News

Original content

In the 2024/25 marketing year (MY), European Union (EU) palm oil imports declined by 20% to approximately 2.8 million metric tons (mmt), mainly due to Spain’s and Italy’s reduced purchases, according to the German Union for the Promotion of Oilseeds and Cereals (UFOP). The Netherlands remained the largest EU importer with 959,000 metric tons (mt), serving as a key hub for both imports and biofuel production. Italy and Spain saw significant declines of 28% and 40%, respectively, while Germany, Belgium, and Sweden also imported less palm oil. In contrast, Greece, Denmark, and Ireland increased their imports.

UFOP links the overall decline to the exclusion of palm oil from EU biofuel quotas, with Germany, France, and the Netherlands phasing out their use. The association advocates for expanding the ban under the Renewable Energy Directive III (RED III) and urges buyers to verify raw material origins. UFOP also proposes raising the biofuel share from crops to 5.9% to stabilize bioethanol and biomethane markets.

China's uptake of certified sustainable palm oil remains low at approximately 8.7% of total imports, lagging far behind Europe and the United States (US), where over 90% is certified. The absence of binding regulations comparable to the European Union Deforestation Regulation (EUDR) has hindered wider adoption, though domestic momentum is growing. Key drivers include enhanced environmental, social, and governance (ESG) disclosure requirements, international scrutiny, and corporate commitments by firms such as Yili and Yihai Kerry, which have begun sourcing identity-preserved (IP) certified palm oil and improving traceability.

Since the Roundtable on Sustainable Palm Oil (RSPO) established its Beijing office in 2015, membership has grown to around 460 Chinese companies. While challenges persist, particularly low consumer awareness and a lack of regulatory enforcement, the RSPO continues to promote sustainability through policy engagement, capacity building, and international cooperation. China is increasingly viewed as a critical player in shaping the global shift toward sustainable palm oil consumption.

Indonesia, the world’s largest producer and exporter of crude palm oil (CPO), has urged India to support a more predictable and transparent policy framework for cooking oil trade, citing recent disruptions from climate shocks, export restrictions, and shifting import duties. In May-25, Indonesia raised its CPO export duty to 10% to support its biofuel and replanting initiatives. Meanwhile, India reduced its effective import duty on key edible oils to 16.5% to stabilize domestic prices. Indonesia also referenced its 2022 export ban as a cautionary example of policy volatility that disrupted global supply chains.

India remains a crucial trading partner, accounting for over 55% of Indonesia’s palm oil exports in the 2023/24 oil year. However, India’s total vegetable oil imports declined by 9% year-on-year (YoY) in the current oil year (November–May). Indonesia projects 2025 palm oil output at 47 mmt, with 25 mmt designated for export. Ongoing diplomatic engagement aims to secure stable trade flows, particularly during peak demand periods such as Ramadan, highlighting Jakarta’s emphasis on continued bilateral dialogue to ensure market stability.

Indonesia's palm oil exports to the US may decline by 15% to 20% if a proposed 32% tariff on Indonesian goods is implemented, according to the Indonesian Palm Oil Association (GAPKI). The US currently imports an average of 2.25 mmt of Indonesian palm oil annually, accounting for 85% of its palm oil imports.

Such a tariff would reduce Indonesia's competitiveness against other vegetable oils such as soybean and rapeseed, and could lead to a shift in US sourcing toward Malaysian palm oil, which faces lower tariffs. In 2024, Indonesia exported 29.5 mmt of palm oil products globally. In response, Indonesian trade officials are heading to Washington to discuss the issue with their US counterparts.

Indonesia has transferred nearly 400,000 hectares (ha) of confiscated oil palm plantations to PT Agrinas Palma Nusantara, a newly established state-owned enterprise, tasked with managing seized palm oil plantations to support Indonesia’s food, energy, and sustainability goals. The land was seized from over 230 companies found in violation of forestry laws. This move expands Agrinas' managed area to over 833,000 ha, positioning it among the world's largest oil palm producers, with a current output of 6,000 mt of raw material per day.

The government's forestry task force has confiscated more than 2 million ha to date, with a target of 3 million ha by Aug-25 for agricultural or reforestation purposes. The development comes amid uncertainty in Indonesia's palm oil trade, as potential US tariffs of 32% threaten to reduce exports to that market.

Malaysia is refining its palm oil market strategy to support sectoral growth and enhance its relevance across diverse regions, according to the Ministry of Plantation and Commodities (MPC). The MPC Minister highlighted rising demand in North Africa, Sub-Saharan Africa, and the Association of Southeast Asian Nations (ASEAN), driven by food processing, industrial use, and refining sectors.

Malaysia is emphasizing downstream development, including specialty fats, oleochemicals, and food ingredients, to deepen value chain integration and encourage joint ventures and technology transfer. In 2024, 80% of Malaysia's 19.3 mmt of palm oil output was exported, with significant growth in non-traditional markets. Exports to North Africa surged by 63.5%, and Sub-Saharan Africa rose by 26% YoY in early 2025. The strategy aims to secure long-term partnerships and resilient industrial growth.

The impending 25% US tariff on Malaysian palm oil intensifies pressure on the USD 28 billion industry, although the US accounts for less than 5% of exports. Malaysia is mitigating the impact through strategic market diversification, shifting focus to India, Africa, and the Middle East, and advancing yield improvements via biotechnology.

Key innovations include AI-driven precision farming and high-yield palm hybrids, addressing challenges such as aging plantations and labor shortages. Malaysia's Malaysian Sustainable Palm Oil (MSPO) 2.0 sustainability certification supports continued access to European markets despite stringent EUDR.

