News

Original content

In its Jul-25 report, the International Grains Council (IGC) maintained its global wheat production forecast for the 2025/26 season at 808 million metric tons (mmt), marking a modest 1% year-on-year (YoY). Despite this production rise, consumption is expected to reach 814 mmt, 12 mmt higher than last year, resulting in a persistent supply deficit. Consequently, global wheat ending stocks were revised down by 1 mmt to 265 mmt. In Ukraine, the wheat harvest started slowly due to cooler weather in May-25 and Jun-25, with early yields averaging 2.51 metric tons (mt) per hectare (ha), down from 3.12 mt/ha last season. However, the wheat crop is reportedly of premium quality, and farmers are holding back sales in anticipation of price rallies.

While tight supplies and sluggish barley sales are driving up domestic bids in the short term, strong global output, particularly from the EU and potentially Russia, is likely to limit significant price gains in the long term. Intense export competition will further contribute to capping long-term price increases. Additionally, shifting demand patterns among traditional buyers such as Spain, Egypt, and Vietnam may alter trade flows, intensifying competition among exporters.

In the first two weeks of the 2025/26 season, which began on July 1, the EU’s wheat exports saw a sharp decline, reflecting broader reductions in grain shipments. Soft wheat exports dropped by 78% YoY to just 245.7 thousand mt, with total wheat and flour exports reaching only 261.9 thousand mt. Key destinations for EU soft wheat included Algeria with 63 thousand mt, Cameroon with 51.7 thousand mt, and Lebanon with 30 thousand mt.

Exports of other grains also fell significantly, barley by 26%, corn by 63%, and durum wheat by 50% compared to the same period in 2024. In total, EU grain and processed product exports amounted to 682.3 thousand mt during the period, marking a 63% YoY decrease, underscoring weaker early-season performance across all major cereals.

India has raised the reserve price of wheat by 10.86% YoY for the 2025/26 season, setting it at USD 29.53/quintal (INR 2,550/quintal) for open market sales through the Food Corporation of India (FCI). Aimed at regulating supply and curbing food inflation, this move comes on the back of a record wheat production of 117 mmt in 2024/25 and robust procurement levels of 30 mmt by early Jul-25, exceeding last year’s volumes.

Despite a 6.59% hike in the minimum support price (MSP), the reserve price increase is notably higher, indicating the government’s intent to manage surplus stocks and support market prices. With wheat stocks at a four-year high and overall grain reserves ample, the elevated reserve price allows greater flexibility to release supplies while ensuring inflation control. This strategic pricing move reflects strong production, procurement, and storage capacity, positioning India to balance food security with market stabilization.

Kazakhstan’s wheat sector is facing significant challenges in the 2025/26 season due to domestic policy shifts and external trade barriers. Wheat production is forecast to decline to 13.8 mmt, down from a record 16.5 mmt in 2024/25. This reduction is attributed primarily to farmers switching to more profitable oilseeds like sunflower. Lower yields are also expected, reflecting financial constraints that limit access to fertilizers and crop protection. Compounding these issues, the United States (US) will impose a 25% duty on Kazakh gluten and starch exports starting August 1, significantly reducing market access for deep-processing enterprises that once relied heavily on American buyers. In response, Kazakhstan’s Ministry of Agriculture plans to introduce subsidies for wheat purchases used in gluten production, aiming to support value-added processing and offset lost export revenues. Domestically, flour production remains strong, but millers face growing competition from Uzbek exports and operate below capacity due to rising input costs. Wheat exports are projected to fall to 7.5 mmt, with ending stocks expected to more than halve to 1 mmt. These dynamics underscore the country's shifting agricultural priorities and the pressure on its wheat industry to adapt.

Russia's wheat outlook for the 2025/26 season reflects regional production disparities, weather disruptions, and intensifying global competition. While the southern region is expected to register its lowest harvest in five years, this decline is offset by improved yields in the Central and Volga regions, keeping national wheat production estimates around 84 mmt. However, quality concerns persist due to extreme heat in the South and heavy rainfall during harvest in Western Russia. Export potential remains strong, projected at 42 mmt, but challenges such as a strong ruble, low global prices, and high export duties have strained margins.

Additionally, Russia’s share in global wheat exports has fallen to around 20%, down from a peak of around 25% to 28%, amid increased output from the EU, Ukraine, and Argentina. Nonetheless, efforts are underway to expand markets in Asia, including the Philippines and China, supported by initiatives to build trust and logistics infrastructure.

Spain’s 2025 wheat harvest is projected to reach 8.3 mmt of soft wheat and 0.69 mmt of durum wheat, positioning it as the second most productive season since 1990, only behind the 2020 record. This marks a significant 25.35% increase over the 2024 harvest. The national average wheat yield is also at a record 4.57 mt/ha, up 16% YoY and 21% above the five-year average. However, harvest progress has been slow due to logistical challenges, machinery shortages, and adverse weather, including spot rainfall and heatwaves. Nonetheless, rising extreme weather events underline the urgency for improved farming practices, especially as cultivated area continues to shrink, now 450 thousand ha less than five years ago.

Despite challenges such as drought, locust invasions, and Russian shelling, Ukraine’s wheat sector is demonstrating resilience in 2025. The Ministry of Agrarian Policy forecasts a wheat harvest of 21.2 mmt, slightly below the 22 mmt recorded in 2024, with export expectations ranging between 15 mmt and 16 mmt. Although weather disruptions may temporarily slow harvesting and impact quality, favorable yields in central regions, reaching up to between 5 mt/ha and 6 mt/ha, are helping sustain market strength.

