Original content

Cane crushing in Brazil’s Center-South region surged over the past week, with the Brazilian Sugarcane and Bioenergy Industry Association (UNICA) reporting a 9% year-on-year (YoY) rise through late May 25, translating into over 2.95 million metric tons (mmt) of sugar processed. This robust production is part of the broader 2025/26 trend, in which UNICA forecasts record-breaking output, prompting a renewed slide in global raw sugar prices toward multi-year lows. Despite minimal interruption from reduced ethanol allocation or weather hiccups, strong global supplies from India and Thailand are capping price support.

Leading international sugar broker Czarnikow's recent projection of 43.6 mmt of Brazilian sugar output in 2025/26 highlights a strategic shift toward sugar at the expense of ethanol production. While this generated a momentary price bloom, particularly aided by oil price dips, the momentum quickly ebbed as futures markets retracted. The Intercontinental Exchange (ICE) No. 11 fell nearly 2% week-on-week (WoW) as evidence that increased harvest pace and a strong United States (US) dollar continue to weigh on price trajectories.

India entered W29 under abundant rains, with monsoon progress exceeding long-term norms and bolstering cane yield expectations. Despite an export allowance of up to 1 mmt to manage surplus, domestic prices remain soft as dispatches lag behind rising stocks

The Indian Sugar and Bioenergy Manufacturers Association (ISMA) is calling for a return to a 50:50 sugar-to-ethanol blending policy, citing mill liquidity risks under current weak sugar pricing. However, with policy action pending, sugar remains the default output stream, exacerbating domestic overhang.

United States Department of Agriculture (USDA) updates confirm Mexico's sugar output is expected to rebound to around 5.1 mmt for 2025/26 (+7% YoY), thanks to improved precipitation and better cane growth. Despite no immediate WoW news, mills are poised for a strong season, reinforcing supply balance.

Mexico’s ongoing exploration of sustainable aviation fuel (SAF) from sugarcane ethanol reflects a structural pivot in the sector. While policy-level discussions mature, short-term sugar pricing remains unaffected, awaiting tangible refineries’ investment and product rollout.

Faced with retail prices nearing USD 0.70 per kilogram (PKR 200/kg), Pakistan’s federal cabinet approved 500,000 metric tons (mt) of duty-free sugar imports, recently accompanied by International Monetary Fund (IMF) concerns over potential breach of loan conditions. Initial tenders are underway, yet delays in logistics and quality checks may stall effective market absorption.

The IMF has officially questioned the import tax waiver, framing it as preferential treatment inconsistent with international bailout commitments. Concurrently, renewed allegations of cartel collusion have reignited competition authority scrutiny over the sector’s pricing dynamics, maintaining high policy risk as imports seek to stabilize supply and pricing.

Although no new domestic data emerged, US sugar futures maintained elevated levels around US¢ 16.5 per pound (lb), carried by continued influence from last week's import news, including volumes from Pakistan and the Philippines. While global oversupply has weighed on world market sentiment, the US remains partially insulated due to restricted import volumes and long-standing protectionist policies. Tariff Rate Quota (TRQ) allocations have already been filled for most origins, and additional quota announcements, particularly from Mexico, have not materialized in recent weeks. This tight control over inflows has prevented domestic prices from declining in tandem with the global market, offering near-term support to both futures and physical markets.

Moreover, trade groups have expressed concern about the potential for supply tightness heading into late summer, particularly as food and beverage manufacturers ramp up cane sugar usage amid renewed consumer preferences for "natural" sweeteners. Any delays in planned import volumes, especially from key suppliers like the Dominican Republic, Brazil, or Mexico, could squeeze refining capacity on the US coasts and drive speculative support in futures trading. Traders are closely watching USDA updates for any revisions to import projections or demand expectations.

Fundamentals remain stable, with beet and cane production unchanged and supply-demand balances intact, reinforcing a sideways trading bias in the US market. The domestic beet sugar industry is operating efficiently, with production levels meeting internal demand expectations. Meanwhile, cane refiners are maintaining stable throughput rates, aided by timely TRQ shipments and inventories carried over from previous quarters. While short-term price pressures exist—mainly tied to external macro factors like the global oversupply of sugar and softening ethanol markets.

Institutional buyers have adopted a largely "wait-and-see" posture, citing no immediate threats to supply or need for aggressive hedging. Analysts from industry groups like the Sweetener Users Association and Rabobank suggest that while volatility may increase seasonally, particularly during hurricane season and beet harvest in Q3–Q4, the current alignment between supply and demand is unlikely to shift drastically.

