News

Original content

In Jun-25, Argentina's sunflower oil exports nearly doubled year-on-year (YoY) to 127,000 metric tons (mt), driven by a record harvest and active seed processing. India and Iraq emerged as top buyers, importing 60,000 mt and 33,000 mt, respectively. Cumulative exports for Jan-25 to Jun-25 reached 660,000 mt, exceeding both last year's volume of 550,000 mt and the five-year average of 491,000 mt. Sunflower meal exports also rose to 146,000 mt in Jun-25, with 105,000 mt destined for the European Union (EU). Total meal exports for the first half of 2025 stood at 680,000 mt, up by 136,000 mt YoY.

Argentina harvested 5.1 million metric tons (mmt) of sunflower in the marketing year (MY) 2024/25, an increase of 1.2 mmt from the previous season, with yields hitting a record 2.24 mt per hectare (ha). The surge in Argentine supply is placing downward pressure on Ukrainian sunflower oil and meal prices, particularly in major markets such as India and the EU, due to intensified price competition.

During a government delegation visit to Kabul, Kazakhstan reaffirmed its commitment to expanding trade with Afghanistan, targeting USD 3 billion in turnover. Among key agricultural exports, sunflower oil shipments rose by 60% in the first half of MY 2024/25 , exceeding USD 17 million in value. Kazakhstan also expressed readiness to boost exports of fuels, fertilizers, and food products while exploring increased imports of Afghan fruits and beverages.

In the first half of Jul-25, Ukraine's sunflower oil exports surged by 76% month-on-month (MoM) to 270,000 mt, the highest mid-month volume recorded in the current agricultural season. The EU and India were the primary destinations, accounting for 38% and 31% of exports, respectively. Since the start of the 2024/25 season, India has remained the top importer, receiving 729,000 mt, the highest volume in three years.

The United States Department of Agriculture (USDA) has revised Ukraine's sunflower harvest forecast for MY 2025/26 downward by 400,000 mt to 14 mmt, while maintaining oilseed export projections at 250,000 mt. In Jun-25, sunflower processing in Ukraine declined by 11% MoM to approximately 1 mmt, bringing total processed volumes since Sep-24 to 10.5–10.6 mmt, 21% below last season's level. Despite recent growth in sunflower oil exports, annual processing is unlikely to exceed 12.5 mmt. Due to persistently low margins, processors are increasingly shifting to other oilseeds such as rapeseed, supported by the upcoming 10% export duty set to take effect on August 1.

.png)

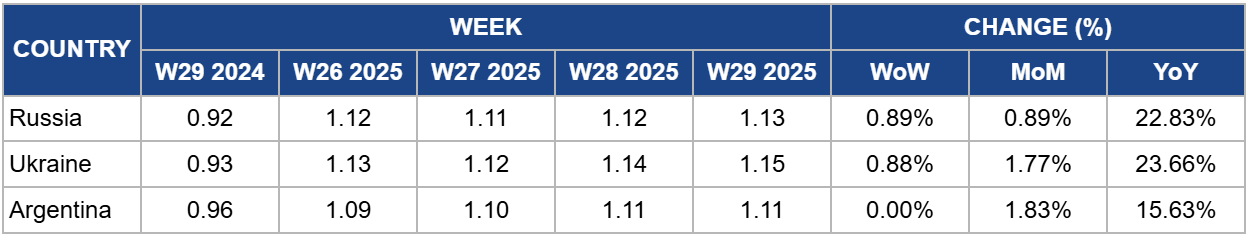

Russia's sunflower oil prices surged by 0.89% week-on-week (WoW) to USD 1.13 per kilogram (kg) in W29, marking a 22.83% YoY increase from USD 0.92/kg. The sharp weekly rise reflects heightened short-term demand, while the broader uptrend is supported by strong supply prospects and export interest.

Despite heat in the country’s southwest, favorable weather across other key regions supports strong yield expectations. The USDA maintains its production forecast at 18 mmt for 2024/25, up from 16.9 mmt last year and 14% above the five-year average. Additionally, sown areas may reach 11 to 11.5 million ha, above the 9.8 million ha reported in 2024, raising the potential gross harvest to 18.5 to 19 million tons. While current price strength is supported by market sentiment and limited near-term supply, a larger-than-expected harvest could ease upward pressure in the coming months, potentially stabilizing or lowering prices in the medium term.

In W29, Ukraine's sunflower oil prices increased by 0.88% WoW to USD 1.15/kg, reflecting a notable 23.66% YoY rise from USD 0.93/kg. This price growth was primarily driven by robust export activity supporting the domestic market.

Oilseed purchase prices remained steady between USD 609.84/mt and 628.97/mt (UAH 25,500 and 26,300/mt) carriage paid to (CPT) enterprise. While some processors ramped up raw material purchases to meet export demand, most maintained moderate buying due to adequate inventories or plans to shift production toward rapeseed. The potential introduction of export duties on sunflower oil could further incentivize this shift, potentially limiting sunflower oil processing volumes.

In W29, Argentina’s sunflower oil prices remained stable at USD 1.11/kg, showing no weekly change but reflecting a 15.63% YoY increase from USD 0.96/kg. The steady pricing comes amid robust processing activity and strong export momentum. Despite USDA projections of a 15.7% decline in 2025/26 sunflower seed production to 4.3 mmt and a drop in oil exports to 1.15 mmt, the current season remains strong. In May-25, Argentina processed 466,000 mt of sunflower seeds, its highest monthly volume in recent years, boosting oil output and reinforcing its global market position.

From Jan-25 to May-25, Argentina exported 532,000 mt of sunflower, more than double YoY, including 223,000 mt to India. A potential India–Mercosur free trade agreement could further boost exports. While the upcoming Black Sea harvest may pressure global prices, Argentina’s strong processing and trade outlook should support stable pricing and volumes.

Given India and the EU's continued dominance as top importers, exporters, particularly in Argentina and Ukraine, should reinforce trade relations, optimize logistics, and explore long-term contracts to secure market share. Argentina should leverage the potential India–Mercosur trade agreement to strengthen its position and expand its presence in these key markets.

With the Black Sea harvest expected to exert downward price pressure and global supply rising, producers and traders should hedge against volatility by locking in forward contracts and expanding into underserved markets such as Afghanistan and North Africa. Kazakhstan’s recent trade outreach offers a model for tapping into new regional demand.

Sources: Tridge, Sinor, Ukr AgroConsult, Agrosektor, Agravery

Read more relevant content

Recommended suppliers for you

What to read next