News

Original content

The European Union (EU) has politically agreed to a new trade deal that includes a 15% United States (US) tariff on olive oil exports. While this averts the immediate threat of a crippling 30% duty, the agreement has sparked a swift and severe backlash from the European olive oil sector, as it represents a significant increase from the previous 10% tariff and creates a major competitive disadvantage. The reaction has been particularly strong in key producing nations. Spain's industry warns of a significant competitive loss, as non-EU rivals like Turkey and Morocco will now have a price advantage with their lower tariff, putting over USD 1.17 billion (EUR 1 billion) in Spanish exports at risk. Similarly, Italy's powerful agricultural union, Coldiretti, estimates a USD 164 million (EUR 140 million) negative impact on its exports and fears a surge in counterfeit Italian-sounding products as authentic Italian oil becomes more expensive for US consumers. Even in Greece, where the deal was officially termed positive, there are deep concerns for the country's USD 35 million (EUR 30 million) in olive oil exports. Although the deal provides some market certainty after months of volatility, the higher costs pose a major challenge to the competitiveness of European olive oil in the crucial US market.

EU olive oil exports to key international markets, including the US, Canada, China, and Australia, surged by 25% during the 2024/25 crop year. According to a new European Commission (EC) report, this strong recovery was driven by a significant 37% year-on-year (YoY) increase in EU production, which reached 2.1 million metric tons (mmt), and the resulting lower prices at origin. The production rebound was led by Spain, whose output soared by 66% to 1.4 mmt, with Greece (+43%) and Portugal (+10%) also recording substantial gains. Italy is the only European country that experienced a production decrease (-25%) during the 2024/25 season, acting as a counterweight to production-driven price decreases in other European countries. This increased overall availability of olive oil in Europe has allowed for a rebound in domestic consumption and is projected to leave the EU with higher ending stocks of over 450,000 metric tons (mt). However, the report warns that the initially favorable outlook for the upcoming 2025/26 harvest may be hampered by the July heat wave across Europe, particularly affecting countries like Spain and Portugal.

The Greek government is actively seeking exemptions for key national exports, including olive oil, from the new 15% US tariff, establishing a working group to analyze the US-EU tariffs agreement and identify opportunities for exemptions or preferential treatment for Greek products. Industry leaders have voiced strong concerns, fearing the tariff will make Greek products uncompetitive in the US market, halt the significant export momentum built over the last fifteen years, and damage items they consider carriers of Greek cultural heritage. There is historical precedent for such a move, as a similar exemption in 2019 was critical to the sector's growth in the American market. An interim 10% tariff has already slowed orders, and the new duty gives a clear advantage to non-EU competitors like Tunisia and Turkey. The long-term risk is that producers will be forced to scale down their established presence in the US market in search of alternative markets, a scenario that could deal a serious blow to the Greek olive oil industry.

Ahaean Land, a pioneering Greek company, is bringing high-quality extra virgin olive oil directly to consumers through a network of new vending machines. Following a model already popular in other Mediterranean countries such as Spain, Portugal, Italy, and Croatia, the company has launched its first machines in Athens, Edessa, Ptolemaida, and Amyntaio, offering its exclusive Oelia Terra brand in metal containers of 250 ml, 500 ml, and 750 ml, at competitive prices. This move marks a significant strategic shift for the company, which was previously 90% export-focused, with primary markets in Germany, the UK, and France. After a successful initial seven-month trial, Ahaean Land plans a major domestic expansion, aiming to install 150 more machines across Greece by the end of 2027. The innovative concept blends tradition with modern convenience, making authentic Greek olive oil more accessible to the local market while the company also plans future expansions into Bulgaria and the US.

Government officials in Andalusia have warned that the new 15% US tariffs will deal a serious blow to the region's vital agri-food sector, which exports over USD 1.17 billion (EUR 1 billion) annually to the US. The tariffs are expected to have severe consequences for olive and wine producers, potentially costing the region over 9,000 jobs and cutting GDP by USD 596 million (EUR 509 million). In response, the regional government is actively promoting the opening of new markets to offset the potential losses, citing recent successful trade missions to China and Japan. While the impact on olive oil is expected to be less dramatic, as officials believe health-conscious US consumers will absorb the cost, the overall situation is creating significant uncertainty. The tariffs pose the greatest risk to smaller, family-run operations that are less equipped to find alternative buyers or absorb the increased costs.

