Original content

According to the latest Institute of Services for the Agricultural and Food Market (ISMEA) report, Italy's olive oil sector demonstrated significant economic resilience in 2024, with export values surging by 42.6% to USD 3.6 billion (EUR 3.09 billion), even as volumes grew by a more modest 6.8%, reaching 344 thousand metric tons (mt). Furthermore, domestic production remains high at 441 thousand mt, with a per capita consumption of 7.5 liters (L). The sector has reached a turnover of USD 6.75 billion (EUR 5.8 billion), consolidating its economic weight in the national food industry. This strong performance, which solidified Italy's position as the world's second-largest exporter, sharply contrasts with a challenging domestic production year. The 2024 harvest yielded just 248 thousand mt, a 24% decrease from the previous season, largely due to climatic factors. Despite the production shortfall, the industry's widespread structure and strong focus on certified quality have sustained its market presence. To address the ongoing challenges, a significant package of financial measures, including over USD 191 million (EUR 164 million) in support for mill modernization and combating pathogens like Xylella, is being deployed to foster innovation and help the sector recover its production volumes.

The Italian Olive Oil Industry Association (ASSITOL) has responded to the new 15% United States (US) tariff, deeming it a sustainable level that allows Italian companies to remain competitive in the strategic American market, despite a global context marked by inflation and a weak dollar. With the US importing 95% of its olive oil, the association notes that American consumers' focus on health benefits has made them willing to accept higher prices for a product they perceive as an investment in health. Despite this resilience, ASSITOL is urging the European Union (EU) to provide greater support by reducing bureaucratic hurdles and energy costs, and increasing access to credit, to help maintain competitiveness in a challenging global environment. The association also continues to advocate for olive oil to be made a duty-free product and calls for greater international promotion to raise awareness and increase global consumption, which currently only accounts for 4% of global dietary fat consumption.

In response to the new 15% US tariff on EU goods, the Greek olive oil sector is pursuing a dual strategy of market diversification and diplomatic lobbying. To mitigate the financial impact of the duties, producers are actively seeking new export destinations, with Australia emerging as a prime alternative, driven by a strong Greek diaspora and growing demand for Mediterranean products. Some producers have already secured new deals in Australia and Brazil, signaling a proactive pivot away from the US. India, the Middle East, and China are also being positioned as future frontiers offering opportunity, but also requiring significant investment and strategic adaptation. Simultaneously, the Greek government is actively lobbying for exemptions from tariffs at the EU level for key national exports like olive oil and is considering targeted support to help the vulnerable sector. This strategic response aims to navigate the fallout from the disruptive trade policy by opening new trade channels while working to protect access to a traditional market.

In a clear example of the market diversification strategy being adopted by Greek producers, the brand Greek Legend has entered the Russian market, aiming to sell 55,000 bottles of extra virgin olive oil by the end of 2025. This move comes as the Greek olive oil sector seeks new export destinations to mitigate the impact of US tariffs. The company is positioning itself to fill a niche for high-quality, traceable products in a Russian market that is recovering to an annual consumption of 25,000-27,000 mt. The initial shipments are a pilot launch to test the market, with ambitious plans to significantly scale up in 2026. The company aims to ship over 150,000 bottles in the first half of 2026 alone, targeting the Hotel, Restaurant, and Cafe (HoReCa) segment. This strategic entry into Russia demonstrates a proactive approach to navigating global trade uncertainties by building a presence in new, high-potential regions.

Spain's vital olive oil sector is facing a significant challenge from new US tariffs, including a 15% tariff on olive oil and a 50% tariff on black olives. These measures are threatening the country's USD 7 billion (EUR 6 billion) industry and are part of a broader US strategy to reduce reliance on EU agricultural imports. In response to this pressure, the Spanish industry is demonstrating resilience and innovation. Producers are strategically exploring the export of bulk olive oil to the US, a tactic designed to bypass the higher tariffs applied to packaged goods. At the retail level, companies are blending oils to maintain price competitiveness for consumers. This industry-led adaptation is being supported by a robust USD 16.4 billion (EUR 14.1 billion) aid package from the EU, underscoring a coordinated effort to protect market share and navigate the new trade landscape.