Wheat prices are rising, driven by limited supply, strong demand, and delayed harvests, particularly in the south. Feed wheat prices have also climbed due to high grain quality and constrained availability. Globally, stronger wheat prices in France, Romania, and the US are reinforcing price support in Ukraine. Meanwhile, export volumes at the start of the 2025/26 season are notably lower than last year, reaching 279 thousand mt, as of July 18, 3.12 times less than in the same period in 2024. However, increased activity in Black Sea ports and international tenders, such as Algeria’s purchase of over 1 mmt, are expected to stimulate Ukrainian wheat exports and maintain price momentum.

In its Jul-25 report, the United States Department of Agriculture (USDA) raised US wheat production estimates by 8 million bushels for 2025, as higher yields helped offset reduced acreage. While the average yield for other spring wheat dropped slightly to 51.7 bushels/acre from 52.5 bushels/acre in 2024, overall spring wheat production reached 504 million bushels. However, Hard red spring (HRS) wheat saw a notable production decline to 469 million bushels, down 34.4 million bushels YoY, mainly due to reduced planted area, particularly in North Dakota.

Durum wheat output is projected at 79.7 million bushels, slightly below last year, with stable yields in key states like North Dakota but reduced yields in Montana. The first surveyed estimate signals a modest decline in wheat yields across the Northern Plains, reinforcing expectations of a similar trend in Canadian wheat production for the year.

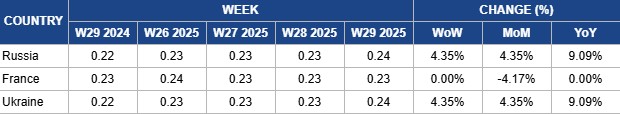

In W29, Russia’s wheat prices saw a 4.35% week-on-week (WoW) and month-on-month (MoM) increase, reaching an average of USD 0.24 per kilogram (kg). This price also marked a 9.09% YoY uptick. The price surge can largely be attributed to the removal of the export duty on Russian wheat, which was lifted on July 9. Additionally, the delayed arrival of the new crop, coupled with lower yields in southern Russia, contributed to the rising prices. By the beginning of Jul-25, only 9% of the area in southern Russia had been harvested, a sharp decline from 40% in the same period last year. However, this slow start was somewhat offset by higher yields in Russia's central and Volga regions. Despite these challenges, export deliveries saw a slight acceleration, although wheat exports remained notably low at the start of the season. Reluctant to sell at the current prices, farmers have further limited supply, fueling concerns about the potential outlook for the harvest.

In W29, France's wheat prices remained stable at USD 0.23/kg for the third consecutive week, unchanged WoW and YoY, but down 4.17% MoM, indicating steady market conditions. The French Ministry of Agriculture forecasts a strong recovery in soft wheat production in 2025, estimating output at 32.6 mmt, 27% higher than in 2024, when excessive rainfall hampered yields. However, France may face challenges in marketing this larger crop, as key export markets such as Algeria and China have reduced their demand due to diplomatic tensions and abundant domestic supply, respectively. Combined with strong competition from lower-priced Black Sea grain, France's soft wheat exports outside the EU are projected to reach only 7.5 mmt in the 2025/26 season, potentially leading to the highest end-of-season wheat stocks in 21 years. While Morocco, West Africa, Egypt, and Thailand helped absorb France's smaller 2024 crop, their demand may not be sufficient to offset this year's surplus and could lower export prices.

Ukraine's wheat prices rose by 4.35% WoW to USD 0.24/mt in W29, reflecting a 4.35% MoM increase and a 9.09% YoY rise. This price increase can be attributed to limited wheat supply, particularly from southern Ukraine, where harvesting has been delayed and yields are low. As of July 11, Ukraine had harvested 1.24 mmt of wheat from 434.8 thousand ha, yielding an average of 2.85 mt/ha. However, yields in central Ukraine, where harvesting just began, were higher, averaging 5 mt/ha to 6 mt/ha, with good grain quality, which has contributed to a rise in feed wheat prices. Wheat exports for the first 14 days of the 2025/26 season were significantly lower compared to the same period in 2024. Although expected precipitation in Ukraine may temporarily slow harvesting support prices, it will also improve conditions for later crops.

India’s record wheat production, coupled with strong stocks, presents an opportunity to stabilize domestic prices and manage surpluses effectively. The Indian government should focus on improving its strategic wheat stock management, ensuring that reserve price adjustments, such as the increase in reserve price for the 2025/26 season, are supported by efficient logistics, timely distribution, and storage infrastructure. This will ensure that surplus wheat is available when needed, curbing inflation, and facilitating smooth market operations without compromising food security.

With Spain’s wheat production increasing significantly due to favorable weather conditions, the government and agricultural stakeholders should focus on promoting sustainable farming practices. Given the shrinkage of cultivated area, coupled with rising extreme weather events, Spain should invest in precision agriculture technologies that help optimize yield/ha while mitigating risks from weather fluctuations. Additionally, providing incentives for farmers to adopt more resilient farming techniques, such as drought-resistant wheat varieties and efficient irrigation systems, will ensure long-term sustainability and productivity.

Kazakhstan’s wheat production is facing decline due to a shift in crop priorities and external market challenges, such as the US tariff on gluten exports. To mitigate this, the Kazakh government should expand its subsidy programs for wheat production, particularly for farmers transitioning to gluten production. This support should be aligned with policies that reduce the financial burden of fertilizer and crop protection costs, which have been a barrier to improving yields. Additionally, Kazakhstan should explore alternatives to oilseeds and improve its wheat processing capabilities, which could increase the value of exports and maintain a competitive edge in global markets.

Sources: Tridge, AgroInvestor, Agropolit, PEefeagro, Sinor, UkrAgroConsult

Read more relevant content

Recommended suppliers for you

What to read next