Original content

GDM Argentina has applied to register three new crop varieties with the National Seed Institute (INASE): two transgenic soybeans and one bread wheat. The new soybean cultivars, DM50E25 SE and NEO 64S25 SCE, offer tolerance to multiple herbicides, with one also providing resistance to major insect pests. The third variety is a new bread wheat named Casuarina. Now open for a 30-day public objection period, these applications represent GDM's effort to strengthen its market position with advanced genetics tailored for modern agricultural challenges.

Argentina's 2024/25 soybean season experienced a strong productive recovery, marked by a 6.4% YoY increase in planted area and a 15% improvement in average yields, resulting in a harvest of 50.3 mmt. Despite this agricultural success, the economic outcome was negative due to low international prices. The soybean complex's contribution to the economy decreased by 12%, exports declined by 5.1% in value, and tax revenues fell by 13.4%. The campaign demonstrates that high production volumes were not enough to offset the financial impact of a weak global market.

In 2025, Mato Grosso's soybean crop is projected to generate USD 92.43 billion, representing over half of the state's total agricultural Gross Value of Production (GVP). This impressive figure is driven by a record harvest, thanks to expanded cultivation area and increased productivity. However, the total value was held back by a year-on-year (YoY) drop in soybean prices. The final GVP figure will depend on the sale price for the 18% of the harvest that is still unsold. Still, the overall performance highlights the crop's critical importance to the region's economy.

Syngenta Korea has registered Miraebit, the first fungicide in South Korea specifically for treating soybean wilt and mummy diseases. These diseases, which thrive in high-humidity conditions and can significantly reduce crop yield and quality, previously had no registered chemical treatment available to Korean farmers. Containing the unique active ingredient P-Diflumetophen, Miraebit is expected to provide an effective solution for farmers to protect their crops, especially as abnormal climate patterns raise concerns about increased disease incidence.

The United States Department of Agriculture (USDA) has significantly increased its forecast for Ukraine's 2025/26 soybean harvest to a record 7.6 million metric tons (mmt), a one mmt jump from its previous estimate. This sharp increase comes as a surprise for the season, as it surpasses last year's record of 7 mmt. This boost contributes to a global outlook of increased soybean supply and stocks. In contrast, the USDA lowered its forecast for Ukraine's wheat production while keeping the corn estimate unchanged.

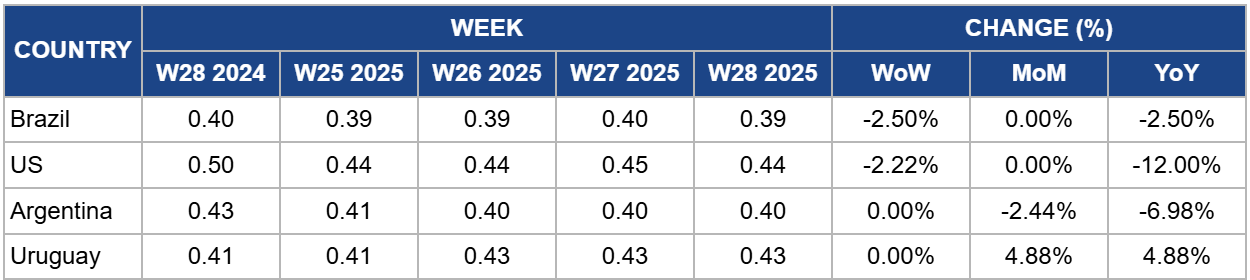

In W28, Brazil’s soybean price decreased both 2.50% week-on-week (WoW) and YoY to USD 0.39 per kilogram (kg), and at the same time remained unchanged over the past month. Brazilian soybean prices decreased primarily due to the overwhelming pressure of a record-breaking domestic harvest, which is contributing to an all-time high in global soybean stocks. This massive supply is the main factor driving prices down, outweighing the otherwise strong and consistent demand from China and the domestic biofuel sector. While this robust demand provides a supportive floor, preventing a more dramatic price collapse, the sheer volume of the current and anticipated crop is the dominant force pushing the market lower.

In W28, United States (US) soybean prices decreased 2.22% WoW and 12.00% YoY to USD 0.44/kg. However, prices remained unchanged month-on-month (MoM). The weekly price decline is primarily due to overwhelmingly favorable growing conditions in the US, which are boosting expectations for a large harvest. The USDA reported that 70% of the soybean crop was in good-to-excellent condition, a significant improvement that has alleviated earlier concerns about dry weather. This positive crop outlook, combined with a higher-than-anticipated planting estimate from the USDA, has put considerable downward pressure on prices as the market anticipates ample supply.

