News

Original content

The threat of a 30% US tariff on European goods is forcing Greek olive oil producers to urgently seek new export markets to mitigate potentially significant losses. With the US being Greece's fifth-largest olive oil market, some producers fear sales could drop by 40% if the tariffs are fully implemented. This has prompted a proactive shift in strategy, with some companies already securing new buyers in non-traditional markets like Brazil and Australia. This move towards diversification highlights a crucial lesson for the Greek sector, which has historically relied heavily on a few key partners. The uncertainty of US trade policy is acting as a catalyst for Greek exporters to build a more resilient and geographically balanced market presence, reducing their vulnerability to the political decisions of a single trading partner.

The heads of Italy's major olive oil miller associations held an official meeting to form a united front, aiming to reaffirm the central role of millers within the supply chain. Their most pressing issue is the severe delay in payments from regional governments for the modernization of olive oil mills under the National Recovery and Resilience Plan (NRRP). The problem is most acute in the key producing regions of Puglia, Sicily, and Campania, leaving many mill owners in "financial overexposure," in debt with bank guarantees, or completely unable to make their planned investments. The associations have collectively decided to bring the issue before the Ministry of Agriculture, urging it to compel the regions to respect the established payment deadlines and resolve the bureaucratic holdup.

A new pan-European project, OLinWASTE, has been launched to transform olive mill waste into valuable bioproducts and green energy. While the initiative involves a wide consortium of European universities and research institutes, it has strong Italian roots. Coordinated by Rome’s Sapienza University, the project held its kick-off meeting in the Italian capital, and is already working directly with an Italian olive mill to develop a zero-emission biorefinery. Backed by nearly USD 4.71 million (EUR 4 million) from Horizon Europe, the four-year project aims to convert the 10 million metric tons (mmt) of olive pomace produced annually in Europe into bioplastics, biofertilisers, and bioenergy. This collaborative effort, which includes partners from the United Kingdom (UK), Sweden, and Austria, seeks to make Europe's bioeconomy more circular and resilient, addressing a significant environmental challenge for the entire olive oil industry.

The Portuguese government is advocating for a patient and unified EU approach in trade negotiations with the United States (US), expressing confidence that a deal can be reached to avoid the threatened 30% tariffs on European goods. Portugal's Minister of Agriculture and Fisheries stressed that the EU should not give up on the crucial US market. For Portugal, the stakes are particularly high, as the US is a key destination for its agroforestry and fishery exports, with olive oil, wine, and cork accounting for 75% of these sales. The minister argued that negotiations are still ongoing and that the EU must be prepared to counter US arguments, such as the trade deficit, by highlighting the EU's own deficit in services. Despite the looming August 1 deadline, the government remains optimistic that the tariffs will ultimately not be applied.

Spanish extra virgin olive oil (EVOO) prices fell to its lowest level since Jun-22 at USD 3.95 per kilogram (EUR 3.36/kg). This significant drop has ignited a debate over market intervention. With current stocks 55% higher than last year, the Andalusian chapter of Cooperativas Agro-Alimentarias, an agricultural cooperative union, is demanding the activation of a European Union (EU)mechanism to withdraw excess oil from the market under Article 167 of EU Regulation 1308/2013. The union is calling the measure "absolutely necessary" to prevent further price collapse and protect farmers. However, industry consultants argue this call is premature, pointing out that current prices remain well above the official EU trigger levels required for such an intervention. They warn that discussing the mechanism could artificially depress prices further. The conflict highlights the growing tension within the sector, as producers fear that another large harvest could push prices below the threshold of profitability for many farms.

Spanish consumers are finally seeing significant relief at the supermarket, as retail prices for olive oil have plummeted by 45.7% over the past year. The price drop is even more pronounced when measured from the peak in Apr-24, showing a dramatic 48% decrease from the record highs that had made the staple product a luxury item for many. This major price correction is providing a welcome respite for households that have been grappling with severe food inflation since 2021. The sharp decline in shelf prices is attributed to two primary factors. Firstly, a strong recovery in the 2024/25 olive harvest significantly improved supply after previous seasons were hit by drought. Secondly, the Spanish government's strategic decision to cut the value-added tax (VAT) on olive oil has directly reduced the final cost. This powerful combination of increased production and government tax relief has successfully translated into lower costs for consumers at checkout.