The world's largest olive oil producer, Deoleo, is signaling a cautiously optimistic return to normalization for the industry after what its chief executive officer (CEO) described as one of the most challenging periods in its history. A 65% rebound in Spain's olive oil production for the 2024/25 season, reaching 1.41 mmt, has been the primary driver of this recovery, a significant improvement from the previous year's disastrous 855,600 mt harvest. The sector had previously been hit by a perfect storm of climate-fueled droughts, high interest rates, and robust inflation, which led to record-high prices and declining consumption. This bumper harvest has caused a 50% drop in raw material costs, allowing brands like Bertolli and Carbonell to lower shelf prices and stimulate a revival in consumer demand. Confident that the trend towards stability will hold, Deoleo is now doubling its investment in advertising and promotion to USD 11.63 million (EUR 10 million). This strategic move aims to re-establish olive oil as an everyday staple for consumers after a period of extreme price volatility, with the company anticipating a more balanced and promising market landscape for the second half of 2025.

In a significant move towards market diversification, Tunisia is in discussions with the Eurasian Economic Union (EAEU) for a potential Free Trade Agreement (FTA). This development comes at a critical time, as the Tunisian olive oil sector grapples with newly imposed 25% US tariffs, highlighting the urgent need to find alternative export destinations. The EAEU, which includes Russia, represents a substantial and growing market for Tunisian goods. Trade between Tunisia and Russia has already increased significantly, with olive oil being a key export. Trade between Tunisia and Russia grew about 40% in 2024 to reach about USD 2.8 billion. A formal FTA would lift existing trade barriers and unlock substantial growth potential for Tunisian olive oil producers. This strategic pivot towards the EAEU offers a vital opportunity to reduce reliance on the volatile US market and secure new, long-term trade partnerships for one of its most important agricultural products.

Tunisia is actively strengthening its economic ties with India, identifying it as a key partner with an estimated USD 214 million in untapped export potential. This strategic pivot is already yielding significant results for the agri-food sector, with Tunisian olive oil exports to India surging by an impressive 250%. This remarkable growth reflects rising demand for Tunisian products and is part of a broader push to reinforce collaboration in priority industries. With bilateral trade already reaching USD 800 million, both nations are working to activate existing trade agreements and resolve customs challenges. This focus on India represents a crucial step in Tunisia's strategy to diversify its export markets, reduce reliance on traditional partners, and capitalize on the growing purchasing power of emerging economies.

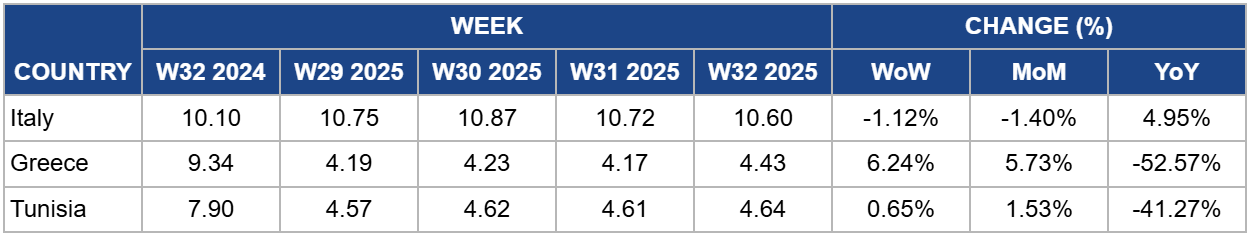

In Italy, the price of extra virgin olive oil was USD 10.60 per kilogram (kg) in W32, a decrease of 1.12% week-on-week (WoW) and 1.4% month-on-month (MoM). However, the price remains 4.95% higher YoY. The Italian olive oil market is experiencing a slight short-term correction, though prices continue to trade at a significant premium. The minor weekly and monthly price dips suggest the market has stabilized at a high level, likely because Italian buyers have successfully secured sufficient volumes of imported oil from Spain and Greece to meet their immediate needs, temporarily easing the intense upward pressure caused by domestic scarcity. This aligns with a typical summer slowdown in trading activity. However, the long-term trend remains the 4.95% YoY price increase. This is a direct consequence of Italy's severe 2024/25 production crisis, which saw the harvest fall by 25%. This fundamental supply deficit is the primary driver supporting the sustained price premium for Italian-origin oil, a situation expected to persist until the new harvest provides relief.

