News

Original content

Global crude palm oil (CPO) prices are forecast to rise by 33% to USD 1,200 per metric ton (mt) by end-2025, up from USD 900/mt, driven by stronger prices in Indonesia and Malaysia, firmer crude oil markets, and biofuel mandates. Despite a 16.3% drop in early 2025, Afrinvest, a leading investment and financial advisory firm based in Nigeria, cites softening United States (US)-China tensions and reduced sunflower oil exports due to the Russia-Ukraine conflict as supporting factors. Nigeria has an opportunity to boost local palm oil production and reduce its 450,000 mt supply gap amid rising global demand and tight supplies.

European Union (EU) palm oil imports declined by 20% year-on-year (YoY) to approximately 2.8 million metric tons (mmt) in the 2024/25 marketing year (MY), driven by sharp declines in demand from Spain and Italy. The Netherlands remained the top importer at 959,000 mt, 2% YoY lower, followed by Italy with 835,000 mt, down 28% YoY. Spain recorded the steepest drop at 40% YoY, while Germany’s imports fell 12% YoY. Declines were also seen in Belgium and Sweden. The reduction reflects broader shifts in biofuel policy, as several member states, including Germany, France, and the Netherlands, have excluded palm oil-based biofuels from national quotas.

India aims to boost domestic CPO production from 0.35 mmt to 2.3 mmt by 2029 under the National Mission on Edible Oils – Oil Palm (NMEO-OP). Plantation area is expected to expand from 0.6 million hectares (ha) to 1 million ha, with major growth in Andhra Pradesh, Telangana, Tamil Nadu, and Odisha. Leading companies such as Godrej Agrovet and Patanjali Food are planning large-scale expansions. The initiative includes price assurance for farmers, intercropping support, and digital integration of plantations, with new yields expected to begin in four to five years.

The Indonesian Palm Oil Association (GAPKI) warns that Indonesia may lose palm oil market share to Malaysia if it fails to secure lower US tariffs during ongoing negotiations. While the US maintained a 32% import duty on Indonesian palm oil, Malaysia faces a lower 25% rate. Both countries currently have a 10% baseline tariff, pending final decisions by August 1. Indonesia exported 2.2 mmt of palm oil to the US in 2024, but rising tariff pressure is prompting calls for export diversification. Progress in the Comprehensive Economic Partnership Agreement (CEPA) talks with the EU and potential trade deals with Turkey are seen as key to offsetting US and EU market risks.

According to the Malaysian Palm Oil Board (MPOB), Malaysia has raised its Aug-25 crude palm oil reference price to USD 914.04/mt (MYR 3,864.12/mt), up from USD 882.43/mt (MYR 3,730.48/mt) in Jul-25, resulting in an increased export duty of 9%. Under Malaysia's progressive tax structure, export duties range from 3% to 10%, with the highest rate applying when prices surpass USD 958.01/mt (MYR 4,050/mt). This adjustment reflects strengthening market prices and may impact export competitiveness.

Malaysia's palm oil exports fell by 10.52% month-on-month (MoM) to 1.26 mmt in Jun-25, while CPO production declined by 4.48% to 1.69 mmt, according to the MPOB. Palm kernel and related product outputs also dropped, with crude palm kernel oil falling 8.48%. Despite lower output, total palm oil stocks rose slightly to 2.03 mmt, driven by a 12.19% increase in processed oil stocks. Palm kernel oil exports dropped 27.60% amid weaker EU demand influenced by biofuel quotas, even as the European Free Trade Association (EFTA) reduced tariffs on Malaysian palm oil by up to 40%.

According to Afrinvest, Nigeria's leading palm oil producers, Okomu Oil Palm PLC and Presco Plc, are projected to post record profits of USD 105,323 (NGN 161 billion) in 2025. This represents an increase of 36.8% YoY, driven by surging global CPO prices and strong operational performance. With CPO prices expected to reach USD 1,200/mt by year-end, the sector is benefiting from global supply constraints, biofuel-driven demand in Southeast Asia, and easing trade tensions. Despite inflationary pressures and naira depreciation, rising revenues and improved efficiency have bolstered margins. Facing a 450,000 mt domestic supply gap, Nigeria stands to gain significantly from strategic reforms and investment, positioning the sector as a key non-oil growth driver.