Risks remain from geopolitical tensions, supply surpluses, and evolving regulations. Investors are advised to focus on companies expanding in emerging markets, investing in biotechnology, and holding sustainability certifications. Malaysia's palm oil sector is leveraging tariffs as a catalyst to enhance resilience through technology and diversified trade partnerships.

Malaysia's palm oil production is projected to increase by 0.5% YoY to 19.5 mmt in the 2025/26 season, following a 1.6% decline in 2024/25. The modest recovery is supported by anticipated El Niño-Southern Oscillation (ENSO) neutral weather and normal rainfall. However, structural challenges, including an acute labor shortage and slow replanting progress, continue to limit long-term growth potential.

Domestic consumption is expected to fall by 2% due to reduced industrial demand and limited progress in biofuel targets. Malaysia's share of global palm oil production is set to decline slightly from 25.2% to 23.9%.

Despite high palm oil prices discouraging replanting in recent years, the government has allocated approximately USD 235,710 (MYR 100 million) in Budget 2025 to incentivize smallholders. Malaysia maintains its position as a reliable exporter, with over 80% of production certified under MSPO standards in 2024. Strengthened traceability and alignment with the EUDR reinforce Malaysia’s commitment to sustainability, providing a competitive advantage in global markets.

.png)

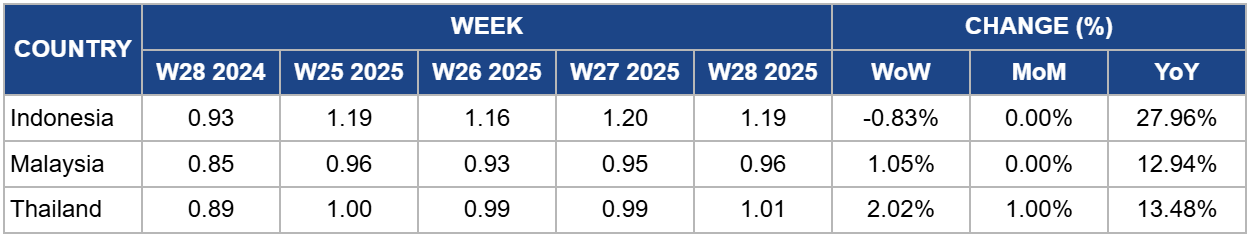

Indonesia's palm oil prices fell by 0.83% week-on-week (WoW) to USD 1.19 per kilogram (kg) in W28, despite registering a strong 27.96% YoY increase from USD 0.93/kg in W28 2024. The recent weekly decline reflects short-term market adjustments influenced by shifting trade policies and demand uncertainties.

Price stability may be challenged in the near term as Indonesia intensifies its call for a more predictable trade framework with India, its largest buyer, which accounted for over 55% of Indonesia's palm oil exports in the 2023/24 oil year. Diverging policies, Indonesia's 10% export duty hike to fund domestic biofuel and replanting programs, and India's reduction of its edible oil import duty to 16.5%, could create pricing pressure and reshape trade flows. With a 2025 production forecast at 47 mmt and 25 mmt set for export, maintaining smooth trade relations and minimizing policy-driven shocks will be key to price stabilization.

In W28, Malaysia's palm oil prices rose by 1.05% WoW to USD 0.96/kg, up 12.94% YoY from USD 0.85/kg. The price increase reflects gains in competing vegetable oils and support from a weaker ringgit (MYR), which boosts export competitiveness. Futures climbed to a near three-month high, with the benchmark September contract closing at USD 979.23/mt (MYR 4,149/mt), tracking strength in the Dalian Commodity Exchange (DCE).

Short-term price momentum is likely to remain firm, supported by rival oil markets and currency effects. However, weaker crude oil prices could weigh on biodiesel demand, while geopolitical uncertainties, including potential US tariffs on Indonesian palm oil, may shift global trade flows, indirectly affecting Malaysian prices.

In W28, Thailand's palm oil prices increased by 2.02% WoW to USD 1.01/kg, reflecting a 13.48% YoY rise from USD 0.89/kg. The upward price trend aligns with broader regional strength in vegetable oil markets and sustained export demand. However, future price stability may be challenged by the impending US tariff of 36% on Thai palm oil exports, set to take effect on August 1. This development could reduce US demand by an estimated 15 to 20%, leading to potential oversupply in regional markets and downward pressure on prices. While Thai officials continue negotiations to mitigate the impact, the lack of tariff relief may prompt exporters to diversify trade partners or adjust domestic stock strategies. Competitive pressures from other suppliers, such as Malaysia and alternative oils, may further influence Thailand’s pricing dynamics in the near term.

Producers in Indonesia, Malaysia, and exporting companies across Asia should accelerate investment in traceability systems and certification programs such as RSPO, MSPO, and identity-preserved (IP) schemes. This will ensure compliance with the EUDR and meet rising ESG expectations in China, helping secure long-term access to premium markets and reduce exposure to sustainability-related trade barriers.

To mitigate risks from declining demand in traditional markets like the EU and tariff threats from the US, palm oil exporters should expand trade relations with emerging markets in Africa, the Middle East, and Southeast Asia. Targeted outreach, joint ventures, and infrastructure investments can support stable demand, especially in high-growth regions such as North and Sub-Saharan Africa, which are showing increased import volumes.

Indonesia and Malaysia should review the timing and structure of export duties and domestic allocation policies to avoid unintended pricing pressures. Coordinated fiscal and trade policy adjustments, particularly during high-demand periods, will help maintain export competitiveness against alternative oils and ensure more predictable trade flows with key buyers such as India and China.

Sources: Tridge, Ukr AgroConsult, Reuters, Hellenic Shipping News

Read more relevant content

Recommended suppliers for you

What to read next