News

Original content

Greece’s olive oil sector is facing a severe price collapse, with producer prices falling from a peak of USD 10.44 (EUR 9) to as low as USD 3.25 (EUR 2.80) per liter (L), creating a devastating situation for farmers' incomes and the value of exports. Market insiders warn that an even sharper drop is expected with the beginning of the new harvest season in October. This dramatic downturn is being driven by expectations of a strong production in both Greece and, more significantly, in Spain, the world's largest producer. The market pressure is reshaping consumer behavior, leading to a collapse in bottled olive oil sales, which have plummeted from 45,000 mt in 2021 to under 18,000 mt today. In its place, the informal market for bulk 16-L tins is seeing a major resurgence. Industry stakeholders are now pinning their hopes on the introduction of mandatory electronic invoicing in October to curb untracked sales and bring some stability back to the formal market. Greek olive oil producers could be in for a challenging start of the 2025/26 harvest.

The latest report from the Central Inspectorate for the Suppression of Fraud on Italian olive oil stocks reveals a shift in the country's supply composition as of late Jun-25. Stocks of authentic Italian extra virgin olive oil have plummeted to just 53,000 mt, a 35% decrease compared to the same period last year. This sharp decline in domestic supply is being offset by a massive influx of foreign oil. Stocks of EU-sourced extra virgin olive oil have surged by nearly 70% to over 59,000 mt, with an additional 12,000 mt imported from non-EU countries. This has created an unusual dynamic where industrial bottling centers like Perugia now hold more olive oil than traditional production heartlands like Bari. While this reliance on imports has kept total inventory stable year-on-year (YoY) at 176,000 mt, the data clearly illustrates the impact of Italy's poor 2024/25 harvest.

European olive oil production grew by 40% in the second quarter of 2025 compared to the previous year, driven by strong recoveries in key nations. Spain solidified its position as the world's top producer with an output of approximately 1.4 million metric tons (mmt), followed by Greece with 250,000 metric tons (mt), Italy with 247,000 mt, and Portugal with 177,000 mt according to estimates still in the consolidation phase. In stark contrast to the general trend, Italy's production fell by 25% due to adverse weather, increasing its reliance on imports. This supply shift has led to lower average export prices from the European Union (EU). In response, European suppliers have increased shipments to the United States (US) ahead of a potential tariff review, while also exploring new opportunities in emerging markets. The market remains under pressure from currency effects and evolving trade policies, creating an uncertain but dynamic global landscape.

Portugal has set an ambitious goal to become the world's second-largest olive oil producer by 2030, leveraging significant gains in efficiency and modernization. The country's production grew by 10% in 2024 to nearly 200,000 mt. This success is attributed to modern farming practices rather than increased land use, particularly in the Alentejo region which accounts for over 50% of the country's olive oil production, supported by irrigation from the Alqueva dam. With an impressive 98% of its output already classified as virgin or extra virgin, the national strategy is now shifting from volume to value. Key plans include developing a strong "Portugal" national brand to boost international recognition and a proposed USD 10.43 billion (EUR 9 billion) "Water that Unites" investment to expand irrigation and professionalize the sector. This focus on creating a premium, differentiated product is seen as essential for navigating falling global prices and consolidating Portugal's position as a leader in high-quality olive oil.

Tunisia’s olive oil sector is facing a new crisis as the US imposes tariffs on Tunisian goods, citing unfair trade practices. Implemented on July 8, the tariffs, starting at 10%, could potentially rise to 25% at the start of Aug-25 if talks fail. These tariffs threaten a vital export industry for Tunisia at a time when olive oil sales have already fallen from USD 3.4 billion to USD 2.3 billion in the first half of 2025 compared to the previous year. The US has been a primary and growing destination for Tunisian olive oil, making the new duties particularly damaging for the entire agricultural value chain, from small farmers to exporters. While negotiations are reportedly underway to reduce the tariff's impact, the situation highlights the significant risks of market concentration. Experts are urging Tunisia to accelerate its efforts to diversify its export destinations, particularly towards emerging Asian markets, to ensure long-term stability.