Tunisia's olive oil sector experienced a significant paradox in the first half of 2025, with export volumes surging while the corresponding value seeing a sharp decline. According to the National Observatory of Agriculture (ONAGRI), Tunisia exported 122,500 metric tons (mt) of olive oil between Jan-25 and Jun-25, a 35.9% increase compared to the same period in 2024. However, this increase in volume was met with much lower global prices. The total export value for the period dropped by 31%, falling to approximately USD 412 million (TND 1.18 billion) from last year's USD 597 million (TND 1.71 billion). This divergence is a clear indicator of the market's return to lower price levels following the significant production rebound of the 2024/25 harvest, which ended the previous season's scarcity and price highs.

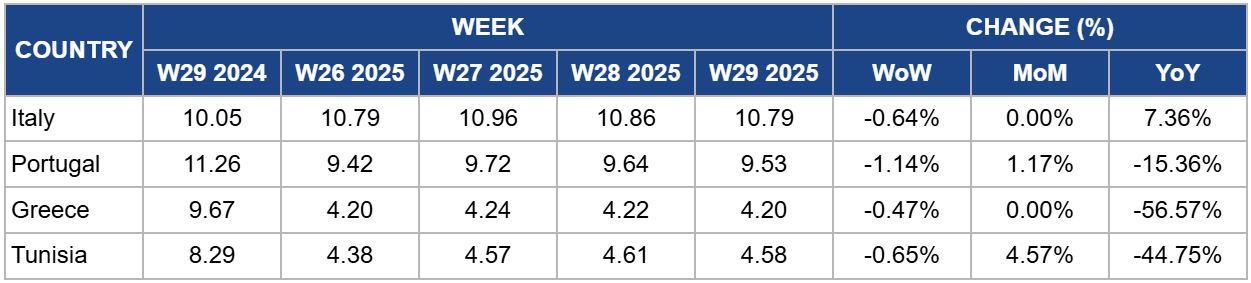

In Italy, the price of extra virgin olive oil was USD 10.79/kg in W29, a slight decrease of 0.64% week-on-week (WoW). The price is the same as one month ago but up 7.36% YoY. The Italian extra virgin olive oil market continues to be defined by a significant price premium compared to other markets, with a slight easing in the past week. The minor WoW dip reflects a market that has found a temporary ceiling after a period of sustained increases, likely due to Italian bottlers having secured sufficient imported volumes from Spain and Greece to meet immediate needs.

With no change MoM, the market appears to have stabilized at this high level as the season concludes. However, the fundamental driver remains the 7.36% YoY price increase, a direct result of Italy's domestic supply crisis. The poor 2024/25 harvest led to a significant drop in available volumes of authentic Italian EVOO, creating a severe scarcity that continues to support these elevated prices. The market remains highly sensitive to quality, with renewed buying interest from Italian packers in Greece suggesting that demand for high-quality oil remains firm.

In Portugal, the price of extra virgin olive oil was USD 9.53/kg in W29, representing a slight decrease of 1.14% WoW. This follows a period of strength, with prices still up 1.17% MoM, but down a significant 15.36% YoY. The Portuguese olive oil market is showing classic end-of-season price dynamics. The minor weekly dip appears to be a small correction in a quiet market that is now shifting its focus to the new season. The correction is likely due to news that the summer heat waves have not caused significant harm to olive trees, alleviating previous fears of a negative impact on the 2025/26 harvest.

This follows a period of strength, evidenced by the monthly price increase, which reflects a tightening market as the season concludes, with reports confirming that Portuguese stocks are now minimal and committed. Additionally, a Mediterranean heatwave added a risk premium to the upcoming 2025/26 harvest over the past month, pushing prices higher for the last available volumes. Over the longer term, the substantial 15.36% YoY price drop is a direct result of the successful 2024/25 harvest, where a strong rebound in Portuguese and wider European production ended the scarcity-driven high prices of the previous year.

