News

Original content

The European Union (EU) has increased its soybean meal imports for the 2024/25 marketing year, with purchases up 5% year-on-year (YoY) to 15.8 million metric tons (mmt) as of mid-July. The import surge is a direct response to the decline in domestic soybean meal stocks, which have reached a three-year low. To meet the consistent demand from its livestock industry, the EU is increasingly relying on foreign suppliers, particularly from South America, to bridge the supply gap.

Brazil's Ministry of Agriculture has incorporated soil management practices into its Agricultural Climate Risk Zoning (ZARC) for the 2025/26 soybean crop. The new methodology will assess how different soil management systems affect water storage and availability, providing more precise guidance on ideal planting windows. This update aims to enhance the resilience and productivity of soybean farming by better aligning cultivation practices with specific local soil and climate conditions, thereby reducing climate-related risks for farmers.

A new herbicide named Predecessor® has been launched in Brazil, developed by Ourofino Agrociência, Brazilian agricultural science company. It features a unique formulation combining three active ingredients, imazethapir, diclosulam, and flumioxazin. with a novel mode of action to control difficult weeds in soybean crops, including resistant horseweed and bitter grass. The product is designed to be a key tool in resistance management strategies, offering farmers a new option to protect crop potential and ensure cleaner fields.

China's Ministry of Agriculture has granted import approval for two new genetically modified (GM) soybean varieties developed in Brazil. The approved traits, one from the Brazilian Agricultural Research Corporation (Embrapa) and the other from GDM Genética do Brasil, provide herbicide tolerance and insect resistance. This decision expands the list of GM crops approved for trade between the nations, potentially streamlining future soybean shipments from Brazil to its largest customer.

South Korea's Rural Development Administration (RDA) has issued a warning to farmers about the increased risk of mummy disease, a condition typically caused by a complex of fungal pathogens, such as Diaporthe species. The RDA also cautioned about other quality-degrading issues in soybeans. These problems are often the result of improper post-harvest management, especially under humid weather conditions. The advisory stresses the importance of proper drying and storage to prevent fungal growth. This comes as "Miraebit," the first fungicide officially registered in the country to combat soybean mummy disease, becomes available to growers.

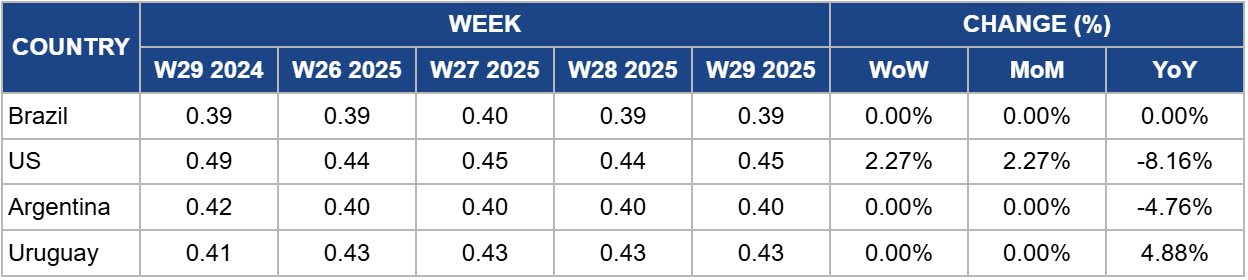

In W29, Brazil's soybean price held steady at USD 0.39 per kilogram (kg), unchanged week-on-week (WoW), month-on-month (MoM), and YoY. This stability reflects a market in equilibrium. Record domestic harvests and global oversupply are limiting price gains, with forecasts projecting up to 179.8 mmt in the next crop. Meanwhile, strong demand from China and the domestic biofuel sector is supporting prices. These opposing forces are offsetting each other, resulting in price stagnation.

In W29, United States (US) soybean prices rose 2.27% WoW to USD 0.45/kg, a rebound that also reflects a 2.27% MoM increase. However, prices remain 8.16% lower YoY. Reversing prior declines, the weekly rebound is driven by a technical correction and a rally in soybean oil, fueled by strong demand from the renewable diesel sector. This soy oil surge is offsetting bearish pressure from favorable weather and expectations of a large US harvest.

The YoY decline reflects a market now shaped by abundant global supply, particularly from South America, and high US stock levels. This oversupply and intense export competition continue to weigh on prices.

In W29, Argentine soybean prices held steady at USD 0.40/kg, unchanged WoW and MoM, but down 4.76% YoY. The market remains stagnant, with ample supply from a completed harvest offset by slow farmer sales, as many withhold stock due to low prices. This reluctance limits market flow and tempers further price declines.

The YoY drop reflects a strong 2024/25 harvest, boosting domestic supply amid weak demand from key importers and a globally oversupplied market, keeping prices well below last year’s levels.

In W29, Uruguay's soybean prices held steady WoW and MoM at USD 0.43/kg, but prices are up 4.88% YoY. The weekly stability suggests that Uruguay's market fundamentals are strong enough to insulate it from the bearish pressures seen globally. While the overarching theme in the international market is oversupply, firm local and export demand for Uruguayan soybeans is providing enough support to keep prices from falling. The market has found a balance where strong demand is effectively absorbing available supplies, leading to price stability.

The positive YoY performance is a testament to Uruguay's strong export position. As seen in previous months, robust sales, particularly to key partners like China, have maintained confidence in the value of Uruguayan soybeans. This sustained demand throughout the year has allowed prices to maintain a premium compared to the same period last year, even as prices in other major producing nations have declined.

With prices stagnant due to a supply glut, Brazil must leverage its latest technological and trade advancements to differentiate its product and solidify its position as a premier supplier to China. Following China's approval of two new Brazilian GM soybean varieties, exporters should immediately launch a targeted marketing campaign to Chinese buyers, highlighting the advanced traits of these crops (e.g., herbicide tolerance, insect resistance) and the potential for higher quality and more reliable yields. This should be combined with promoting Brazil's commitment to sophisticated, climate-resilient agriculture, as evidenced by the updated ZARC soil management system and the availability of advanced herbicides like Torez. By marketing a technologically superior and more sustainable product, Brazil can move the conversation beyond price and command a premium in a crowded market.

The recent WoW price increase, driven almost entirely by a surge in the soybean oil market for renewable diesel, provides a clear strategic path for the US. To insulate itself from the volatility of the global raw soybean market, the US should aggressively pivot to meet this growing domestic demand. This involves a multi-pronged strategy: producers and processors should advocate for supportive government policies for biofuels, invest in expanding domestic crushing capacity to produce more soybean oil, and market US soy as the ideal feedstock for the renewable diesel industry. By building a robust domestic end-market, the US can create a stable demand floor, reduce its reliance on fiercely competitive export markets, and ensure that more of the final product's value is captured at home.

Argentina is facing commercial obstacles where a massive harvest is stuck on farms due to farmers' unwillingness to sell at low prices, creating a critical bottleneck. To break this impasse, the government and agricultural sector must introduce financial incentives to encourage sales without crashing the market. This could include offering preferential financing rates for farmers who sell their stored grain, providing access to sophisticated hedging tools to lock in future prices, or creating tax incentives tied to sales volume. By motivating farmers to release their supply, Argentina can restart its export engine, generate much-needed foreign currency, and capitalize on its production success before the next global harvest adds further pressure to already low prices.

Sources: Yonhap News, AFL News, Agrolink, FoodMate, UkrAgroConsult, Agri.bg

Read more relevant content

Recommended suppliers for you

What to read next