News

Original content

A new study from Tel Aviv University titled Female Moths Incorporate Plant Acoustic Emissions into Their Oviposition Decision-Making Process (2024, eLife) reveals that plants emit sounds when stressed, which are inaudible to humans while detectable by insects and certain animals. Experiments showed that female moths avoided laying eggs on tomato plants emitting distress sounds, suggesting insects use these cues to make decisions. This is the first evidence of animals responding to plant sounds, suggesting a complex, invisible ecosystem of sound-based interactions. Researchers speculate that this may indicate co-evolution between plants and animals in sound-based communication.

These findings open the door to revolutionary, non-chemical approaches to crop management. The most immediate application is the development of bio-acoustic pest control. By identifying and replicating the specific distress frequencies of a crop, it may be possible to broadcast these sounds across a field, creating an auditory shield that naturally deters pests like moths from laying eggs. Furthermore, this discovery could lead to advanced precision monitoring systems. Acoustic sensors could "listen" to a field, providing farmers with a real-time, early warning system for crop stress from drought, nutrient deficiency, or disease long before visible symptoms appear, allowing for highly targeted interventions.

Jeonbuk Province’s Agricultural Research and Extension Services has expanded the mass propagation and free distribution of beneficial insects such as predatory root mites to 55 eco-friendly farms, resulting in a reduction of pest damage by over 40%. Farmers report less pesticide use and healthier crops. The initiative addresses the growing issue of pesticide resistance and promotes sustainable pest management, particularly in smart farms. The program combines local production, technical support, and free supply, making natural enemy use more accessible. Ongoing efforts include tailored distribution and further development of integrated pest management (IPM) models to enhance effectiveness and support eco-friendly agriculture.

Mexico faces growing pressure from a new United States (US) tariff on its tomato exports, raising concerns about surplus and food waste. The US has imposed a 17% anti-dumping duty on Mexican tomatoes, threatening a critical export market for Mexican producers. Mexico already discards nearly 926,000 metric tons (mt) of tomatoes each year, which is nearly half of its domestic consumption, due to stagnant internal demand. With reduced access to the US market, more tomatoes could go unsold. Experts warn that the tariff may worsen supply chain inefficiencies and increase food waste on both sides of the border

Mexico's tomato industry is now facing a 17% US tariff, imposed on July 15 after a bilateral trade deal ended. Mexican officials have labeled the tariff "unfair," highlighting that it will disrupt a supply chain where Mexico provides two-thirds of all tomatoes consumed in the US, which is likely to raise consumer prices. The Mexican government is now focused on a dual strategy: supporting its producers in negotiations while simultaneously working to develop alternative export markets to reduce its reliance on the US.

Ukraine has imposed anti-dumping duties ranging from 20.1% to 26.9% on fresh cucumber and tomato imports from Turkey for five years. The decision follows an investigation that concluded the imports were undermining the profitability and viability of Ukraine’s domestic greenhouse sector. Made by the Interdepartmental Commission on International Trade (ICIT) after complaints from local producers, the decision aims to ensure fair competition and support domestic agriculture. Ukrainian government officials emphasized that the move is intended to protect Ukrainian farmers, encourage investment, and provide the availability of high-quality, locally grown produce for consumers.

According to the United States Department of Agriculture's (USDA) May 25 report, California's processing tomato acreage has fallen to its lowest level since 1972, totaling just 82,960 hectares (205,000 acres). Production is projected at 10.3 million metric tons (mmt), the smallest volume since 2006. This reduction is driven by adverse weather such as drought, inventory adjustments, and cost pressures. The condensed pack season, running from early July to mid-September, limits flexibility for bulk orders, making early contract commitments essential. Although supply remains close to the 10-year average, it is vulnerable to disruptions. Food manufacturers are advised to secure forward contracts early to ensure reliable access and pricing stability for bulk tomatoes in 2025.

Recent tariffs on imported tomatoes are already benefiting domestic agriculture, with farmers and local business owners reporting increased interest and sales, particularly in states like Florida. Farmers and local businesses in these regions note that the policy is leveling the competitive landscape against cheaper imports from Mexico. The tariffs are intended to stabilize prices in the domestic fresh-market sector and encourage retailers and consumers to source more locally grown produce. This market intervention stands in contrast to the supply-side crisis in California's processing tomato sector, highlighting the distinct challenges facing different segments of the US tomato industry.