.png)

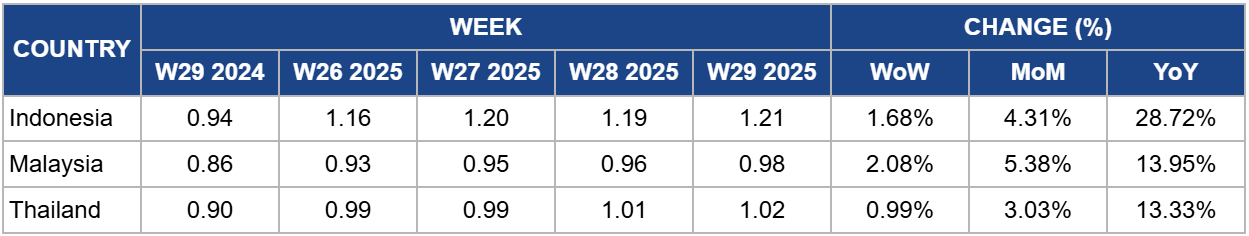

Indonesia’s palm oil prices rose by 1.68% week-on-week (WoW) to USD 1.21 per kilogram (kg) in W29, reflecting a strong 28.72% YoY increase from USD 0.94/kg. The sustained price rally is supported by global supply constraints and robust biodiesel demand, though looming trade tensions may influence future trends. With the US maintaining a 32% import duty on Indonesian palm oil, higher than Malaysia’s 25%, Indonesia risks losing market share unless a more favorable tariff is secured by the August 1 deadline. This uncertainty, coupled with elevated prices, may prompt buyers to shift toward Malaysian suppliers, potentially exerting downward pressure on Indonesian prices in the medium term. However, ongoing CEPA negotiations with the EU and efforts to secure new trade deals, such as with Turkey, could help cushion the impact and sustain export demand.

In W29, Malaysia's palm oil prices increased by 2.08% WoW to USD 0.98/kg, a rise of 13.95% YoY from USD 0.86/kg in W29 2024. The market remains buoyed by strength in rival edible oils in the Dalian Commodity Exchange (DCE) and Chicago Board of Trade (CBOT), with Malaysian futures posting a 3.40% weekly gain, the highest close in 14 weeks. Supportive factors include a weaker ringgit, rising crude oil prices, and improved competitiveness of palm oil as a biodiesel feedstock. However, declining export volumes, as reported by AmSpec (-5.3%) and Intertek (-6.2%), could temper further upside. Additionally, Malaysia's increase in its Aug-25 CPO reference price and higher export duties (to 9%) may influence export dynamics. Overall, elevated global oilseed prices and biodiesel-linked demand are likely to sustain palm oil price strength in the near term, though export softness may moderate gains.

In W29, Thailand's palm oil prices rose by 0.99% WoW to USD 1.02/kg, marking a 13.33% YoY increase from USD 0.90/kg. The modest price gain reflects steady demand and cautious optimism as Thailand nears a potential agreement with the US to avoid a proposed 36% tariff on its exports. The final stretch of negotiations, expected to conclude before the August 1 deadline, could secure a tariff rate more in line with regional peers such as Vietnam (20%) and Indonesia (19%). A successful deal would sustain export momentum, particularly to the US, Thailand's largest market, and potentially support continued price stability or further gains. However, any delay or unfavorable outcome could pressure future prices, especially given domestic economic headwinds and political uncertainty.

Governments and private sector actors in Nigeria and India should intensify investments in plantation expansion, farmer support, and processing infrastructure to capitalize on the projected 33% rise in global CPO prices by end-2025. Strengthening local supply chains and reducing import dependence will enhance food security and create long-term value amid tightening global supplies and rising biofuel demand.

Exporters in Indonesia, Malaysia, and Thailand should proactively expand trade partnerships beyond the US and EU, focusing on emerging markets in Africa, the Middle East, and South Asia. Strategic engagement through bilateral trade deals and CEPA agreements, combined with targeted promotion in high-growth regions, can help offset risks from tariff barriers and falling EU demand linked to biofuel policy shifts.

Malaysia and Indonesia should align their export tax regimes with current market dynamics to avoid dampening competitiveness amid rising CPO reference prices. Temporarily adjusting export duties or offering tiered structures during high-demand periods could help maintain price attractiveness, especially as rival origins gain from more favorable tariff access to key markets like the US.

Sources: Tridge, Ukr AgroConsult, Hellenic Shipping News

Read more relevant content

Recommended suppliers for you

What to read next