Original content

The Agricultural Outlook 2025-2034 report released by the Organisation for Economic Co-operation and Development (OECD) and the Food and Agriculture Organisation of the United Nations (FAO) forecasts a decade of stagnation for European Union (EU) milk production, citing declining dairy cow numbers and slower yield growth as primary constraints. While global milk output is expected to grow robustly, driven by expansion in India, Pakistan, and Sub-Saharan Africa, the EU's production is projected to remain flat. A significant trend within the European dairy sector is the increasing shift towards organic and other non-conventional systems, with countries such as Germany, France, and Italy experiencing notable growth in this area. However, the report highlights that these systems have lower yields, approximately 75% of conventional methods, necessitating a significant price premium to maintain profitability. This structural shift towards value-over-volume, combined with environmental regulations, will define the EU's dairy landscape for the next ten years.

Belgium's dairy industry demonstrated robust and diverse production in March 2025, with a total of 53.6 million liters (L) of drinking milk produced. The output was led by semi-skimmed milk, which accounted for over half (54.1%) of the total, followed by whole milk at 36.5%. Beyond liquid milk, the sector showcased significant processing capacity in other value-added categories. Production included 29.2 million L of fermented milk and yoghurt, 23.6 million L of cream, and 11.1 million L of milk drinks. Furthermore, the industry produced substantial quantities of storable commodities, with cheese output reaching 12,357 tonnes, milk powder at 19,376 tonnes, and traditional butter at 6,212 tonnes.

New Zealand consumers are grappling with a significant dairy price shock, as the cost of milk surged 14.3% in the year to Jun-25, alongside even steeper increases for butter (46.5%) and cheese (30%). The average price for a 500-gram (g) block of butter has hit USD 5.09 (NZD 8.60), leading to shortages in some stores. These dramatic price hikes are a direct result of strong international demand and record-high global prices, which incentivize the nation's export-focused industry to prioritize more profitable overseas markets. This dynamic creates a tight domestic supply, forcing local prices to align with higher international benchmarks. As New Zealand exports the vast majority of its dairy products, local consumers must effectively compete with global buyers. While this situation hurts household budgets, the broader economy is benefiting from a substantial USD 2.7 billion (NZD 4.6 billion) boost from the higher dairy payout, highlighting a stark contrast between consumer pain and export prosperity.

Polish dairy cooperative Mlekpol has announced a historic approximately USD 110 million (PLN 400 million) investment to significantly expand and modernize its cheese production capabilities. The multi-year project, running from 2025 to 2029, will focus on the company's main plant in Grajewo and will involve expanding storage, adding new packaging lines, and automating technological processes. Mlekpol's president described the investment as a "historic milestone," aimed at boosting processing capacity and strengthening the cooperative's competitive position in both Polish and international markets. The project, supported by government tax incentives, underscores a strategic push for growth and efficiency from one of Europe's largest dairy cooperatives, which currently processes six million L of milk daily and exports to over 100 countries.

Spain's dairy industry is facing a significant crisis, with production in the key region of Castilla y León falling by 2.87% in the first five months of 2025. This decline, which surpasses the national average decline of 1.72%, highlights the severe economic pressure on farmers who are grappling with a widening gap between milk prices and soaring production costs. The issue is systemic, with prices for cow, sheep, and goat milk all falling below the cost of production, forcing hundreds of farm closures. Farmer organizations report that small-scale operations are hit hardest, receiving significantly less per liter than larger farms. With a crucial contract renewal deadline looming on July 31 and high summer temperatures adding further stress, industry groups are demanding urgent government intervention to ensure market transparency and fair pricing to prevent a deeper collapse.

A new common understanding on food safety rules between the United Kingdom (UK) and the EU has been widely welcomed by the dairy industry, offering a path to ease significant post-Brexit trade frictions. While not yet a final deal, the agreement aims for dynamic alignment on regulations, which could eliminate costly veterinary checks and export health certificates that have hampered trade since 2021. The current red tape has contributed to a 20% decline in the EUR 5 billion annual dairy trade between the two partners, disproportionately affecting small producers like artisanal cheesemakers. If a formal agreement is finalized, it is expected to reduce border delays, cut compliance costs, and revive cross-Channel trade, particularly for premium and perishable products. This would provide a significant boost for an industry that has faced considerable challenges in recent years.

Germany-based Unternehmensgruppe Theo Müller has announced a significant USD 60.2 million (GBP 45 million) investment into its recently acquired Yew Tree Dairy plant in Skelmersdale, UK. The investment is aimed at enhancing liquid milk production and transforming the site into a flagship facility for milk drying.

This strategic move will increase the plant's powdered milk production capacity by 30%, positioning Müller to become a major producer and exporter of British milk powders. The expansion will also significantly improve the company's milk-balancing capabilities, particularly following periods of high milk production like the spring flush. This investment signals a clear strategy to capitalize on global demand for long-life dairy products, creating new growth opportunities for British dairy farmers by turning surplus milk into a valuable export commodity.