The significant YoY price drop reflects a broader trend of a well-supplied global market and robust domestic stock levels. Last year's prices were higher amid greater uncertainty. In contrast, the current market is characterized by high beginning stocks and strong production forecasts not just in the US, while also in key competitor nations like Brazil. This abundance of supply, coupled with fierce competition for export sales, continues to weigh on prices compared to the same period last year.

In W28 in Argentina, prices remained stable at USD 0.40/kg unchanged WoW. On the other hand, prices are down 2.44% MoM and 6.98% YoY. The weekly price stability reflects a market balancing bearish supply news with a positive development in trade. The primary downward pressure comes from the recent completion of Argentina's 2024/25 soybean harvest, which has confirmed an ample domestic supply and removed any weather-related risk premium. However, this was offset by the significant news that the first cargo of Argentine soymeal is set to ship to China after a nine-month hiatus. The reopening of this key export destination provided enough support to keep prices from falling further during the week.

The MoM and YoY price declines are a direct result of this successful harvest, which ensures the market is well-supplied. This contrasts with previous periods where supply was less specific. Furthermore, weak demand from major importers, such as China, where the downstream soymeal market is struggling, has contributed to the lower price environment compared to both last month and last year.

In W28, Uruguay’s soybean prices remained stable WoW at USD 0.43/kg, although they are up both MoM and YoY by 4.88%. The WoW soybean prices in Uruguay, which remains unchanged,suggest that the market is currently well-balanced, with strong local demand factors offsetting the broader bearish sentiment seen in other major producing regions. While ample global supplies are capping potential price increases, firm demand for Uruguayan soybeans is preventing any price erosion.

The notable monthly and yearly price increase is directly attributable to Uruguay's robust export performance. Soybeans were the country's leading export product in Jun-25, with sales reaching USD 201 million, indicating strong and immediate demand from international buyers. Strategic trade developments, including expanded agricultural cooperation and market access, support this surge in sales, with China playing a key role. This has bolstered market confidence in sustained demand for Uruguayan soybeans, justifying the higher price levels compared to both last month and last year.

With a record-breaking harvest depressing prices and 18% of the crop still unsold, Brazil must implement a strategic sales and inventory management plan to avoid further price erosion. Instead of liquidating the remaining supply into an already saturated global market, producers and exporters should leverage storage capacity to phase sales over the coming months. This approach allows the market to gradually absorb the volume, preventing a price crash and potentially capturing higher values later in the season. This strategy should be coupled with sophisticated hedging using futures and options to lock in acceptable prices and protect against downside risk, ensuring the final GVP is maximized despite the challenging price environment.

Market

With global supplies at a high and prices under pressure from record harvests in competing nations, the US must shift its competitive focus from volume to value. Instead of engaging in a price war, US exporters should aggressively market the superior quality, reliability, and sustainability credentials of American soybeans, as certified by programs like the US Soy Sustainability Assurance Protocol (SSAP), a national program that verifies the sustainability of US soy exports. By highlighting these attributes, the US can appeal to quality-conscious buyers and justify a premium over lower-cost alternatives. This strategy involves targeted marketing campaigns emphasizing lower foreign matter, consistent protein levels, and sustainable farming practices to secure market share in high-value destinations and insulate farmers from pure price-based competition.

Argentina faces a critical paradox: record production is leading to falling economic returns. To break this cycle, the nation must leverage its advanced domestic AgriTech, such as the new GDM transgenic varieties, as a key commercial advantage. By marketing its crop as a product of superior, high-efficiency genetics, Argentina can differentiate its supply and negotiate better terms. Furthermore, to escape the trap of low raw commodity prices, Argentina must intensify its focus on value-added exports. Expanding crushing capacity to increase the output of higher-margin soybean meal and oil will capture more revenue domestically and reduce the sector's direct exposure to volatile raw bean prices, ensuring that impressive production gains translate into economic growth.

Sources: UkrAgroConsult, Global Agriculture, CEPEA, USDA, Canal Rural, Agro Link, Agri Net, Super Agronom, Chacra

Read more relevant content

Recommended suppliers for you

What to read next