News

Original content

Global sunflower oil prices recovered in the 2024/25 season. They are expected to face downward pressure as supply expands significantly. The United States Department of Agriculture (USDA) forecasts global sunflower seed production to reach 56.3 million metric tons (mmt) in 2025/26, up 3.9 mmt year-on-year (YoY), driven by improved yields in key Black Sea producers.

Dominating the global sunflower oil and meal exports, Ukraine and Russia are projected to increase output and boost exports by 500,000 metric tons (mt) of oil and 700,000 mt of meal, respectively. The anticipated surge in supply is expected to weigh on prices, especially as export volumes rise from the Black Sea region.

As of W28, Ukrainian sunflower oil trades at near parity with Argentine soybean oil, a rare occurrence, indicating softening sunflower oil premiums. Meanwhile, soybean oil prices in South America are climbing due to Brazil's move to raise biodiesel mandates and new United States (US) support for biodiesel. However, US soybean oil prices remain notably higher. Despite the recent firmness, the sunflower oil market is poised for volatility as ample supply prospects emerge for the 2025/26 season.

Sunflower oil consumption in Spanish households increased by nearly 40% over the past year, reaching 158.3 million liters (L). However, it remains below olive oil consumption, which totals 274 million L despite a 10.8% decline. Each person consumes 3.4 L of sunflower oil annually compared to 5.9 L of olive oil.

The price difference influences consumer behavior. Sunflower oil is significantly cheaper, attracting households facing economic challenges. Meanwhile, olive oil prices have remained high, increasing over 60% YoY in early 2024. The recovery of the hospitality sector has also supported growing demand for sunflower oil.

Industry experts highlight that sunflower and olive oils serve different markets and are not direct substitutes. Olive oil continues to dominate household consumption, but rising sunflower oil use reflects changing consumption patterns and pricing dynamics.

The Regional Ministry of Agriculture, Livestock, and Rural Development of Castilla-La Mancha (CAGDR) has launched a training program for over 1,000 producers to qualify for agro-environmental sunflower aid, which provides USD 150.93 per hectare (EUR 130/ha) annually over four years, the initiative aims to meet the needs of farmers while fulfilling agri-environmental commitments outlined in the Strategic Plan for the Common Agricultural Policy (CAP). The total budget for sunflower-specific aid is USD 22.99 million (EUR 19.8 million), part of a broader USD 37.73 million (EUR 32.5 million) regional investment under the CAP.

Training sessions have already begun in the provinces of Cuenca and Guadalajara, the main beneficiaries of the program. In the first year, 1,080 applications covering 47,227 ha were submitted, reflecting strong interest from producers. The initiative aims to promote sustainable cultivation practices and revive an aid program that had been inactive for over a decade.

.png)

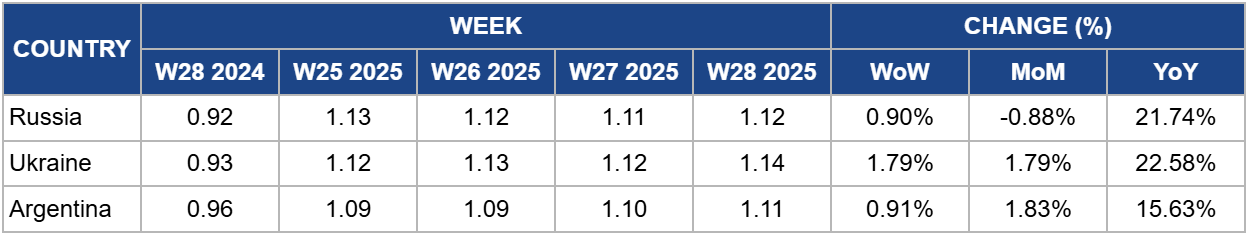

In W28, Russia's sunflower oil prices rose by 0.90% week-on-week (WoW) to USD 1.12 per kilogram (kg), marking a 21.74% YoY increase. This upward trend aligns with strong global vegetable oil prices, though future domestic supply growth may moderate price momentum.

According to the USDA, Russia is set to achieve a record sunflowerseed harvest in 2025/26, estimated at 17.5 mmt, a 4% increase over the current season, driven by improved yields rather than expanded acreage. Favorable weather conditions are expected to support yields averaging 1.82 mt/ha, the third-highest on record.

Already the world’s leading sunflowerseed producer, Russia is projected to supply over 31% of global output in 2025/26. As most of the harvest is processed domestically, a larger crop could support increased export volumes of sunflower oil and meal. While short-term prices remain firm, the anticipated supply growth could exert downward pressure on prices later in the marketing year, especially if global demand remains stable.

In W28, Ukraine's sunflower oil prices rose by 1.79% WoW to USD 1.14/kg, reflecting a strong 22.58% YoY increase from USD 0.93/kg. This price momentum is underpinned by firm global demand for vegetable oils, particularly from the EU, where a stronger euro lifted delivered prices to USD 1,200 to 1,220/mt delivered at place (DAP).

Domestically, sunflower seed prices remained elevated at USD 555 to 565/mt, with some processors offering premiums for large volumes, reinforcing upward pressure on oil prices. However, competition from cheaper palm oil in the Indian market and expectations of a larger sunflower harvest in Russia could temper further gains. Weather-related risks in southeastern Ukraine may limit domestic supply if drought conditions persist, potentially tightening the market and supporting prices. Conversely, the upcoming rapeseed harvest in Ukraine and the European Union (EU) could cap price increases, as rapeseed oil remains a key substitute in European markets.

In W28, Argentina's sunflower oil prices increased slightly by 0.91% WoW to USD 1.11/kg, though they remain 15.63% higher YoY from USD 0.96/kg. FOB prices have surged by 45% since the beginning of 2025, driven by strong international demand and constrained global supply.

The sharp increase in Argentine sunflower oil prices reflects a broader tightening in global vegetable oil markets, particularly due to production declines in Ukraine and Russia, which together account for 70% of global sunflower oil exports. Independent global forecasting service Oil World projects that vegetable oil exports for 2024/25 will hit a three-year low, further supporting elevated prices.

Argentina has capitalized on these conditions, recording its highest sunflower oil export levels in 18 years. With 3.2 mmt processed domestically and 70% of sunflower by-products exported, well above historical averages, Argentina has reinforced its position as a key global supplier. If global production shortfalls persist, current price levels are likely to remain firm or rise further, incentivizing continued export-oriented processing.

Producers, traders, and buyers should anticipate greater supply from the Black Sea region in 2025/26, potentially pressuring prices. Implement flexible procurement and sales strategies to manage volatility, including diversifying sourcing origins and adjusting contract terms to accommodate fluctuating market conditions.

Exporters and marketers should focus on markets like Spain, where sunflower oil consumption is rising sharply due to its cost advantage over olive oil. Tailor marketing and distribution efforts to capture consumers' shifting preferences, emphasizing sunflower oil’s affordability and growing acceptance in both household and hospitality sectors.

Sunflower producers should actively engage in agro-environmental aid programs, such as Castilla-La Mancha’s CAP-funded initiative, to adopt sustainable practices and improve yields. Public-private partnerships can accelerate the adoption of improved agronomic techniques, supporting long-term production stability and export competitiveness amid expanding global supply.

Sources: Tridge, Agravery, Bichos del Campo, Voz Populi, El Diario, Clarín, Oils & Fats International

Read more relevant content

Recommended suppliers for you

What to read next