News

Original content

India's Vegetable Oil Producers' Association (IVPA) and Indonesia's Palm Oil Association (GAPKI) have signed a three-year Memorandum of Understanding (MoU), effective July 24, to strengthen cooperation in the palm oil sector, a cornerstone of bilateral edible oil trade. The agreement targets five areas: technical exchange, sustainability, policy coordination, food security, and market intelligence. India imports over 60% of its edible oil, largely from Indonesia. It will work with GAPKI to promote certified sustainable palm oil and integrate smallholder farmers into the supply chain. In 2024, bilateral trade totaled USD 26 billion, with palm oil and derivatives contributing USD 4.4 billion.

India's palm oil imports fell 10% month-on-month (MoM) in Jul-25 to 858,000 metric tons (mt) as higher prices prompted contract cancellations, while soybean oil imports surged 38% MoM to a three-year high, driven by lower prices and delayed shipments. The decline in palm oil purchases by the world's largest vegetable oil importer is expected to boost inventories in Indonesia and Malaysia, pressuring Malaysian palm oil futures, which fell 1.4% to USD 988/mt. Ample global supplies of alternative oils, particularly low-priced soybean oil from Brazil and China, are likely to keep palm oil prices under downward pressure ahead of the sunflower harvest.

Indonesia's exports surged 11.3% year-on-year (YoY) to USD 23.44 billion in Jun-25, driven by a 15.1% rise in palm oil shipments as exporters accelerated sales ahead of new United States (US) tariffs. Palm oil exports increased nearly 25% in the first half of 2025 (H1-2025), reinforcing Indonesia's position as the world's largest producer. Imports grew 4.3% YoY to USD 19.33 billion, resulting in a USD 4.11 billion trade surplus for Jun-25. The US tariff on Indonesian palm oil was set at 19% after Indonesia agreed to reduce tariffs on US goods. Meanwhile, the European Union (EU) granted Indonesia zero tariffs on palm oil imports, supporting continued strong export demand.

Palm oil supplies from Malaysia and Indonesia, which account for 85% of global output, are projected to decline by up to 20% over the next five years due to ageing trees, slow replanting rates, and Indonesia's increased biodiesel mandates. Smallholders who manage 40% of plantations face financial and logistical barriers to replacing old trees, despite government subsidies, leading to reduced yields. Ageing acreage is expanding rapidly, with more than half of Malaysian smallholder trees past peak production, according to industry estimates. With global demand expected to rise by 50 million metric tons (mmt) by 2050, supply constraints are likely to sustain upward pressure on palm oil prices and shift buyers, including India, toward alternative vegetable oils.

The Malaysian government plans to invest USD 330.96 million (MYR 1.4 billion) over five years under the 13th Malaysia Plan (13MP) to support oil palm plantation rehabilitation, focusing on replanting ageing trees among smallholder farmers. The Minister of Plantations and Commodities emphasized that this initiative aims to strengthen Malaysia's position as the world's second-largest palm oil producer and enhance export potential, currently valued at USD 27.18 billion (MYR 115 billion). The Prime Minister of Malaysia highlighted the broader commitment to boosting agricultural productivity through modern technology in strategic sectors, including oil palm.

Malaysia's palm oil exports to the US rose 51.8% to 93,000 mt from Jan-25 to May-25 compared to the same period last year, with 65% certified organic and 19% palm stearin. Despite the US imposing a 25% tariff on Malaysian goods starting August 1, 2025, the Ministry of Plantations and Commodities is actively monitoring trade policies and engaging with relevant authorities to protect market access. Efforts to enhance sustainability through MSPO 2.0 certification and the Sawit Intelligent Management System (SIMS) aim to meet international Environmental, Social, and Governance (ESG) standards and ensure traceability. Recent trade agreements with the United Arab Emirates (UAE) and the European Free Trade Association (EFTA) are expected to improve market access and reduce trade barriers, supporting Malaysia's position as a sustainable palm oil producer.

