News

Original content

According to the European Commission (EC), European Union (EU) soft wheat exports for the 2025/26 season reached 1.11 million metric tons (mmt) by August 3, marking a 58% year-on-year (YoY) drop. Romania dominates shipments with 740.14 thousand metric tons (mt), followed by Germany with 126.23 thousand mt, and Bulgaria with 95.7 thousand mt, while France reported no wheat exports in the period. Key buyers include Saudi Arabia, Nigeria, Algeria, the United Kingdom (UK), and Vietnam. Ukraine supplied 50.42 thousand mt of soft wheat to the EU during the same period, alongside other grains, under the framework of a newly signed but not yet fully approved trade agreement. The updated EU–Ukraine deal increases quotas for sensitive goods, such as wheat, compared to pre-war levels, but keeps them below the peaks seen during the temporary duty-free regime. This aims to protect EU farmers while expanding Ukraine’s market access until 2028.

Jul-25 rains have significantly improved Australia’s 2025 wheat outlook, rescuing crops in drought-hit regions like Victoria and South Australia and boosting yields in key producing areas such as northern New South Wales, southern Queensland, and Western Australia’s Esperance region. Forecasts now range from over 30 mmt to as high as 34 mmt, with traders citing stronger market sentiment following the rainfall. While conditions have improved, Victoria and South Australia will still need more rain in September to maintain high yield potential, as subsoil moisture remains low.

By August 4, France had harvested 94% of its winter wheat, eight days ahead of the five-year average, raising expectations for a larger 2025 crop. However, the country faces mounting challenges in marketing this wheat, as demand from major buyers like Algeria and China has declined and competition from cheaper Black Sea suppliers intensifies. FranceAgriMer projects wheat exports outside the EU at just 7.5 mmt in 2025/26, contributing to the highest end-of-season stocks in 21 years. A stronger euro, reduced access to key markets, and increased competition from maize and Spain’s bumper crop are further limiting sales prospects, pushing France to explore lower-priced feed markets for potential relief.

According to the Institute for Agricultural Market Studies (IKAR), Russia’s wheat harvest forecast for 2025 has been raised by 0.5 mmt to 84.5 mmt, driven by better-than-expected yields in the central and Volga regions. Wheat exports are now projected at 41.5 mmt for Jul-25–Jun-26, with total grain exports expected to reach 53 mmt. While most regions report higher wheat yields than last year, the Southern Federal District remains an exception, lagging 14% behind 2024 levels due to spring frosts and summer drought, with a current gross wheat harvest of 20.6 mmt.

Prolonged rains in Jul-25 and early Aug-25 have significantly damaged wheat quality in western and northern Ukraine, with 20% to 60% of incoming grain affected by fungal diseases such as smut, alternaria, and sooty mold. While still usable as feed, this substandard wheat is stored separately from standard grade 4 feed wheat, and batches with over 25% smut are often rejected. As rainfall eased, harvesting accelerated, leading to a surge in feed and low-quality wheat entering the market, suggesting a higher-than-usual share of feed grain this season.

The surplus of feed wheat has widened the price gap with bread wheat to USD 19.28/mt to USD 21.69/mt, while substandard wheat is discounted a further USD 9.64/mt to USD 14.46/mt. As of early Aug-25, bread-grade wheat for export via Black Sea ports was priced at between USD 226/mt and USD 230/mt, grade 4 feed wheat at USD 203/mt to USD 210/mt, and substandard wheat at USD 185/mt to USD 192/mt. With dry, warm weather now aiding harvest completion, a clearer assessment of the season’s overall quality is expected soon.

As of August 6, Ukraine’s 2025/26 wheat exports totaled 960 thousand mt, 1.5 times less than in 2024/25, reflecting tighter EU trade quotas and overall weaker grain shipments. The reduction follows the end of the temporary duty-free regime with the EU, which previously allowed up to 4.7 mmt of wheat exports but now limits them to 1.3 mmt. While Ukraine retains a free trade zone agreement offering better terms than pre-2022, the new restrictions still pose significant challenges for farmers, who had demonstrated resilience despite the war. Supported by industry stakeholders, government efforts are focused on maintaining dialogue with Western partners to secure expanded market access and strengthen Ukraine’s wheat trade position in Europe.

Nearly halfway complete, the UK wheat harvest is showing stronger-than-expected results despite early setbacks. Initial winter wheat yields were 11% below the five-year average, but overall yields have recovered to 7.66 mt per hectare (ha), just 1% lower than average. This was driven by strong performances in regions like the South East, where yields are 24% above normal. Drier conditions in the East of England have reduced yields on lighter soils by up to 16%. However, grain quality remains high, with an average specific weight of 79 kilograms per hectolitre (kg/hl) and protein levels in Group 1 wheat averaging 13.5%, indicating strong milling quality. This resilience in both yield and quality positions the 2025 UK wheat crop more favorably than initially anticipated.

