News

Original content

The European Union (EU) and Indonesia have agreed to allow duty-free imports of Indonesian crude palm oil (CPO) and palm kernel oil under a newly concluded Comprehensive Economic Partnership Agreement (CEPA). While shipments within quotas will face a 0% tariff, volumes exceeding the limit will be subject to a reduced 3% duty—significantly lower than the 19% rate imposed by the United States (US). Reached despite initial EU resistance due to the incoming European Union Deforestation Regulation (EUDR), the deal is expected to intensify competition with other vegetable oils. Under CEPA, 80% of Indonesian exports to the EU will benefit from zero tariffs, boosting trade amid ongoing global trade tensions.

The Indian Vegetable Oil Processors Association (IVPA) and the Indonesian Palm Oil Association (IPOA) signed a Memorandum of Understanding (MoU) in New Delhi to enhance cooperation in the palm oil sector, focusing on sustainability, food security, and trade stability. The three-year agreement outlines joint initiatives in technical exchange, sustainability certification, policy alignment, and market intelligence. With palm oil accounting for USD 4.4 billion in bilateral trade in 2024, the MoU formalizes a long-standing partnership and aims to support India’s edible oil needs while advancing Indonesia’s commitment to responsible palm oil production.

On July 31, 2025, Indonesia and Canada reaffirmed their strategic agricultural partnership during a high-level meeting between the Indonesian Minister of Agriculture and the Canadian Minister of Agriculture and Food Security. A key focus was expanding Indonesia's crude palm oil (CPO) exports to Canada, as part of broader efforts to enhance bilateral trade amid global uncertainties. Both sides expressed commitment to sustainable and inclusive agricultural development, with cooperation also extending to livestock, dairy, and agricultural technology. Canada reiterated support for the Indonesia–Canada CEPA, positioning palm oil as a potential growth sector in future trade.

Indonesia and Malaysia have agreed to coordinate efforts to defend their palm oil industries against negative campaigns and looming US tariffs set to take effect on August 1. As the world's top two producers, supplying around 85% of global palm oil, both countries are expanding trade ties beyond traditional markets such as India and China, targeting new partners, including the US. Recent progress in the EU has seen Malaysia secure tariff reductions of 20 to 40 percentage points. Indonesian exports within quotas are now duty-free, while a 3% rate is applied outside quotas.

Malaysia has increased its share of India's palm oil market to 35% in H1-2025, driven by competitive pricing, tariff reductions, and renewed export volumes, according to the Malaysian Palm Oil Council (MPOC). Monthly exports rebounded to 250,000 metric tons (mt) in May-25 and Jun-25, aided by demand ahead of the Diwali season. Malaysian CPO is now the most price-competitive edible oil in India, offering an edge over Indonesian suppliers. Beyond trade, Malaysia has deepened engagement through a strategic partnership with the Indian Vegetable Oil Producers’ Association (IVPA) to promote the sustainability and nutritional benefits of Malaysian palm oil. With steady demand and favorable pricing, Malaysia is poised to maintain momentum in India’s edible oil market through the remainder of 2025.

The Malaysian Palm Oil Board (MPOB) forecasts palm oil production to rise from 19.3 million metric tons (mmt) in 2024 to 19.5 mmt in 2025, supported by improved labor availability. Imports are expected to reach 17 mmt. Despite a higher CPO base price of USD 910.81/mt and an export duty increase to 9% for Aug-25, Sep-25 futures fell 1.3% to USD 1,013/mt (MYR 4,273/mt) due to weaker Jul-25 exports and anticipated stock build-ups. Globally, rising supplies of soybean and sunflower oil, along with improved crop prospects and duty suspensions, are expected to restrain palm oil prices in the coming months despite recent price gains.

Effective August 4, the Yangon Region Household Edible Palm Oil Distribution and Sales Committee will reduce the household purchase limit of edible palm oil from USD 4.5 per kilogram (kg) to USD 4.1/kg per order. The change is intended to improve access across 44 townships through monthly home delivery services. Prices will be set weekly based on wholesale benchmarks and cost assessments, with payment due upon delivery. Orders can be placed via call centers on weekdays, with deliveries expected within three days. The benchmark wholesale price was set at USD 2.91/mt (MMK 6,130/mt) from July 28 to August 3.