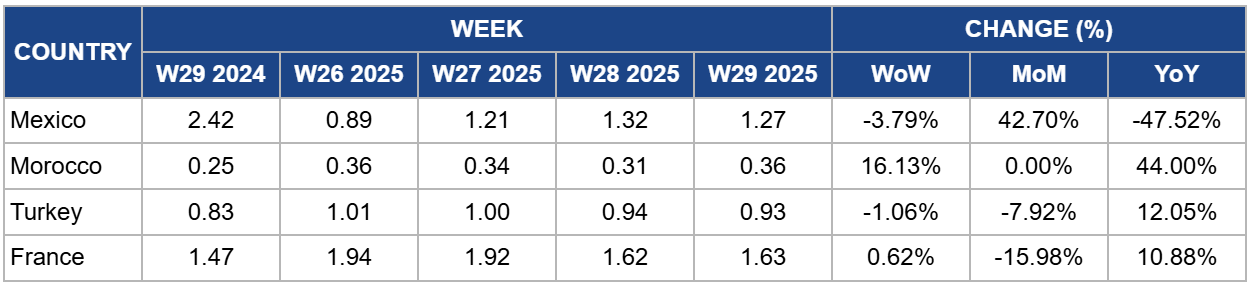

In W29, Mexico’s wholesale price for tomatoes edged down by 3.79% week-on-week (WoW) to USD 1.27 per kilogram (kg), though it remained 42.70% higher month-on-month (MoM). However, prices were still 47.52% lower year-on-year (YoY), compared to USD 2.42/kg in W29 2024.. A tariff imposed by the US on Mexican tomatoes has made it more expensive for the product to be exported. As a result, a significant volume of tomatoes is being retained in the Mexican market. This increase in the domestic supply, without a corresponding increase in demand, puts downward pressure on prices.

In W29, Morocco’s tomato prices increased 16.13% WoW to USD 0.36/kg but remained unchanged MoM. A surge in export demand, particularly from Spain, drove Moroccan tomato prices up. According to Hortoinfo, Moroccan fruit and vegetable exports to Spain soared in Q1 2025, marking a 22% YoY increase in volume, totaling 188,076 mt, valued at USD 564.40 million (EUR 481 million). The number one commodity in Morocco-Spain trade was tomatoes, with volumes increasing by 34% and value by 57% YoY. This surge in demand has also kept YoY prices high, with a 44% increase compared to the same period last year.

In W29, Turkey's wholesale tomato price decreased slightly 1.06% WoW and 7.92% MoM to USD 0.93/kg. This minor drop is attributed to a modest increase in supply as the summer harvest reaches its peak, though it falls far short of the typical seasonal price relief. On the other hand, prices soared 12.05% YoY. This annual increase is driven by ongoing agricultural challenges, including climate change-induced droughts that have damaged yields and soaring production costs for farmers. Key agricultural inputs, particularly diesel fuel and fertilizers, have seen dramatic price hikes, squeezing farmer margins and pushing wholesale prices upward. These farm-level challenges are compounded by high national inflation, ensuring that even with peak seasonal supply, prices remain elevated compared to previous years.

In W29, France’s tomato prices increased 0.62% WoW. Conversely, prices dropped 15.98% MoM to USD 1.63/kg. Overall stability in the French market was the main reason for the minimal weekly price changes. A slight uptick suggests that prices may be finding a floor after the peak summer harvest has passed. On the contrary, the significant MoM drop is driven by a large volume of tomatoes in France and from Spain, the Netherlands, and Morocco. French tomato producers have launched a marketing initiative centered on a 250-gram (g) tray of French cherry tomatoes to compete directly with cheaper Moroccan imports that dominate supermarket shelves. The campaign appeals to consumer loyalty by encouraging them to 'buy French' and support domestic farmers. Despite this effort to encourage consumers to buy French, producers face significant challenges. Domestic tomatoes are priced higher compared to the Moroccan equivalent, a difference driven by French labor costs being fourteen times higher, according to the French tomato producers’ association. Producers claim that their profit margins are very low and also accuse large retailers of taking a higher margin on French products, thereby further disadvantaging them through what they consider unfair competition.

The implementation of significant tariffs highlights the extreme vulnerability of relying on a single trade corridor. Exporters must urgently identify and develop alternative markets to mitigate the impact of sudden protectionist policies. Likewise, importers should establish a diversified sourcing portfolio, incorporating domestic and other international suppliers to ensure price stability and a consistent supply chain resilient to geopolitical friction.

The market is facing supply shocks from multiple angles. For US food manufacturers, especially those reliant on processed products, securing forward contracts for tomatoes is critical to hedge against impending scarcity and price hikes. For European producers, pre-season agreements are crucial in protecting margins from the volatility of the spot market during the harvest peak.

The success of Jeonbuk's natural enemy program in Korea provides a clear and profitable model for growers worldwide. Investing in IPM is a strategic move to lower input costs, combat growing pesticide resistance, and improve overall crop health and quality. As consumers and retailers increasingly prioritize sustainability, produce grown under IPM protocols gains a significant competitive advantage, potentially commanding premium prices and securing access to discerning markets.

Sources: Superagronom, Foodmate, Sinor, Agropolit, Agrinet, One Source Food Solutions, The White House

Read more relevant content

Recommended suppliers for you

What to read next