The United States (US) wheat sector is expected to benefit from the newly established Agricultural Trade Promotion and Facilitation Program. This program will provide USD 285 million annually from 2027 to expand global market access, complementing the existing Market Access Program (MAP) and Foreign Market Development (FMD) funding of USD 234.5 million. US Wheat Associates highlighted that the program will help attract new buyers, leveraging the high quality and reliability of US wheat, which has kept exports stable despite global trade uncertainties. However, market conditions remain bearish due to abundant domestic supply and weak demand, with low corn prices narrowing the wheat–corn price spread. While this surplus pressures prices, recent trade deals, such as Bangladesh’s purchase of 700 thousand mt of US feed wheat and increased buying from Indonesia, suggest potential for demand growth. Experts see trade agreements and geopolitical engagement, particularly in Africa, as opportunities to stimulate demand, improve prices, and strengthen the US wheat market heading into winter.

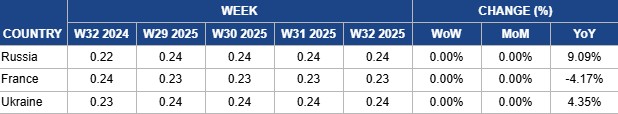

In W32, Russia’s wheat prices remained stable week-on-week (WoW) and month-on-month (MoM) at USD 0.24/kg, reflecting steady demand, while rising 9.09% YoY. Export duties on Russian wheat were set at USD 0.24/mt (RUB 19.4/mt) as of August 6, following four weeks at zero. However, they are scheduled to return to zero on August 13, likely supporting robust exports in the coming week. Nonetheless, heavy rains forecasted for Central Russia may complicate harvesting and reduce wheat quality, increasing the risk of sprouting. Additional rainfall is expected in the Volga region, while abnormally hot conditions persist in southern Russia, adding further pressure on the crop.

In W32, France’s wheat prices remained flat WoW and MoM at USD 0.23/kg, though down 4.17% YoY, reflecting a stable but subdued market. As the EU’s largest wheat producer, France faces challenges marketing its larger 2025 crop amid shrinking export demand and strong competition from cheaper Black Sea grain. Key buyers, including Algeria and China, have reduced purchases, with non-EU exports projected at just 7.5 mmt, potentially driving ending stocks to a 21-year high. Last year, a smaller crop was absorbed by Morocco, West Africa, and limited shipments to Egypt and Thailand, but similar demand may not materialize this season. Diplomatic tensions with Algeria, weaker Chinese imports, and a strong euro further complicate exports. Meanwhile, Russia, Ukraine, Romania, and Bulgaria dominate key markets, forcing France to consider offloading surplus wheat into feed markets, though competition from maize and a strong Spanish harvest adds further uncertainty.

In W32, Ukraine’s wheat prices remained steady WoW and MoM at USD 0.24/kg, while rising 4.35% YoY. The flat short-term prices reflect a stable market, whereas the YoY increase is linked to weather-related challenges in western regions, which have delayed harvesting and affected wheat quality. Feed wheat prices have fallen sharply due to a high proportion of fungal-damaged grain, while prices for food-grade wheat are rising. Prolonged rains in Jul-25 and early Aug-25 significantly damaged wheat in western and northern Ukraine, with 20% to 60% of incoming grain affected by fungal diseases such as smut, alternaria, and sooty mold. Although still usable as feed, substandard wheat is stored separately, and batches with over 25% smut are often rejected. As rainfall eased, harvesting accelerated, leading to a surge of feed and lower-quality wheat entering the market, suggesting a higher-than-usual share of feed grain this season.

Given the sharp 58% YoY drop in EU wheat exports and France’s export headwinds, exporters should aggressively pursue diversification beyond traditional North African and Asian buyers. Targeting emerging markets in Sub-Saharan Africa, Southeast Asia, and Latin America can reduce reliance on a few major buyers. Strategic trade missions, leveraging EU trade agreements, and partnerships with local millers in these markets will help absorb surplus wheat and reduce stock burdens.

With Australia’s yield outlook improving to as high as 34 mmt after Jul-25 rains, producers should lock in forward sales while global sentiment is strong. Pre-harvest contracting with traders in deficit regions, especially in Asia and the Middle East, can secure favorable prices before potential supply competition intensifies from the Black Sea and North America later in the season. This is particularly crucial for Victoria and South Australia, where additional September rain remains a yield determinant.

The UK’s strong milling wheat quality and protein levels, alongside the US’s reputation for reliable, high-quality supply, create opportunities to strengthen presence in premium milling and specialty flour markets. Exporters should expand relationships with premium millers in Asia, Africa, and the Middle East, emphasizing traceability, consistency, and quality certifications. Premium branding can justify higher prices and maintain margins even in oversupplied global markets.

Both the US and Ukraine face quota and demand constraints that can be mitigated through proactive trade diplomacy. Coordinated lobbying for more flexible quota terms, coupled with leveraging geopolitical relationships, particularly in Africa and the Indo-Pacific, can open new channels for wheat exports. Participation in joint marketing programs, public–private export promotion funds, and bilateral grain corridor agreements will be key to expanding market access in the face of increased global competition.

Sources: Tridge, Agropolit, Sinor, Superagronom, UkrAgroConsult

Read more relevant content

Recommended suppliers for you

What to read next