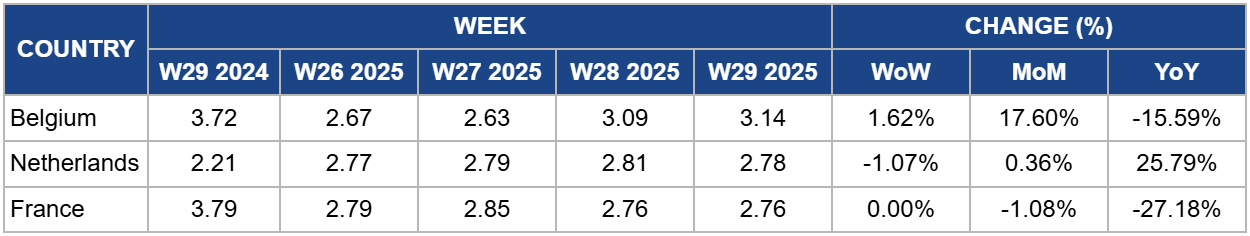

In Belgium, the price of whole milk powder (WMP) was USD 3.14 per kilogram (kg) in W29, an increase of 1.62% week-on-week (WoW). This contributes to a substantial 17.6% month-on-month (MoM) rise, though the price remains down 15.59% year-on-year (YoY). The Belgian SMP market is experiencing a strong short-term rally, driven by tightening raw material supply across the EU. The significant monthly price jump is a direct consequence of the EU-wide reduction in milk production, which has been constrained by smaller cattle herds. With less raw milk available, the cost of producing storable commodities like SMP has increased, and processors are passing these costs on. However, the 15.59% YoY price decline indicates that the market is still correcting from the historically high commodity prices seen in 2024. While the current supply squeeze is causing a sharp rally, prices have not yet returned to the peak levels of the previous year.

In the Netherlands, the price of skimmed milk powder (SMP) was USD 2.78/kg in W29, down 1.07% WoW. The price is up a slight 0.36% MoM and shows a significant 25.79% increase YoY. The Dutch SMP market is defined by a strong YoY price surge, reflecting severe underlying supply constraints, although prices have stabilized in the short term. The substantial 25.79% YoY increase is a direct result of the significant impact of the bluetongue virus outbreak on the Dutch dairy herd, which reduced milk yields and overall production. This domestic supply reduction, combined with broader EU production constraints, has fundamentally tightened the market for raw milk, driving up the cost of producing storable commodities like SMP compared to last year. However, the recent monthly and weekly price movements show a market that has largely absorbed this supply shock and is now finding a new equilibrium. The marginal MoM increase and slight WoW dip indicate that prices have plateaued at this new, higher level. This stability suggests that the peak seasonal milk flush is providing enough raw material to meet current demand without causing further price spikes.

In France, the price of semi-skimmed milk powder (SMP) was USD 2.76/kg in W29, unchanged from the previous week. This contributes to a 1.08% MoM decline and a significant 27.18% drop YoY. The French SMP market is currently stable but operating at a much lower price point than last year. The flat WoW price and slight monthly decline suggest that the market has found a temporary equilibrium. This stability is likely a result of the seasonal peak in milk production providing sufficient raw material for processors, which has offset the underlying supply tightness caused by smaller herd sizes. Furthermore, recent trade disruptions, including UK import restrictions on certain fresh French dairy products and the looming threat of US tariffs, may be diverting more milk towards the production of storable commodities like SMP, further balancing the market and preventing short-term price increases. The dominant trend remains the massive 27.18% YoY price collapse. This indicates a significant market correction from the crisis-level prices seen in mid-2024. While current EU milk production is constrained, the supply situation is less critical than it was a year ago, leading to substantially lower prices.

The crisis in Castilla y León, where production is declining because farmgate prices are below production costs, is a critical warning for the entire EU dairy sector. Farmer organizations must intensify their lobbying efforts for urgent government intervention to ensure fair and transparent contract pricing that covers the true cost of production. Simultaneously, cooperatives should leverage their collective power to negotiate better prices for essential inputs like feed and fertilizer, and invest in shared resources and technologies that improve on-farm efficiency. This dual approach of political advocacy for fair market conditions and practical, on-farm cost management is essential for ensuring both the immediate financial survival and the long-term sustainability of dairy farming in Europe.

The new understanding on food safety rules between the UK and the EU signals a significant opportunity to reverse the 20% decline in dairy trade seen post-Brexit. UK dairy exporters, especially the small and medium-sized cheesemakers who were hit hardest by the administrative burden, should begin preparing for re-entry into the EU market now. This proactive preparation should include re-establishing contact with former EU distributors, ensuring packaging and labeling comply with current EU standards, and developing marketing strategies targeted at European consumers. By preparing in advance, UK businesses can gain a first-mover advantage once the final agreement is signed, allowing them to quickly reclaim lost market share and capitalize on the removal of costly trade barriers.

The strong consumer and retail push in Germany for tax parity on plant-based milk highlighted in W28 is a clear signal of a permanent shift in the market. European dairy processors, particularly those in Western Europe, can no longer treat plant-based alternatives as a niche competitor. To protect market share and ensure long-term growth, companies must innovate. This includes developing and marketing new lactose-free products, highlighting the unique nutritional benefits of dairy, and investing in sustainable and ethical production practices that resonate with modern consumers. Furthermore, larger processors should consider a "hybrid" strategy, diversifying their own portfolios to include plant-based options. By embracing this changing landscape and meeting consumer demand for choice, sustainability, and health, the dairy industry can adapt and thrive rather than simply defending its traditional market space.

Sources: Tridge, Agriland, Statbel, France24, Food & Beverage Business, Dairy News, Dairy Industries, Just Food

Read more relevant content

Recommended suppliers for you

What to read next