News

Original content

Northern Argentina's tomato sector is facing a severe crisis due to oversupply, weak demand, rising input costs, and increased competition from imports, particularly from Chile, Paraguay, Brazil, and Bolivia. Farmgate prices have dropped to USD 1.54 to 3.08 per 18-kilogram (kg) box (ARS 2,000 to 4,000/18-kg box), often below harvesting costs, forcing some producers to abandon crops or distribute tomatoes for free in protest. The 2024 oversupply stems from last year's high prices, which encouraged expanded planting, coinciding with late-season overlaps from other domestic regions and foreign inflows. Production costs have surged to USD 9,241.71 to 11,552.14 per hectare (ARS 12 to 15 million/ha), driven by dollar-priced inputs, freight, and labor, while processing demand has dropped, making it cheaper to import tomato sauce than produce it locally. Producers cite lack of protective trade measures, porous borders, and restricted export access to neighboring markets as key challenges, warning that without policy support, regional horticulture risks long-term decline.

In Lajeado, Brazil's municipality of Feliz, cherry tomato cultivation under the Company for Technical Assistance and Rural Extension of Rio Grande do Sul and Southern Association for Rural Credit and Assistance (Emater/RS-Ascar) administrative region is in its off-season, with crops currently in development and flowering stages. Grown in protected environments, production continues year-round, minimizing seasonal disruptions. No major phytosanitary issues have been reported, though common pests such as borers and leafminer larvae are present. Local market prices range from USD 2.22 to 2.77/kg (BRL 12 to 15/kg).

Delhi's tomato prices have eased after spiking to USD 0.97/kg (INR 85/kg) in late Jul-25 due to heavy rainfall in northern and north-western India. The Government of India, through the National Cooperative Consumers' Federation of India (NCCF), has been retailing tomatoes at subsidized rates of USD 0.54 to 0.68/kg (INR 47 to 60/kg) since August 4, selling over 27 metric tons (mt) via stationary outlets and mobile vans. As of W32, average prices in Delhi stand at USD 0.83/kg (INR 73/kg), compared to USD 0.57/kg (INR 50/kg) in Chennai and USD 0.66/kg (INR 58/kg) in Mumbai. The all-India average is USD 0.59/kg (INR 52/kg), below last year's USD 0.62/kg (INR 54/kg) and far lower than 2023's USD 1.55/kg (INR 136/kg). The ministry attributes price movements to temporary weather-related disruptions rather than structural supply shortages, noting that potato, onion, and tomato prices remain largely under control this monsoon, supported by higher output and buffer stock measures.

From Apr-25 to Jun-25, Kazakhstan harvested a total of 50,400 mt of tomatoes nationwide, with Turkestan Oblast as the leading producer at 36,800 mt. Greenhouse tomato cultivation covered 4.5 million square meters (m²) across the country. Other major producing regions included Aktobe, Pavlodar, Almaty Oblast, Almaty city, and Shymkent, contributing smaller volumes. The data reflect the continued growth and significance of greenhouse tomato production in Kazakhstan.

The Korea Rural Economic Institute (KREI) forecasts wholesale tomato prices in Aug-25 to reach USD 14.39/5kg (KRW 20,000/5kg), a rise of 33.2% from the three-year average and 18.1% from last year, driven by reduced production from heat wave conditions. The institute warns that continued high temperatures or heavy rains could push prices even higher.

Moroccan tomato exports to Denmark reached 1,660 mt between Jul-24 and Jun-25, marking a 32% increase from the previous year and a 67% rise from 2022/23. While Denmark accounts for under 1% of Morocco's total tomato exports, shipments now occur monthly without seasonal interruptions, reflecting Morocco's strategy to diversify beyond traditional markets. The country is the only non-European tomato supplier to Denmark and is expanding its presence across Scandinavia, including record exports to Norway, alongside other products such as pickled vegetables, watermelons, almonds, and strawberries.

In Ukraine, the Aug-25 tomato canning season is underway, but prices remain high due to delayed harvests and adverse weather. According to the Ukrainian Agribusiness Club (UCAB), drought in the southern and central growing regions, along with temperature fluctuations and rains, has reduced yields. This contrasts with the usual seasonal trend of peak supply and lower prices during this period.

Ukraine’s greenhouse tomato prices have declined to USD 0.96 to 1.32/kg (UAH 40 to 55/kg) in W32 amid resumed harvesting and low consumer demand. Open-field tomatoes are struggling with quality issues due to drought and heat damage, including sunburn and cracks. Despite the recent price drop, greenhouse tomatoes remain 69% higher than last year, reflecting reduced domestic production.