In Greece, the price of extra virgin olive oil was USD 4.43/kg in W32, a 6.24% increase WoW. This reflects a 5.73% MoM rise, though the price remains 52.57% lower YoY. The Greek olive oil market has seen a significant short-term price rally, breaking its recent stability. The strong WoW and MoM increases are driven by a classic end-of-season supply squeeze, as dwindling inventories of high-quality oil are met with renewed buyer interest, particularly from Italian packers looking to cover their domestic shortfalls. This demand is intensified by mounting pressure on Greek producers to sell their remaining stocks before high summer temperatures degrade the quality, forcing the last available volumes onto the market at a premium. However, the 52.57% YoY price collapse remains the dominant long-term trend. This is a direct consequence of the strong production rebound in both Greece and, more significantly, Spain during the 2024/25 season, which ended the severe scarcity and record-high prices of the previous year.

In Tunisia, the price of extra virgin olive oil was USD 4.64/kg in W32, a slight increase of 0.65% WoW. This reflects a 1.53% MoM rise, but the price remains 41.27% lower YoY. The Tunisian olive oil market continues to firm up as the season concludes, driven almost entirely by scarcity. The steady WoW and MoM price increases are a direct result of domestic stocks being nearly depleted. With very little oil left to trade and quality concerns rising due to the summer heat, buyers are competing for the last available volumes, pushing prices higher. However, the 41.27% YoY price collapse remains the long-term trend. This reflects the significant market correction following the excellent 2024/25 harvest, which ended the supply crisis and record-high prices of the previous year.

The new 15% US tariff necessitates a strategic pivot away from direct price competition. European producers should focus on segmenting their offerings to emphasize high-value, less price-sensitive products. This includes marketing single-estate, organic, and Protected Designation of Origin (PDO) oils whose quality, story, and traceability can justify a premium price point for discerning US consumers. For more commercial-grade oils, exporters should explore partnerships with US-based bottlers, potentially shipping in bulk to reduce the tariff's impact on finished, packaged goods. Following the lead of major players like Deoleo, companies should consider increasing their marketing and promotional investments within the US. The goal is to reinforce the narrative of European olive oil's superior quality and heritage, thereby building brand loyalty that can withstand price increases and defend market share against lower-cost competitors from outside the EU.

The US tariff situation underscores the risk of over-reliance on traditional markets. Industry players, particularly from Spain and Greece, should follow Tunisia’s proactive example and launch an aggressive diversification strategy focused on emerging economies. The 250% surge in Tunisian exports to India highlights a significant opportunity. European exporters should invest in detailed market analysis to understand the consumer preferences, price sensitivity, and distribution networks in high-growth regions like India, Southeast Asia (e.g., Vietnam, Indonesia), and Brazil. This may require adapting products, such as offering smaller, more affordable bottle sizes or developing specific blends suited to local cuisines. Building strong relationships with local importers and distributors will be critical to navigating customs, logistics, and retail landscapes. This proactive expansion will not only offset potential losses in the US but also establish a foothold in the growth markets of the future.

The innovative Greek vending machine concept highlights a powerful, underutilized strategy: leveraging technology to strengthen markets and build direct consumer relationships. Producers should view their home markets not just as a sales channel but as a stable foundation to buffer against export volatility. Companies can develop direct-to-consumer (D2C) e-commerce platforms to sell their products nationally, capturing higher margins and building a loyal customer base. This D2C approach allows producers to tell their unique story—about their family, their region, and their production methods—creating a powerful brand identity that transcends price. Furthermore, selling directly provides invaluable data on consumer purchasing habits, which can inform product development and marketing efforts. By investing in technology to enhance sales and brand storytelling, producers can create a more resilient and profitable business model.

Sources: Tridge, Olive Oil Times, Greek Reporter, Tovima, The Spanish Eye, CNBC, Maghrebi, Interfax

Read more relevant content

Recommended suppliers for you

What to read next