Spanish research consortium Olicomp3D has developed a groundbreaking sustainable packaging solution for extra virgin olive oil by 3D-printing bottles from agricultural waste. The innovative biocomposite material is created using residues from olive grove pruning and olive pits, representing a significant advancement in applying circular economy principles to the sector. This project, a collaboration between technology centers, universities, and industry partners, builds on previous research proving the viability of using olive farm waste as a natural filler in polymers. The resulting packaging is not only biodegradable but also features lower density and potentially reduced production costs compared to traditional materials. This initiative offers a compelling model for sustainable innovation in the agri-food industry, transforming a waste stream into a value-added product and addressing the growing demand for eco-friendly packaging solutions.

The United Kingdom (UK) government has announced the details of its annual zero-duty import quota for Tunisian olive oil, making nearly 6,970,307 kilograms (kg) available to British importers. This presents a significant opportunity for UK businesses to source olive oil without tariffs, a key advantage in the current volatile trade environment. The application window for licenses is set for the first week of August, from the 1st to the 7th. To be eligible, importers must be established and value added tax (VAT)-registered in the UK and provide a security of USD 229/mt (GBP 170/mt) with their application. The licenses will be valid from September 1 through December 31, 2025, covering the start of the new harvest season. This quota allows for a substantial volume of Tunisian oil to enter the UK market, providing a stable supply channel for bottlers and retailers.

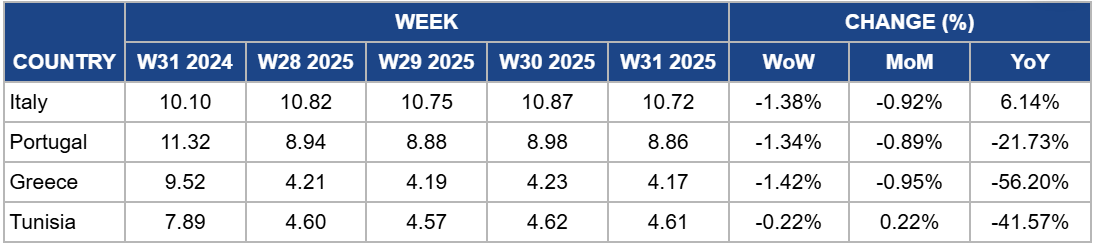

In Italy, the price of extra virgin olive oil was USD 10.72/kg in W31, a decrease of 1.38% week-on-week (WoW). The price is down 0.92% month-on-month (MoM) but remains 6.14% higher year-on-year (YoY). The Italian olive oil market saw a slight price correction this week, though it continues to trade at a significant premium compared to last year. The minor WoW and MoM dips suggest the market has stabilized at a high level. This is likely because Italian buyers have successfully secured sufficient volumes of imported oil from Spain and Greece to meet their immediate needs, temporarily easing the intense upward pressure caused by domestic scarcity. However, the dominant long-term trend remains the 6.14% YoY price increase. This is a direct consequence of Italy's severe 2024/25 production crisis, which saw the harvest fall by 25% and stocks of authentic Italian extra virgin olive oil (EVOO) plummet. This fundamental supply deficit is the primary driver supporting the sustained price premium for Italian-origin oil, a situation expected to persist until the new harvest provides relief.

In Portugal, the price of extra virgin olive oil was USD 8.86/kg in W31, a decrease of 1.34% WoW and 0.89% MoM. The price is down a significant 21.73% YoY. The Portuguese olive oil market is experiencing a typical summer slowdown, with prices softening slightly as the season concludes. The minor weekly and monthly price decreases reflect a quiet market with minimal trading activity and ample carry-over stocks from the strong 2024/25 harvest. With the market's focus shifting to the upcoming season, prices have stabilized at this new, lower level. The long-term trend remains the 21.73% YoY price collapse. This is a direct result of Portugal's second-highest harvest on record in the 2024/25 season, a performance that, combined with a broader European production rebound, ended the scarcity-driven high prices of the previous year and brought the market back to a more balanced state.