.png)

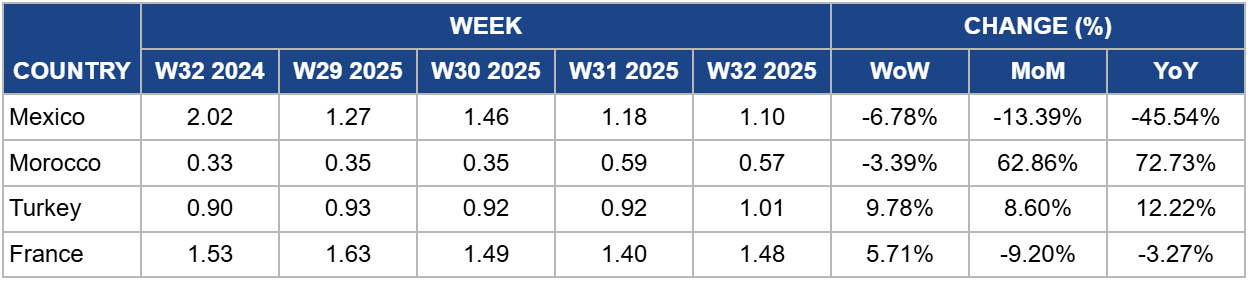

In W32, Mexico's tomato prices fell 6.78% week-on-week (WoW) to USD 1.10/kg and declined by 45.54% year-on-year (YoY) from USD 2.02/kg, driven by stable domestic supply and slightly weaker United States (US) demand. The decline comes amid concerns over a 17% US tariff on Mexican fresh tomatoes, announced in mid-July, which threatens exports from key producing states like Baja California.

To stabilize the market and protect domestic producers, the Mexican government implemented minimum export prices on August 8 for various tomato varieties, including USD 0.95/kg for round tomatoes, USD 0.88/kg for Roma, and USD 1.70/kg for cherry, stem, grape, and other specialty types. This measure is designed to prevent market distortions, safeguard national supply, and maintain orderly trade without limiting export volumes. The new minimum prices are likely to support current export revenues, providing a price floor that may prevent further declines. However, ongoing US tariffs could constrain demand, potentially keeping pressure on Mexican tomato exports and influencing future domestic and international price dynamics.

Morocco's tomato prices decreased slightly by 3.39% WoW to USD 0.57/kg in W32, but remained 72.73% higher YoY from USD 0.33/kg, reflecting the end of the primary export season to Europe. Reduced export volumes have tightened supply, supporting elevated prices despite the minor weekly decline.

Morocco's tomato exports to Denmark reached 1,660 mt in Jul-24–Jun-25, up 32% YoY, reflecting strategic market diversification. Ongoing shipments and expansion into Scandinavia, including record exports to Norway, support strong international demand and are likely to sustain Moroccan tomato prices in the near term.

In W32, Türkiye’s tomato prices rose to USD 1.01/kg, up 9.78% WoW and 12.22% YoY from USD 0.90/kg. The increase reflects tightening supply and steady domestic demand. If current trends continue, prices may remain supported in the near term, particularly if production constraints persist or export demand strengthens.

In W32, France's tomato prices rose 5.71% WoW to USD 1.48/kg but remained slightly below last year’s level, down 3.27% YoY from USD 1.53/kg. The domestic market faces mounting pressure from increased Moroccan tomato imports, which benefit from improved production techniques and preferential European Union (EU) trade terms. Rising imports, particularly of premium small tomatoes, are intensifying competition and weighing on local prices. If Moroccan production expands further, especially in Western Sahara, French tomato growers may face continued price challenges, potentially limiting upside for domestic markets despite short-term weekly gains.

Argentina's authorities should consider temporary protective measures, such as import controls or export incentives, to shield local producers from foreign competition while improving access to neighboring markets. This could help stabilize farmgate prices and prevent the long-term decline of regional horticulture.

Producers should diversify into processed products such as tomato paste, sauces, and canned tomatoes to offset low fresh-market prices. This strategy can enhance margins, reduce post-harvest losses, and create more resilient income streams amid oversupply and weak domestic demand.

Encouraging greenhouse cultivation, as seen in Brazil and Kazakhstan, can reduce seasonal volatility, improve yield consistency, and mitigate weather-related risks, supporting stable supply and higher-quality tomatoes for both domestic and export markets.

Sources: Tridge, India Times, Bichos del Campo, Agro Link, the Ukrainian Independent Information Agency of New (UNIAN), Yonhap News Agency (YNA), Foodsmate, the North Africa Post, France 24, Portal Fruticola, Redagrícola, Fresh Plaza

Read more relevant content

Recommended suppliers for you

What to read next