News

Original content

Coffee futures rose sharply after the United States (US) President imposed a 50% tariff on Brazilian imports starting August 1. As the world's largest Arabica producer and key supplier to the US, Brazil’s tariff has unsettled investors and raised concerns over higher prices for American consumers. Arabica prices in the New York Stock Exchange (NYSE) increased by over 3.5% following the announcement. Industry leaders warn that tariffs on major coffee producers such as Brazil and Vietnam could significantly increase coffee costs in the US. Despite recent price declines from peak levels, supply challenges and geopolitical tensions keep the market volatile.

The US announcement of new tariffs on Brazilian products, including a potential increase in import duties on coffee from 10% to 60%, poses a significant threat to Brazil's coffee exports. As Brazil supplies 42% of global Arabica coffee and the US is its key market, the tariff hike could severely impact trade viability and narrow profit margins. Itaú BBA, Latin America’s leading corporate and investment bank, projects that substitution by other origins is limited, making a pass-through of higher costs to American consumers likely. While a weaker Brazilian real might offer short-term export advantages, rising input costs could offset these gains, adding further strain to the coffee supply chain.

Since peaking at USD 378.83 per 60-kilogram (kg) bag (BRL 2,102.12/60-kg bag) in Jan-25, the Center for Advanced Studies on Applied Economics — Luiz de Queiroz College of Agriculture (CEPEA/ESALQ) Robusta coffee indicator for Espírito Santo has dropped sharply by 49.3%, losing USD 186.58/60-kg bag (BRL 1,035.35/60-kg bag). Similarly, Arabica prices fell 37.5% from a record high of USD 499.09/60-kg bag (BRL 2,769.45/60-kg bag) in Feb-25, declining by USD 181.72/60-kg bag (BRL 1,008.36/60-kg bag). Despite tight national and global stocks, the ongoing harvest in Brazil has increased spot market supply, exerting downward pressure on prices. Robusta harvesting is nearing completion, supporting the recent price easing.

The US imposition of a 50% tariff on Brazilian coffee, effective August 1, may significantly disrupt trade flows and raise coffee prices for American consumers, creating a strategic opening for other producers. As Brazil supplies nearly one-third of US coffee consumption, importers may seek alternative sources, including Peru, Colombia, Honduras, and Vietnam. In particular, Peru stands to benefit, with its coffee exports exceeding USD 1.1 billion in 2024, driven by high-quality and organic production. As Brazil's shipments become less competitive, Peru could expand its presence in the US market, especially in the growing specialty and sustainable coffee segments.

Vietnam’s coffee exports are projected to reach USD 7.5 billion in 2025, driven by a strong first half of the year (H1-2025) performance of USD 5.45 billion, a 67.5% increase in value compared to 2024. Export volume in the first six months rose by 5.3% to 953.9 thousand mt, with an average price increase of 59.1% to USD 5,708.3/ton. Germany, Italy, and Spain remain the top-consuming markets for Vietnamese coffee, showing substantial export value growth. As the world's largest coffee importer, the US continues to offer opportunities, especially for high-end and specialty products.

The European Union (EU), Vietnam's largest market, classifies the country as "low risk" for deforestation, supporting competitive exports under the European Union Deforestation Regulation (EUDR). Full compliance with EUDR by Jan-26 is critical to maintaining market access. Additionally, Vietnam is expanding its focus on Northeast Asia and India to diversify markets. Despite challenges from climate change and global supply constraints, Vietnam's coffee sector remains well-positioned to sustain growth and strengthen its international presence in 2025.

.png)

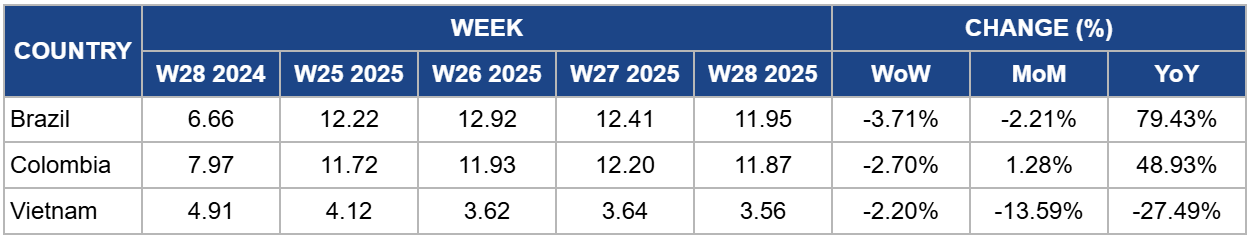

In W28, Brazil's coffee prices fell by 3.71% week-on-week (WoW) to USD 11.95/kg, though they remain 79.43% higher year-on-year (YoY), reflecting ongoing global supply tightness and strong export demand. However, the recent US announcement of a 50% tariff on Brazilian imports, including coffee may shift this trend. As the US is Brazil's largest coffee buyer, accounting for 30% of its coffee exports, the tariff could weaken demand and exert downward pressure on Brazilian coffee prices in the coming weeks. If US buyers reduce imports or shift to lower-tariff suppliers, Brazilian exporters may face reduced margins and seek alternative markets, potentially increasing domestic supply and moderating prices.

In W28, Colombia's coffee prices declined by 2.70% WoW to USD 11.87/kg but remained significantly higher YoY, a rise of 48.93% from USD 7.97/kg in W28 2024. The recent price drop reflects short-term volatility despite strong underlying supply-side pressures. Jun-25 coffee production fell by 22% YoY to 909,000 bags due to excessive rainfall, marking the third consecutive monthly decline. However, exports rose 6% YoY in Jun-25, and cumulative figures for H1-2025 show a 7% increase in output and an 11% rise in exports, signaling medium-term recovery. Continued weather disruptions may tighten supply and support future price increases, although high YoY gains suggest current prices already factor in recent production risks.

Vietnam's coffee prices declined by 2.20% WoW to USD 3.56/kg in W28, marking a steep 27.49% YoY drop from USD 4.91/kg. The downward pressure reflects subdued domestic trading as the crop season winds down and global supply rebounds, particularly from Brazil and Indonesia. Vietnamese farmers have lowered their asking prices amid cautious demand from major roasters, who are concerned about potential US tariffs. Increased rainfall in key growing areas may support future production, while rising export volumes, up 4.1% in H1-2025 and 53% YoY in Jun-25, suggest improved availability. Unless global demand strengthens or geopolitical risks intensify, continued pressure from competitor exports and inventory liquidation may limit short-term price recovery.

Brazilian and Vietnamese exporters should actively pursue alternative markets such as the EU, Northeast Asia, and the Middle East to offset reduced US demand following the tariff hike. Producers of high-quality or organic coffee, especially in Peru, Colombia, and Vietnam, should strengthen their positioning in premium and sustainable segments, where substitution opportunities and consumer loyalty are higher.

Given rising supply from Brazil and falling prices in Vietnam and Colombia, exporters should secure forward contracts or hedge using options to protect against further downside risks. With Arabica futures rising post-tariff announcement but underlying harvest-driven pressure building, strategic sales pacing is essential to maintain profitability in H2-2025.

In Vietnam and Brazil, where falling prices and rising input costs are eroding margins, growers should delay major replanting or input purchases unless tied to yield-critical needs. Emphasizing crop maintenance and cost-reduction measures while monitoring Q4 price signals may preserve liquidity and ensure more efficient capital deployment.

Sources: Tridge, Agrolink, Canal Rural, Sociedade Nacional de Agricultura (SNA), Agro, DF SUD, Infobae, La Nación, Mint

Read more relevant content

Recommended suppliers for you

What to read next