News

Original content

In W28, prices for salad tomatoes dropped significantly across major Brazilian wholesale markets, with declines ranging from 11.5% to as much as 25.8% week-on-week (WoW) in Rio de Janeiro. According to researchers at Hortifrúti / Center for Advanced Studies in Applied Economics (Cepea), this is due to an increased supply. Favorable warmer temperatures in growing regions have accelerated ripening and improved fruit quality, resulting in greater tomato availability. Furthermore, key production areas, such as Mogi Guaçu (São Paulo), Araguari (Minas Gerais), and Linhares (Espírito Santo), are either in the midst of their winter harvest or are now increasing their supply, putting further downward pressure on prices.

To combat a sudden spike in tomato prices, the Indian government plans to sell tomatoes at subsidized rates. Prices in the Delhi National Capital Territory (NCR) have doubled to over USD 0.70 per kilogram (INR 60/kg) following heavy rains in Himachal Pradesh, which damaged crops and disrupted supply chains. The government will procure tomatoes from southern producing regions and sell them for under USD 0.58/kg (INR 50/kg) through the agencies National Cooperative Consumers' Federation (NCCF) and National Agricultural Cooperative Marketing Federation (NAFED). This initiative aims to provide relief to consumers by curbing the sharp increase in retail prices and is expected to begin within a few days.

A project by Jeonbuk Province's Agricultural Research Services in South Korea is receiving high praise from eco-friendly farms. The agency is mass-propagating and distributing natural enemies, like root mites, to combat pests. In the first half of this year, 5.6 million natural enemies were supplied free of charge to 55 farms, resulting in a pest damage reduction of over 40%. Farmers report a dramatic decrease in pesticide dependency and visibly healthier crops. This initiative offers a sustainable and effective alternative to chemical pesticides, addressing issues such as pest resistance, particularly in greenhouse and smart farm environments.

According to a forecast from the World Processing Tomato Council (WPTC), Ukraine's 2025 tomato harvest for processing is projected to be 550,000 metric tons (mt), a figure consistent with the previous year. Adverse spring weather, including night frosts in April and May, had a minor impact, damaging some early plantings, though most plants have since recovered. May rains caused slight delays in transplanting, whereas overall, planting was completed on schedule. The current crop area is deemed sufficient to meet the forecast. With normal development through Jun-25, processing is expected to commence in the first ten days of Aug-25.

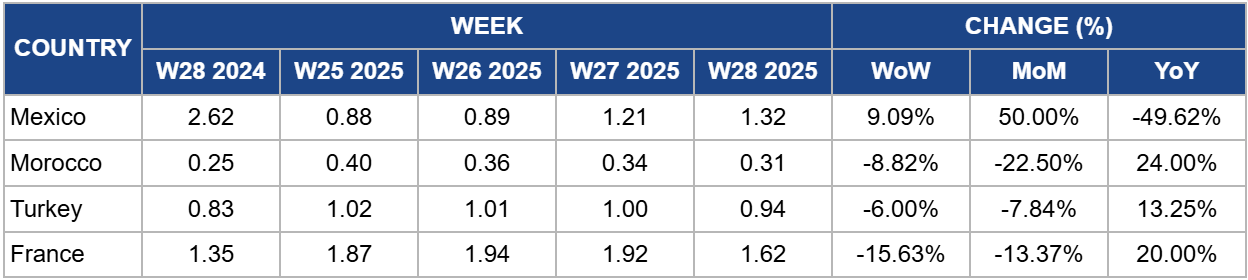

In W28, Mexico’s wholesale tomato prices rose to USD 1.32/kg, reflecting a 9.09% WoW increase, and a 50.00% month-on-month (MoM) surge. One of the main contributors to the weekly price hike was the imposed United States (US) tariffs of 17% on most fresh tomatoes imported from Mexico, starting July 14. Mexican government officials announced that they are working to mobilize and mitigate the consequences of Washington's decision. Nevertheless, prices were down 49.62% year-on-year (YoY), reflecting increased supply of fresh tomatoes in the observed period. In the short-term, it appears that the overall bearish sentiment surrounding new tariffs will continue to influence the wholesale price of fresh tomatoes in Mexico in the upcoming weeks.

In W28, Morocco’s tomato prices declined to USD 0.31/kg, marking a 8.82% WoW drop and 22.50% MoM decrease. The market is currently experiencing a surge in supply not only from Morocco but also from major European producers, including Spain, the Netherlands, and France. This seasonal glut naturally puts downward pressure on prices as supply outstrips immediate demand. However, despite the recent drop, prices remain elevated, 24.00% higher YoY due to rising input and labor costs.

In W28, Turkey's wholesale tomato price decreased 6.00% WoW and 7.84% MoM to USD 0.94/kg due to weakened demand. This indicates that the market hasn't reached the expected levels ahead of the tomato paste season, which hasn't started yet. This was the case in Kahramanmaraş, where a significant mismatch between supply and demand led to sellers struggling with excess inventory, forcing them to cut prices to avoid a total loss. On the other hand, the wholesale price of fresh tomatoes in Turkey was 13.25% YoY higher in W28, marking a significant influence of macroeconomic pressures and soaring production costs.

In W28, France’s tomato price decreased 15.63% WoW and 13.37% MoM to USD 1.62/kg. The primary factor contributing to the decline in the weekly and monthly prices of fresh tomatoes in France is an abundant supply. Mid-July marks the peak harvest season for domestic tomato production, while Morocco’s tomatoes are also in high volume, as are those of other European countries. Another point is the softened demand, due to summer holidays. While demand increases in tourist areas, the large-scale, consistent demand from major population centers can soften.

The significant price drops in France, Morocco, and Brazil are a direct result of a predictable seasonal supply glut, where peak domestic and international harvests flood the market. To avoid being caught in this price collapse, producers should prioritize establishing forward contracts and pre-season agreements with major buyers, such as retailers and processors. Locking in volumes and prices before the harvest peak provides crucial revenue stability and protects margins from the volatility of the spot market.

The 9.09% weekly price hike in Mexico underscores how quickly political decisions can override market fundamentals and disrupt supply chains. Buyers heavily reliant on a single import corridor are exposed to significant price and volume risks. It is critical to actively diversify sourcing by building strong relationships with suppliers in multiple, politically stable regions. For European buyers, this means balancing Moroccan supply with Spanish or domestic options; for US buyers, it means developing domestic or Canadian partnerships to buffer against trade friction with Mexico.

The success of South Korean farms using natural enemies to reduce pest damage by over 40% offers a powerful model for producers everywhere. Investing in Integrated Pest Management (IPM) strategies is not just an eco-friendly choice but a sound business decision. By reducing dependency on chemical pesticides, growers can lower input costs, overcome pest resistance, and produce healthier, higher-quality crops. This enhances marketability, particularly to consumers and retailers who are increasingly prioritizing and paying a premium for sustainably grown produce.

Sources: AgroPolit, CanalRural, AgriNet, The Economic Times-India, Agro Meat

Read more relevant content

Recommended suppliers for you

What to read next