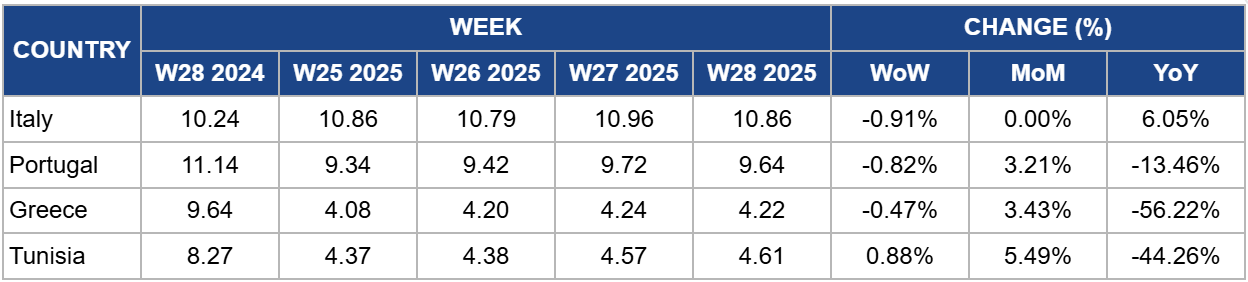

In Italy, extra virgin olive oil prices decreased slightly in W28, dipping 0.91% week-on-week (WoW) to USD 10.86 per kilogram (kg). The current price matches the level from one month ago and reflects a 6.05% increase YoY.. The WoW decrease reflects the industry's successful strategy of importing olive oil, particularly from Spain, to compensate for its severe domestic production shortfall. With Italian buyers having actively secured foreign stocks, the immediate pressure of scarcity has eased slightly, allowing for a small pullback from recent price peaks. However, the long-term bullish trend remains firmly in place. The 6.05% YoY price increase is a direct consequence of Italy’s poor 2024/25 harvest. With domestic stocks of authentic Italian extra virgin olive oil (EVOO) down 35% from last year, the fundamental supply deficit continues to support a high price premium for Italian origin oil.

In Portugal, extra virgin olive oil prices were down 0.82% WoW, dipping to USD 9.64/kg in W28. Prices are still up for the month, trading 3.21% higher month-on-month (MoM) but are down 13.46% YoY. The price correction over the past week is consistent with other European countries. The 3.21% monthly price increase indicates a tightening market. With reports confirming that Portuguese stocks are now minimal and committed and a Mediterranean heatwave adding a risk premium to the upcoming 2025/26 harvest, prices for the last available volumes have been pushed higher. The 13.46% YoY price drop is a direct result of the successful 2024/25 harvest, where Portugal’s production rebounded and the broader European supply increased by 40%.

In Greece, the price of extra virgin olive oil dipped by 0.47% WoW to USD 4.22/kg in W28 but still 3.43% higher than the past month. However, prices are still down 56.22% YoY. The recent price dip is the result of a price correction across the European market. Producers are dissatisfied with current price levels and are holding stock in the hopes of future price increases, resulting in few offers in the market. However, Greece still holds significant volumes of unsold olive oil. The country’s limited storage capacity may lead to a deterioration in quality during the summer months. As a result, Greek producers might be forced to sell in the coming months, despite dissatisfaction with price levels. Producers are hoping for demand from Italy. However, it is more likely that Italy will continue to purchase Spanish olive oil until stocks are depleted.

In Tunisia, extra virgin olive oil prices continue to show short term strength, increasing 0.88% WoW to USD 4.61/kg. The latest increase results in a 5.49% rise MoM. However, the recent price is still down 44.26% YoY. The Tunisian market is now almost entirely driven by end-of-season dynamics as stocks are nearing depletion. This, combined with a weather risk premium from the July heatwave affecting the upcoming 2025/26 crop, is pushing prices higher for the last available volumes. As the market tightens, Tunisia’s role in the supply chain will likely diminish until the new harvest begins, shifting focus to European markets.

The heavy reliance on the US market is a critical vulnerability for European and Tunisian exporters, given the high probability of disruptive tariff changes. A proactive diversification strategy is essential. Exporters should aggressively target high-growth regions in Asia and South America, capitalizing on opportunities like Brazil's proposed elimination of import duties. Concurrently, companies should explore strategic investments to protect their US market share, such as establishing bottling and storage facilities within the US to potentially bypass certain tariff classifications. This dual approach—diversifying into new regions while strategically fortifying the US position—will build a more resilient and adaptable export program, reducing the impact of unpredictable trade policies and ensuring long-term stability.

Greek producers are currently holding significant volumes of unsold oil, hoping for better prices. However, this strategy is undermined by a lack of adequate storage infrastructure, which puts the oil at high risk of quality degradation during the hot summer months. Producer cooperatives must take collective action to invest in modern, climate-controlled storage facilities. This would allow them to preserve the quality of their extra virgin olive oil, giving them the leverage to wait for more favorable market conditions without sacrificing the value of their product. Although this is not necessarily a short-term strategy, in the medium term, it can prevent a forced sell-off of lower-quality oil at the start of the next season, which would only serve to further depress prices.

The current market presents a complex challenge for buyers, with a clear scarcity of high-quality extra virgin olive oil, particularly from Spain and Italy. Given that the July heatwave poses a significant threat to the quality and quantity of the upcoming 2025/26 harvest, securing supply now is a prudent risk-management strategy. Buyers should focus on locking in contracts for the remaining high-quality 2024/25 EVOO from Spain and Greece before quality deteriorates further due to poor storage. For more price-sensitive product lines, capitalizing on the lower prices of Virgin and Lampante oils from Spain, where stocks are highest, offers a cost-effective solution. This balanced approach ensures both quality for premium lines and cost control for others.

Sources: Tridge, EFA News, Olivo News, Tovima, The New Arab

Read more relevant content

Recommended suppliers for you

What to read next