News

Original content

Down from the previously threatened 30%, the United States (US) imposed a 15% tariff on most European Union (EU) goods at the start of Aug-25, bringing certainty to the trade relationship. However, trade tensions have escalated dramatically with a new threat from the US to impose a 35% tariff on EU goods if the bloc does not invest USD 600 billion in the US economy. EU companies have expressed interest in investing at least USD 600 billion in various sectors in the US by 2029. This ultimatum creates extreme uncertainty for the European dairy sector. A 35% duty would be a devastating blow, potentially making high-value European products like specialty cheeses prohibitively expensive for American consumers and effectively closing off a vital export market. The move threatens to create a surplus of dairy products within the EU, which would put severe downward pressure on prices and threaten the viability of thousands of farms. This latest development adds another layer of instability to a global dairy market already grappling with significant supply and demand challenges.

The European Commission's (EC) latest short-term outlook forecasts stable EU milk deliveries for 2025, as a 1.2% increase in yields is expected to offset a continued 1% decline in the dairy herd. However, this stability masks significant regional differences, with production falling in disease-hit Western European countries like Germany and France, while rising in Ireland and Poland due to favorable conditions. With raw milk supplies constrained, processors are making a strategic pivot, prioritizing cheese and whey production, which are both forecast to grow by 0.7%. This comes at the expense of butter and milk powders, whose exports are expected to decline due to weaker global demand. Despite questionable consumer demand amid food inflation, farmer margins are expected to remain favorable, supported by milk prices that are 28% above the five-year average and lower feed costs.

Germany's largest dairy cooperative, DMK Group, is entering the plant-based market by launching a new vegan range under its popular Milram brand. DMK’s new vegan products will include oat-based vanilla, chocolate, and rice puddings, as well as an oat-based version of DMK’s existing Milram Kakao chocolate milk drink. This initial rollout directly targets a market gap where consumer preference for oats is high, but soy-based options still dominate. This expansion follows the co-op's earlier announcement to develop vegan cheese. This pivot is a direct response to rising consumer demand for plant-based proteins, with DMK's own research revealing that over 40% of its customers already buy milk alternatives. While affirming that milk remains its core business, the co-op's CEO described the plant-based trend as "unstoppable." The CEO stated the goal is not simply to imitate animal products but to create a diverse portfolio of "tasty, healthy and varied concepts" that serve the modern consumer who integrates both dairy and plant-based options into their diet.

German retail giant Rewe Group has unveiled an ambitious strategy that poses a significant challenge to the traditional dairy sector, setting a target for 60% of its food sales to come from plant-based products by 2035. This move signals a major strategic pivot from one of Europe's largest retailers, building on its 2024 success, where vegan products already accounted for 54% of sales, directly competing with dairy for shelf space and consumer spending. As part of this strategy, Rewe is calling on the German government to create a national protein roadmap that actively supports the dietary transition away from animal products. The company's policy demands, particularly the call to scrap the discriminatory 19% VAT on plant-based milk, would eliminate a key price advantage for conventional dairy. Alongside similar moves by Lidl, this initiative represents a coordinated push by major retailers to reshape the market, increasing competitive pressure on dairy producers and processors to adapt to evolving consumer and corporate sustainability goals.

Dutch dairy cooperative FrieslandCampina has announced its strategic exit from the Romanian market, agreeing to sell its entire operations to the Bonafarm Group. The deal includes the leading local brand Napolact, two production facilities in Cluj-Napoca and Târgu Mureș, and approximately 400 employees. FrieslandCampina stated the decision follows a strategic review, aiming to focus on core markets where it can better valorize its member farmers' milk. While a market leader, the Romanian business offered limited synergy with the company's broader European portfolio. The new owner, Bonafarm Group, views the acquisition as a strategic opportunity to invest in and grow the well-established Napolact brand, leveraging its strong regional presence to further develop the Romanian dairy industry. The transaction is expected to be completed by the end of 2025.

In another significant strategic pivot, Dutch dairy cooperative FrieslandCampina has announced it will discontinue its investments in precision fermentation, a technology used to create animal-free proteins. The company stated that changing market conditions and intensified competition have made continued investment in this area no longer economically viable. This move marks a clear refocus on the company's core dairy operations, prioritizing the production of milk proteins and other dairy-derived nutrients. While stepping back from precision fermentation operations, FrieslandCampina will continue to explore and develop hybrid products that blend traditional dairy with plant-based ingredients, provided they meet strict criteria for taste, nutrition, and sustainability. The company's CEO emphasized that greater sustainability gains can be achieved by further improving the carbon dioxide (CO₂) footprint of its core dairy products, signaling a renewed commitment to its foundational business.