.png)

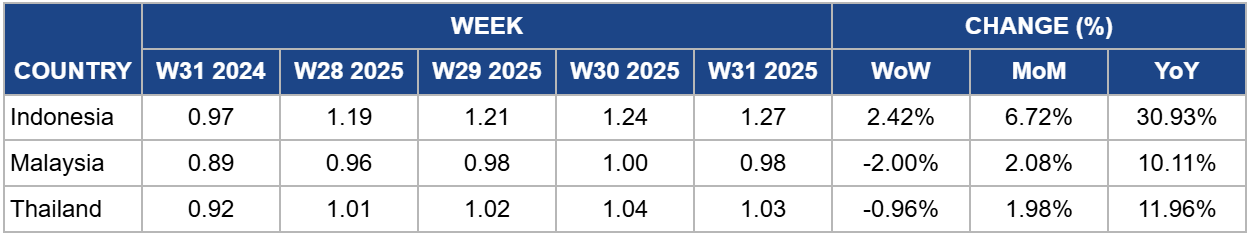

In W32, Indonesia's palm oil prices rose 2.42% week-on-week (WoW) to USD 1.27 per kilogram (kg), marking a strong 30.93% YoY increase from USD 0.97/kg. This price rise is supported by a significant export surge, with shipments up 15.1% in Jun-25 and 24.91% in the H1-2025, as exporters accelerated sales ahead of US tariffs.

Indonesia's overall exports increased 11.29% YoY in June, surpassing forecasts, contributing to a larger-than-expected trade surplus of USD 4.11 billion. The US imposed a 19% import tariff in Jul-25, lower than the initially threatened 32%, following Indonesia's commitment to reduce tariffs on US goods and increase American imports. Additionally, the EU's decision to allow Indonesian palm oil at a 0% tariff rate further supports export growth. These developments suggest continued price strength, underpinned by strong export demand and favorable trade conditions. However, future price trends will depend on how export volumes adjust to tariff impacts and global demand shifts.

Malaysia's palm oil prices declined by 2% WoW to USD 0.98/kg in W32, despite a 10.11% YoY increase from USD 0.89/kg. This recent price dip correlates with a forecasted rise in Malaysian palm oil stockpiles for the fifth consecutive month, expected to reach 2.25 mmt, the highest level in nearly two years. The stockpile increase, up 10.8% from Jun-25, results from output growth outpacing export demand.

Crude palm oil (CPO) production in Jul-25 is projected to rise 8% to 1.83 mmt, reaching a one-year high, while exports are expected to grow 3.2% to 1.3 mmt. Total supply stands at 3.918 mmt versus domestic consumption of 368,275 mt. Malaysian palm oil exports to the US have surged 51.8% year-to-date, reflecting strong demand. Rising inventories amid higher production may pressure prices unless exports increase further. Strong US and global demand could help stabilize prices. The upcoming Malaysian Palm Oil Board (MPOB) report will offer clearer insights into near-term market trends.

Thailand's palm oil prices fell 0.96% WoW to USD 1.03/kg in W32 but remained 11.96% higher YoY. The dip reflects short-term adjustments amid stable supply and robust exports, with palm oil contributing to Thailand's 15.5% YoY export growth in Jun-25, driven by pre-emptive foreign buying ahead of anticipated US tariffs.

While currency strength and a likely moderation in export momentum in H2-2025 may exert pressure, sustained demand from key markets and seasonal restocking could help stabilize prices. Palm oil's strong trade performance continues to underpin Thailand's export-led growth despite emerging global headwinds.

Indonesia and Malaysia should accelerate replanting programs for ageing oil palm trees, particularly among smallholders who manage 40% of plantations. Coupling replanting with sustainability certifications (e.g., MSPO 2.0, RSPO) will help maintain yields, meet ESG requirements, and protect export competitiveness in key markets such as India and the EU.

Producers and exporters should implement targeted marketing campaigns in India and emerging markets to emphasize palm oil’s cost-efficiency, versatility, and certified sustainability. Strengthening brand positioning can help mitigate substitution risks from lower-priced soybean and sunflower oils.

Indonesian exporters should frontload shipments to the EU under the 0% tariff regime, while Malaysian suppliers should align export schedules with new trade agreements (UAE, EFTA) to capture additional demand. Coordinated trade diplomacy and pricing strategies can optimize benefits from tariff advantages while offsetting losses from US duties.

Sources: Tridge, Ukr AgroConsult, Hellenic Shipping News, Grain Trade, Oil World

Read more relevant content

Recommended suppliers for you

What to read next