.png)

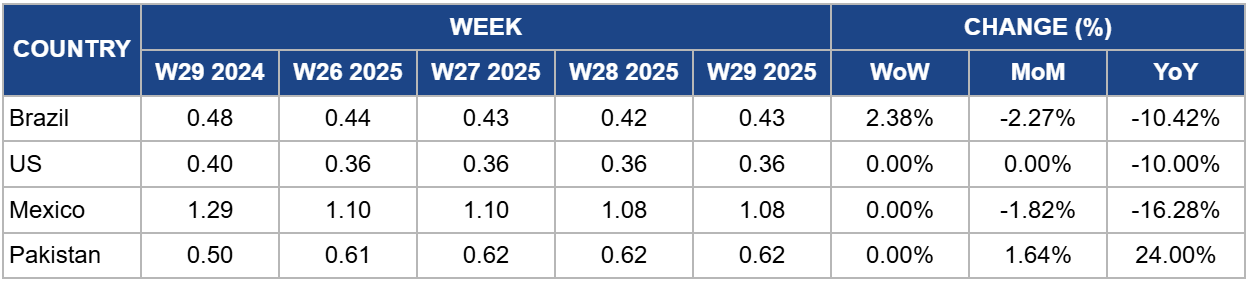

In W29, Brazilian wholesale sugar prices were at US 0.43/kg, a 2.38% WoW increase, reflecting stable supply from ongoing high cane-crushing volumes and no major disruptions in domestic demand. Additionally, Intercontinental Exchange (ICE) No. 11 futures softened to about US¢ 16.36/lb, down 2.7% on July 21 amid expectations of record Brazilian output and weak global demand.

Looking ahead, Brazilian wholesale sugar prices will likely soften unless there are unexpected shifts in weather or export logistics. Futures direction will be critical: a sustained softening below US¢ 16/lb could pressure spot prices further, while stronger ICE signs may offer modest support.

In W29, US wholesale sugar prices remained flat WoW and month-on-month (MoM) at USD 0.36/kg due to steady domestic production and balanced supply chains. US sugar futures held near US¢ 16.36/lb, slightly below earlier highs, as ICE #11 prices slipped in response to improved outlook for global supply.

US wholesale refined sugar prices are expected to remain stable in the coming weeks, anchored by current fundamentals. Without global supply shocks or policy changes, futures are likely to linger in the US¢ 16–17/lb range, keeping wholesale flows stable unless production data shifts.

Mexican wholesale white sugar continues to trade flat at USD 1.08/kg in W29, similar to the previous week. The lack of fresh demand or logistical disruption has maintained this narrow spread, with retail markets also remaining quiet.

Wholesale prices in Mexico are projected to remain flat next week. Only unexpected cane supply issues, export inquiries, or policy shifts, such as expansion in SAF use, would likely alter the price plateau.

In W29, Pakistan's wholesale sugar prices remained flat at USD 0.62/kg. Despite this weekly price stability, YoY prices are up 24% amid a deep supply squeeze. Despite government authorization of 500,000 mt of duty-free imports, physical availability remains scarce, prolonging price pressure.

Wholesale prices are expected to soften slightly as imported stocks begin clearing customs. However, the pace of import rollout and warehousing levels will determine how quickly relief is felt; delays may prolong elevated prices.

With Brazil maintaining high crushing volumes and ICE No.11 futures softening, importers and industrial buyers should consider locking in long-term supply agreements at current favorable price levels. This can hedge against potential weather disruptions or policy-driven export restrictions later in the season.

Given the steady but tight pricing in the US and Mexico, food manufacturers and traders should diversify sourcing portfolios by exploring alternatives from low-cost regions like Brazil or monitoring potential exports from India once domestic surplus conditions stabilize. This strategy would mitigate risk from regional supply plateaus or sudden tariff interventions.

For exporters and traders, Pakistan presents a short-term opportunity. Given the ongoing import clearance delays and high local prices, there is room to time bulk shipments or forward contracts for refined or raw sugar to Pakistan, particularly if customs clearance speeds up and official demand channels open up further.

Sources: Tridge, Daily Pakistan English News, Fitch Solutions, Trading Economics, Nasdaq, The Express Tribune, Arab News, The Friday Times

Read more relevant content

Recommended suppliers for you

What to read next