New Zealand's dairy season has kicked off with exceptional strength, as June milk solids production surged by a record 17.8% year-on-year (YoY) to 23.96 million kilograms (kg), while total milk volume was up 14.6% to 261,000 metric tons (mt). This powerful start is supported by a high opening farmgate price of USD 5.92 per kilogram of milk solids (kgMS) (NZD 10.00/kgMS) and excellent pasture conditions, keeping industry confidence high. The strong market is also reflected in export returns. While June's export volumes were flat, their value increased by a significant 11% due to firm global pricing. Furthermore, export volumes have risen 2.5% year-to-date (YTD), while value is up 17.7%. However, this positive domestic picture is now overshadowed by a major external shock. The confirmation of a new 15% US tariff on New Zealand dairy products, alongside similar or higher duties in other key markets, has introduced a new level of uncertainty. While farmers are currently benefiting from favorable conditions, this wave of protectionism poses a real threat to future competitiveness and profitability.

French dairy giant Lactalis has reportedly entered exclusive negotiations to acquire Fonterra's global consumer business, which includes iconic household brands like Anchor and Mainland. While Fonterra has not officially commented, this development positions the world's largest dairy company as the frontrunner in a competitive sale process that also included Japan’s Meiji and Australia’s Bega Group. The potential deal is a key part of the cooperative's turnaround strategy to focus on its ingredients and foodservice operations. With the Australian competition regulator having already cleared the move, a major hurdle has been removed. A successful acquisition by the privately-owned Lactalis would, however, end the possibility of a public stock market listing for the brands, a route Fonterra had also been exploring.

.png)

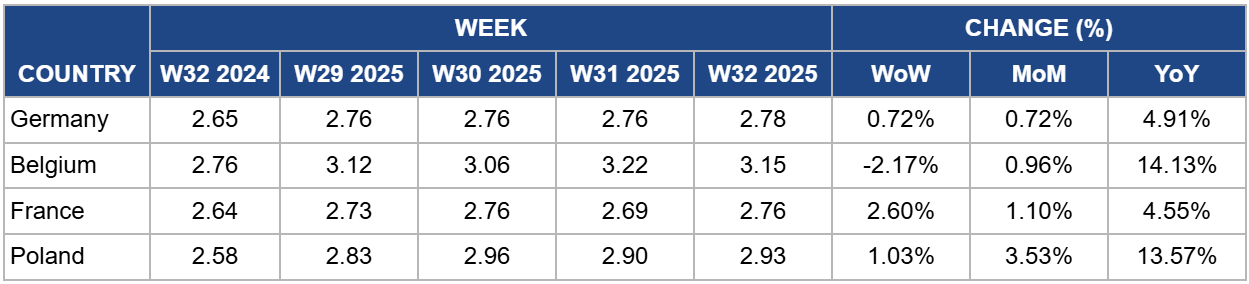

In Germany, the price of skimmed milk powder (SMP) was USD 2.78/kg in W32, a 0.72% increase week-on-week (WoW) and month-on-month (MoM). The price also remains 4.91% higher YoY. The German SMP market is showing signs of firming up after the seasonal production peak. The slight WoW and MoM increases suggest that the downward pressure from the spring/summer milk flush has subsided, allowing the underlying tightness in the EU's raw milk supply to reassert itself. This has stabilized prices and is beginning to push them upwards again. The significant YoY price increase is a direct consequence of the structural supply constraints facing the EU dairy sector. As highlighted in recent reports, reduced cattle herds from disease, environmental pressures, and low farmer margins have created a fundamentally tighter raw milk market compared to the same period last year. This scarcity continues to support a higher price floor for storable commodities like SMP.

In Belgium, the price of SMP was USD 3.15/kg in W32, a decrease of 2.17% WoW. The price is up 0.96% MoM and remains 14.13% higher YoY. The Belgian SMP market is experiencing a slight correction after a recent price surge, though the underlying fundamentals remain strong. The WoW price dip appears to be a minor recalibration after a significant increase in the previous week, suggesting the market is finding a new, albeit high, equilibrium. However, the positive MoM trend is driven by a significant domestic supply squeeze, with Belgian SMP production down 8.9% in the first half of 2025, which has kept prices firm over the past month. The dominant long-term trend remains the 14.13% YoY price increase. This reflects the fundamental supply tightness across the EU, where reduced cattle herds have constrained overall milk production. The fact that Belgian SMP is currently the most expensive among its EU peers underscores the severity of its domestic production shortfall, which keeps prices at a significant premium compared to last year.