In Greece, the price of extra virgin olive oil was USD 4.17/kg in W31, a decrease of 1.42% WoW and 0.95% MoM. The price remains 56.2% lower YoY. The Greek olive oil market is characterized by a tense stability, with minor price dips reflecting a quiet summer trading period. The slight weekly and monthly decreases indicate a market in equilibrium, where producers are holding back significant volumes of unsold oil in hopes of better prices, preventing a major slide. This standoff is creating a very cautious market with low trading volumes as the season concludes. However, with high summer temperatures threatening to accelerate quality degradation, some pressure is building to move stock before the onset of August heat. The long-term trend remains the massive 56.2% YoY price collapse. This is a direct result of the strong production rebound in both Greece and, more significantly, Spain during the 2024/25 season, which ended the severe scarcity and record-high prices of the previous year.

In Tunisia, the price of extra virgin olive oil was USD 4.61/kg in W31, a slight decrease of 0.22% WoW. The price is up 0.22% MoM but remains down a significant 41.57% YoY. The Tunisian olive oil market has entered a quiet, stable phase as the season concludes, with prices showing minimal movement. The slight weekly dip and marginal monthly gain indicate a market in equilibrium, where the upward pressure from depleted stocks is being balanced by a typical summer slowdown in trading activity. With reports confirming that domestic inventories are nearly exhausted and the remaining oil faces quality risks from the summer heat, Tunisia's market presence is diminishing until the new harvest. The dominant long-term trend remains the massive 41.57% YoY price collapse. This reflects the significant market correction following the excellent 2024/25 harvest, which ended the supply crisis and record-high prices of the previous year.

The imposition of US tariffs requires a proactive and multi-faceted response to protect and grow revenue. Spanish and Greek exporters should adopt a two-pronged strategy. Firstly, to maintain a foothold in the strategic US market, follow the Spanish model of innovation by exploring the export of bulk olive oil to US-based bottlers. This approach can circumvent the higher tariffs applied to pre-packaged, branded goods, allowing oil to remain price-competitive on American shelves after it is bottled locally. Secondly, aggressively pursue the market diversification strategy demonstrated by Greek producers. Target countries with growing demand and favorable conditions, such as Australia, with its strong diaspora and demand for Mediterranean products, and Russia, which presents a niche for high-quality, traceable products. This dual strategy not only mitigates the immediate impact of US tariffs but also builds long-term resilience by reducing dependency on a single market and opening new growth frontiers.

The opening of the UK's annual zero-duty import quota for 6,970,307 kg of Tunisian olive oil presents a critical, time-sensitive opportunity to gain a significant cost advantage. With Tunisian EVOO prices down 41.57% YoY and the prospect of sourcing it tariff-free, UK businesses can secure high-quality oil at a substantially lower cost basis than competitors importing from the EU. Immediate action is required from interested parties, as the application window is only open from August 1 to August 7, 2025. To be eligible, a business must be established and VAT-registered in the UK 🇬🇧 and provide the required security of USD 229/mt (GBP 170/mt). Securing a license, which is valid from September 1st, allows the holder to lock in supply for the start of the new harvest season. This protects their margins and enhances their price competitiveness in the UK retail and HoReCa markets for the coming year.

Given the current market dynamics, Italian producers and exporters should intensify their focus on strategic branding to justify and sustain the significant price premium their product commands. With Italian extra virgin olive oil priced at USD 10.72/kg, more than double its competitors, the immediate action is to pivot marketing efforts to celebrate this value. Producers should launch targeted campaigns, particularly in high-value markets like the US, that go beyond general quality claims and instead highlight specific, verifiable attributes such as regional origin, protected designation status, and unique organoleptic profiles. The narrative should frame Italian olive oil not merely as a commodity but as a luxury agri-food product, similar to fine wine, where heritage, craftsmanship, and terroir command a higher price. By deeply entrenching the concept of premium by design in the consumer's mind, the industry can protect its high-margin position and build lasting brand loyalty that will endure even when production volumes recover.

Sources: Tridge, The Pack Hub, AInvest, Interfax, Neos Kosmos, Cibus Link, Olivo News, UK Government

Read more relevant content

Recommended suppliers for you

What to read next