly impacting regional agricultural output.

.png)

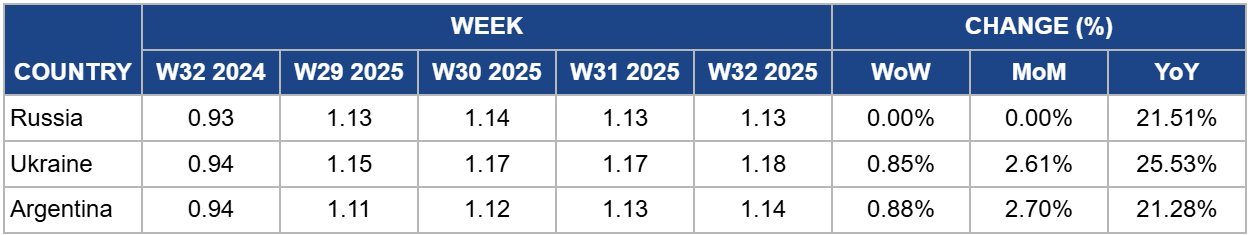

In W32, Russia's sunflower oil prices held steady at USD 1.13 per kilogram (kg), showing no change week-on-week (WoW) or month-on-month (MoM), but rising 21.51% year-on-year (YoY) from USD 0.93/kg. Despite the stability, adverse weather in key producing regions, particularly Rostov Oblast and northern Krasnodar Krai, threatens up to half of the local sunflower crop and has significantly reduced yield quality. Low soil moisture has forced some farms to abandon fields, while overall regional losses, including wheat and other grains, indicate broader agricultural stress. These supply pressures, combined with drought across the Black Sea region, have supported export prices. If adverse conditions persist, limited supply may maintain upward price pressure in both domestic and international markets, despite currently stable nominal prices.

Ukraine's sunflower oil prices rose 0.85% WoW to USD 1.18/kg in W32, up 25.53% YoY from USD 0.94/kg, reflecting tight domestic supply at the close of marketing year (MY) 2024/25. Limited sunflower seed availability and the shift of processing plants to soybeans and rapeseed have supported both domestic and export prices, which range from USD 1,100/mt for Sep-25 to USD 1,220/t for Aug-25 deliveries. While the projected national production of 13.5 to 14 mmt may ease pressure, dry conditions in southern regions could reduce yields by up to 1 million tons. Looking ahead, expanded output in neighboring countries, particularly Russia and Kazakhstan, is likely to increase regional competition for export markets, potentially moderating price growth despite sustained global demand.

Argentina's sunflower oil prices rose 0.88% WoW to USD 1.14/kg in W32, up 21.28% YoY from USD 0.94/kg, supported by record crushing volumes and strong global demand. While higher output has bolstered supply, the 27% MoM export drop in Jun-25 to 105,000 mt may tighten availability in export markets, sustaining upward price pressure. If international demand remains firm and domestic crushing stays elevated, prices could maintain current strength in the near term, though seasonal harvest inflows later in the year may ease market tensions.

Producers in the Black Sea region should invest in improved irrigation systems and drought-resilient sunflower varieties. This will help mitigate the impact of extreme heat and drought on yields and oil quality, reducing supply volatility and supporting stable domestic and export prices.

Sunflower oil exporters should expand crushing capacity and enhance logistics networks to efficiently convert available harvests into exportable supply. Addressing bottlenecks caused by low processing volumes or transport challenges will help maintain competitiveness amid strong global demand.

Traders and buyers should closely track weather developments and regional production trends in key sunflower-producing countries. Anticipating yield shortfalls and tight supplies can inform strategic sourcing, contract timing, and pricing decisions to manage exposure to potential price spikes.

Sources: Tridge, Sinor, Agroinvestor, Revista Chacra, Ukr AgroConsult

Read more relevant content

Recommended suppliers for you

What to read next