News

Original content

Brazil’s 2025/26 coffee harvest has surged ahead this week, with Safras & Mercado reporting 77% completion by July 16, compared to last year’s 74% and the five-year average of 69%. Arabica and Robusta volumes are flooding the market, as Cooperativa Regional de Cafeicultores em Guaxupé (Cooxupé) noted harvest gains among member growers at 49% by July 11. This accelerated harvest, combined with favorable weather, has weighed on futures markets: September Arabica futures hit a 7½-month low, with Robusta faltering despite tariff-related volatility.

Adding to this, the United States (US) government's proposed 50% tariff on Brazilian coffee imports, effective August 1, caused a brief rally; Arabica futures rose before harvest pressure resumed dominance. US traders rushed to pre-import Brazilian beans ahead of the tariff deadline, re-routing shipments from alternative origins and increasing US import positions. While the immediate tariff announcement sparked price spikes, underlying fundamentals remain bearish due to the rapid inflow of Brazilian coffee.

W29 brought renewed scrutiny over labor practices on Rainforest Alliance-certified farms in Antioquia, Colombia. An investigative report by Repórter Brasil, a non-profit journalism network, detailed overcrowded and inadequate worker housing and widespread informal labor, raising concerns about compliance with upcoming European Union Deforestation Regulation (EUDR) standards set to begin in Dec-25. For exporters and traders, this signals a potential risk to Colombia’s position in premium and ethical origin categories, with reputational and market access implications.

While W28’s focus centered on unfavorable weather affecting flowering, this update shifts attention to systemic social compliance issues. Agricultural analysts emphasize that farms will need to accelerate improvements in worker conditions, documentation, and traceability. Failure to address these concerns could result in buyers diverting orders to other certified origins or deploying stricter audit protocols.

Vietnam continues its strong export momentum: the Ministry of Agriculture reports USD 5.5 billion in coffee export earnings for the first half of 2024 (H1-2025), surpassing its full-year target. Driven by high-value processed coffee and robust global demand, shipments have soared. Domestic Robusta prices in the Central Highlands are supported at USD 3.67–3.75 per kilogram (VND 96,000–98,000/kg), buoyed by low Intercontinental Exchange (ICE) inventories and stable exchange rates.

Despite domestic price strength, the global landscape is more nuanced: international Robusta futures are easing from earlier peaks, reflecting profit-taking and eased supply concerns. Analysts suggest Vietnam’s local prices may swing between USD 3.67 and 4.40/kg (VND 96,000–115,000/kg), depending on global demand and speculative flows. Farmers and exporters are advised to monitor inventory levels and futures trends while capitalizing on current price stability through selective forward sales.

.png)

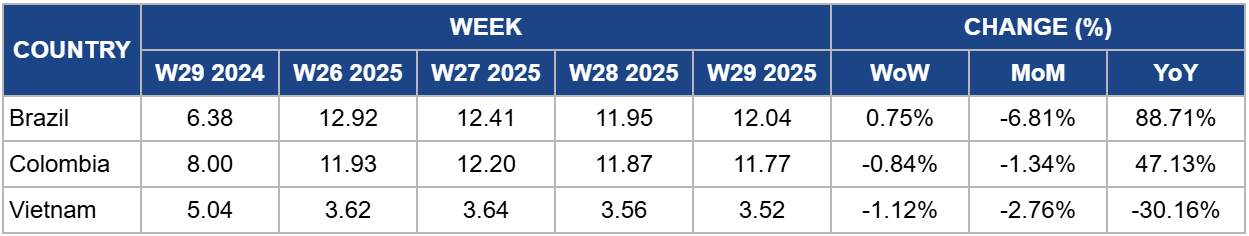

Brazil’s wholesale coffee prices remained relatively flat in W29 at USD 12.04/kg, up 0.75% week-on-week (WoW). Despite this stability, prices have declined by 6.81% month-on-month (MoM), driven by accelerated harvest volumes and ample physical availability. While recent dryness in Minas Gerais triggered a brief futures rally, the underlying trend remains bearish as harvest inflows continue to press on local prices.

Wholesale prices in Brazil are likely to remain under pressure unless a sudden weather disruption or harvest delays occur. Exporters may continue to offer aggressively on free on board (FOB) levels, especially if ICE futures stabilize or decline. A sharp shift in export demand or currency dynamics (e.g., a weaker Brazilian real) could push the market slightly higher, but near-term market balance favors stability or mild softness.

Colombian wholesale coffee prices dropped slightly by 0.84% WoW to USD 11.77/kg in W29. However, prices are maintaining a higher band, up 47.13% year-on-year (YoY), reflecting modest global demand and constrained output amid harvest season. Despite ongoing global premium compression, the rainy season is limiting fresh arrivals and supporting farmgate pricing.

Looking ahead, Colombian wholesale prices are expected to stabilize. Spot supply should remain balanced with seasonal buying, and any minor upward pull could come from quality-driven micro-lot sales. However, unless labor compliance issues or weather risks cause disruptions or speculative buying, significant price rallies are unlikely.

Vietnam’s coffee prices remained subdued in W29 at USD 3.52/kg, down 1.12% WoW and 30.16% YoY, facing pressure from global oversupply and fund liquidation. W29 saw regional prices slightly dip toward the bottom of the range, reflecting eased futures panic and the completion of early-season selling.

Wholesale Robusta prices are likely to hold steady within USD 3.63–3.79/kg (VND 95,000–99,000/kg), barring any demand surprises. With export volumes strong but lacking momentum and futures stabilizing, local pricing should remain tight. The key triggers to watch are ICE London Robusta futures and input costs; should either shift significantly, Vietnamese prices may see wider movement accordingly.

With Brazil’s harvest progressing quickly and physical availability expanding, exporters and cooperatives should prioritize moving inventory in the short term, especially while international buyers are still absorbing early-cycle volumes. Spot offers should be competitively priced to prevent accumulation as more supply enters the market in the coming weeks, particularly in Arabica-growing regions like Minas Gerais and São Paulo.

Given sustained domestic price stability and sluggish global premiums, Colombian sellers should leverage quality-based segmentation to preserve margins, focusing on traceable micro-lots and specialty buyers. Engagement with direct-trade partners and certifications (e.g., Rainforest Alliance, organic) can help differentiate offers and offset weak mainstream demand, especially in Europe and Asia.

With Robusta prices stabilizing and speculative pressure easing, Vietnamese exporters should lock in forward contracts while prices remain at or slightly above local breakeven points. This minimizes downside risk from potential oversupply in Q4 while providing flexibility to renegotiate if ICE London futures rebound. Exporters may also consider staggered shipment contracts to balance cash flow with market exposure.

Sources: Tridge, Business & Human Rights Resource Centre, Financial Times, Reuters, Barchart, Commodity Board Europe GmbH, Investopedia, Daily Coffee News

Read more relevant content

Recommended suppliers for you

What to read next