.png)

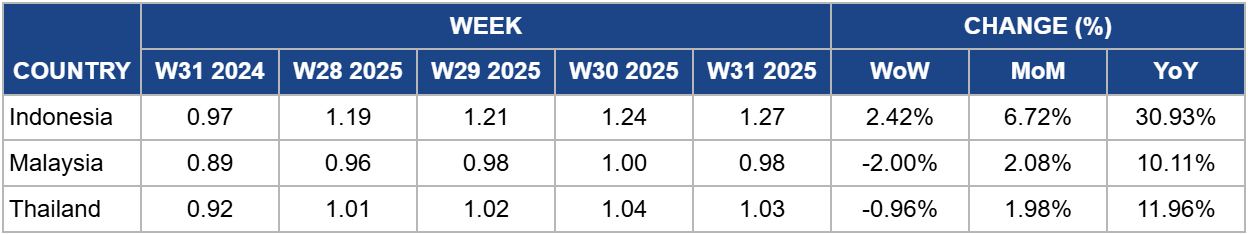

In W31, Indonesia's palm oil spot prices rose by 2.42% week-on-week (WoW) to USD 1.27/kg, reflecting tighter domestic supply and marking a 30.93% year-on-year (YoY) increase from USD 0.97/kg in W31 2024. The recent CEPA agreement with the EU, which allows duty-free access for Indonesian CPO and palm kernel oil within quotas, is expected to support continued demand growth and improve export margins. With 80% of Indonesian exports to the EU now eligible for zero tariffs, the deal enhances market competitiveness, especially against other vegetable oils. Combined with ongoing supply constraints, this policy shift may keep Indonesian palm oil prices elevated in the short to medium term.

In W31, Malaysia's CPO prices declined by 2% WoW to USD 0.98/kg, though they remained 10.11% higher YoY from USD 0.89/kg in W31 2024. Futures rose modestly midweek, with the benchmark Oct-25 contract closing at USD 1,009.92/mt (MYR 4,277/ton), supported by gains in rival Dalian oils, a weaker ringgit, and strength in Chicago soyoil and energy futures.

The softer ringgit improved CPO's export competitiveness, helping cushion the impact of the price decline. However, Malaysia faces downside risks from increased Chinese soyoil exports to India at discounted rates, which may curb palm oil demand in key markets. Additionally, weaker crude oil prices reduce the appeal of palm oil for biodiesel production. While near-term futures may find support from currency and market fundamentals, substitution pressures and global macroeconomic uncertainties could limit upside potential for Malaysian palm oil prices in the coming weeks.

Thailand's wholesale palm oil prices declined by 0.96% WoW to USD 1.03/kg in W31, though they remained 11.96% higher YoY from USD 0.92/kg. The slight price dip reflects short-term market adjustments amid stable supply and strong export activity. Palm oil contributed notably to Thailand's 15.5% YoY export growth in Jun-25, supported by increased foreign demand ahead of anticipated US tariff measures.

While near-term prices may remain under pressure from currency strength and expected export moderation in H2-2025, continued demand from key markets and seasonal restocking could provide support. Overall, palm oil's strong trade performance reinforces its strategic role in sustaining Thailand's export-driven growth despite emerging global headwinds.

Indonesia and Malaysia should deepen bilateral and multilateral cooperation with key importers such as India, Canada, and the EU. Strengthening joint initiatives in sustainability certification, technical exchange, and policy alignment will help meet evolving regulatory demands, support long-term trade stability, and secure access to high-value markets amid rising protectionist measures.

Exporters should maximize utilization of newly available duty-free quotas under the EU–Indonesia CEPA by optimizing shipment schedules and export volumes. For volumes exceeding quotas, strategic pricing adjustments can maintain competitiveness against other vegetable oils. Exporters should also monitor global tariff trends to recalibrate routes and secure improved access in key markets such as the EU and Canada.

Producers in Indonesia and Malaysia should invest in targeted market intelligence and brand positioning campaigns to counter rising competition from soybean and sunflower oil. Highlighting the nutritional and sustainability credentials of palm oil—especially in India and emerging markets—can strengthen buyer confidence and limit substitution, supporting demand consistency amid volatile global conditions.

Sources: Tridge, Foodmate, Republika, Ukr AgroConsult, Hellenic Shipping News, Vietnam+

Read more relevant content

Recommended suppliers for you

What to read next