In France, the price of SMP was USD 2.76/kg in W32, an increase of 2.6% WoW and 1.1% MoM. . The French SMP market is showing clear signs of firming as the seasonal milk production peak subsides. The positive WoW and MoM price movements are driven by a tightening domestic supply situation, with both raw milk deliveries (-0.8%) and SMP production (-1.5%) down in the first half of 2025. As the summer flush wanes, this underlying scarcity is reasserting upward pressure on prices. The significant YoY increase is a direct consequence of the broader structural supply constraints facing the EU dairy sector. Reduced cattle herds from disease outbreaks like Lumpy Skin Disease (LSD) and bluetongue have created a fundamentally tighter raw milk market compared to the same period last year, supporting a higher price floor for storable commodities.

In Poland, the price of SMP was USD 2.93/kg in W32, an increase of 1.03% WoW. This reflects a 3.53% MoM rise and a significant 13.57% YoY increase. The Polish SMP market continues to demonstrate significant strength, with prices firming across all timeframes. The positive WoW and MoM movements are driven by a tightening domestic supply of powder; despite a slight 0.6% increase in raw milk deliveries in the first half of 2025, SMP production fell by a substantial 7.5% during the same period. This indicates that processors are diverting milk to other value-added products, creating a domestic scarcity of SMP that is supporting the recent price rally. The 13.57% YoY price increase highlights the impact of broader EU supply constraints. Although Poland's milk production is bucking the negative trend seen in Western Europe, it is not enough to offset the continent-wide tightness caused by smaller herds. Combined with strong export demand for Polish dairy products, this has created a fundamentally tighter market compared to last year, supporting a significantly higher price floor for storable commodities.

The US threat of a 35% tariff on EU goods and the confirmed 15% duty on New Zealand products represent a clear and present danger to export-dependent producers. Relying on the US market is now a high-risk strategy. Exporters and trade bodies must immediately accelerate market diversification efforts, focusing on high-growth regions like Southeast Asia, the Middle East, and Latin America, where demand for dairy protein is rising. This involves conducting in-depth market research to understand local consumer preferences, building relationships with new importers, and adapting packaging and product formulations for these new markets. For the US market, exporters should focus on shifting their product mix towards less price-sensitive, high-value specialty items that have no direct domestic substitutes, such as protected designation of origin (PDO) cheeses. Concurrently, industry associations must intensify lobbying efforts and explore all available trade dispute mechanisms to challenge these protectionist measures and restore market stability.

The strategic divergence between German retailers embracing plant-based alternatives and FrieslandCampina's refocus on core dairy highlights a critical market reality: the modern consumer is a flexitarian. Instead of viewing plant-based products as a direct enemy, processors should develop a hybrid product strategy that blends dairy with plant-based ingredients. This creates innovative, value-added products that appeal to consumers seeking variety, sustainability, and novel taste profiles, as FrieslandCampina plans to explore. Simultaneously, the industry must proactively and aggressively reinforce the value proposition of core dairy products. Marketing and communication should emphasize dairy's superior nutritional profile (e.g., bioavailability of calcium and protein), taste, and functionality. Furthermore, producers must continue investing in and promoting sustainability initiatives, such as reducing the CO₂ footprint of milk production, to directly counter the sustainability claims that often drive consumers toward alternatives.

The EU's constrained raw milk supply and corresponding high SMP prices signal a fundamental market shift that requires an immediate operational response. Processors can no longer rely on a cheap and abundant supply of milk. The first priority is to secure and stabilize raw milk inputs by forging stronger, long-term partnerships with farmers. This includes offering more attractive contracts with pricing models that reward quality, sustainability, and loyalty, thereby reducing the risk of supply disruptions. Secondly, with raw materials being both scarce and expensive, processors must critically evaluate their product portfolios to maximize profitability. The report clearly indicates that EU processors are pivoting from powders to cheese and whey. Companies should follow this trend, investing in the capacity and technology needed to produce higher-margin products such as specialty cheeses and whey protein concentrates, which offer better returns on every liter of milk processed.

Sources: Tridge, Dairy News, AHDB, Coop News, Green Queen, Feed and Additive, Vegconomist, Farmers Weekly NZ, Interest

Read more relevant content

Recommended suppliers for you

What to read next