In Greece, the price of extra virgin olive oil was USD 4.20/kg in W29, a slight decrease of 0.47% WoW. The price is the same as one month ago but down a significant 56.57% YoY. The minor WoW dip and flat MoM price reflect a stagnant market where producers, dissatisfied with current levels, are holding back significant volumes of unsold oil. This standoff is preventing further price drops but is also being capped by the reality of a well-supplied European market.

The dramatic 56.57% YoY price crash remains the dominant story, driven by the strong production rebound in both Greece and especially Spain. This recovery ended the scarcity that caused last year's record prices. While the July heatwave adds a risk premium, concerns are growing that Greek producers' limited storage capacity may force them to sell their held-back stock as the new harvest approaches, potentially leading to quality degradation and further price pressure.

In Tunisia, the price of extra virgin olive oil was USD 4.58/kg in W29, a slight decrease of 0.65% WoW. However, the price is up 4.57% MoM, but still down a significant 44.75% YoY. The Tunisian olive oil market is exhibiting classic end-of-season volatility, with a minor weekly dip following a strong monthly rally. The 4.57% MoM price increase is a clear signal of supply scarcity, with reports confirming that Tunisian stocks are nearly depleted, buyers are competing for the last available volumes. This tightness is compounded by a weather risk premium from the July heatwave, which has created uncertainty for the upcoming 2025/26 harvest. The new US tariffs add future uncertainty but are not the primary driver of the current price. Despite the recent gains, the massive 44.75% YoY price collapse remains the dominant long-term trend. This is a direct result of the excellent 2024/25 harvest, where a rebound in Tunisian and broader European production ended the supply crisis that caused last year's record-high prices.

The heavy reliance on the US market is a critical vulnerability for European and Tunisian exporters, given the high probability of disruptive tariff changes. A proactive diversification strategy is essential. Exporters should aggressively target high-growth regions in Asia and South America, capitalizing on opportunities like Brazil's proposed elimination of import duties. Concurrently, companies should explore strategic investments to protect their US market share, such as establishing bottling and storage facilities within the US to potentially bypass certain tariff classifications. This dual approach—diversifying into new regions while strategically fortifying the US position—will build a more resilient and adaptable export program, reducing the impact of unpredictable trade policies and ensuring long-term stability.

The current market, where a massive Spanish harvest has led to crashing producer prices, demonstrates the risks of competing primarily on volume. To escape this commodity trap, Spanish and Greek producers should adopt Portugal's strategic focus on building value through strong national and regional branding. This involves a collective effort by cooperatives and industry bodies to market the unique qualities, varieties, and terroir of their olive oils directly to international consumers, rather than selling bulk, unbranded oil to be bottled elsewhere. By investing in quality certifications (like DOP/IGP), traceability, and targeted marketing campaigns, they can build brand equity that commands a price premium. This strategy moves them up the value chain, ensuring better and more stable returns for farmers and insulating them from the price volatility of the bulk commodity market.

The current market presents a complex challenge for buyers, with a clear scarcity of high-quality extra virgin olive oil, particularly from Spain and Italy. Given that the July heatwave poses a significant threat to the quality and quantity of the upcoming 2025/26 harvest, securing supply now is a prudent risk-management strategy. Buyers should focus on locking in contracts for the remaining high-quality 2024/25 EVOO from Spain and Greece before quality deteriorates or stocks are gone. For more price-sensitive product lines, capitalizing on the lower prices of standard-grade oils (Virgin, Lampante) from Spain, where supply is more plentiful, offers a cost-effective solution to balance their portfolio.

Sources: Tridge, Avant Premiere, Reuters, Eco News, The Engineer, Olivo News, Spanish News Today, Olive Oil Times

Read more relevant content

Recommended suppliers for you

What to read next