Original content

Raw milk prices across the European Union (EU) are rising, driven by significant production constraints. The average price reached USD 0.62 per kilogram (EUR 0.53/kg) in Jun-25, a 15% increase compared to the same period last year. This upward trend is attributed to a reduction in cattle herds, a consequence of bluetongue disease outbreaks and persistent drought conditions, which have collectively restrained milk yields. The impact of this supply shortage is being felt across the dairy sector, contributing to higher prices for key products like butter. While prices have risen in major producing nations like France and the Netherlands, the situation varies across the bloc, with some countries like Slovakia seeing a decrease. The ongoing reduction in the EU's cattle population suggests that these supply-side pressures and elevated prices are likely to persist in the near term.

The EU’s dairy sector is on high alert as the United States (US) threatens to impose a 30% tariff on most EU imports, including cheese and other dairy products, starting August 1. French dairy producers have described the potential duty as "disastrous," warning it could jeopardize a significant portion of their USD 407.37 million (EUR 350 million) in annual sales to the US and make their products uncompetitive for American consumers. The Spanish Federation of Food and Beverage Industries (FIAB) has echoed the alarm, highlighting the strategic importance of the US market. In response, the European Commission (EC) has extended its suspension of retaliatory measures until early Aug-25, emphasizing a preference for a negotiated solution while preparing countermeasures worth up to USD 83.9 billion (EUR 72 billion) if talks fail. The uncertainty is forcing the European dairy industry to consider contingency strategies, including market diversification and accelerating shipments before the deadline.

The United Kingdom (UK) has implemented new safeguard measures restricting certain dairy imports from France following a confirmed outbreak of lumpy skin disease (LSD) in late Jun-25, which resulted in the country losing its disease-free status. Effective from July 11, 2025, the new rules suspend imports of raw milk and raw dairy products, creating a significant trade barrier for French producers. The restrictions specifically target bovine milk products that have undergone heat treatment less than full pasteurization, such as heat-treated cheeses, if their aging or maturation process began on or after May 23, 2025. This directly impacts a key segment of France's export market to the UK, particularly affecting producers of certain artisanal and raw-milk cheeses. However, products that are fully pasteurized or long-aged hard cheeses that began their maturation process before this date are exempt from the new rules and can continue to be imported.

Australia's competition regulator, the Australian Competition & Consumer Commission (ACCC), has announced it will not oppose the proposed acquisition of Fonterra's Australian consumer and food service businesses by French dairy giant Lactalis. The ACCC concluded that the deal is unlikely to substantially lessen competition, citing the presence of alternative raw milk buyers in Victoria and Lactalis's limited existing footprint in Tasmania. The regulator also noted a lack of significant product overlap between the two companies. While the decision clears a major regulatory hurdle, the deal is not yet final, as Fonterra is still considering its options. However, the potential merger has raised concerns among farmer groups, who fear that further market concentration could put downward pressure on farmgate milk prices in an already fragile industry. Lactalis appears to be the front-runner, with few other bidders publicly noted.

Major German retailers and plant-based milk producers, including Rewe Group and Oatly, have launched a petition demanding that the government lower the value-added tax (VAT) on plant-based milk from 19% to 7%, the same rate applied to cow's milk. The campaign argues that the current tax disparity unfairly penalizes consumers making climate-friendly and health-conscious choices, contradicting Germany's own sustainability goals. If successful, the VAT reduction would have a significant market impact, bringing the average price of plant-based milk nearly to parity with dairy. Proponents state this would create a level playing field, remove a financial barrier for consumers with allergies or dietary preferences, and better align Germany with other European nations that have already adopted equal tax rates. The move is framed as a crucial step towards a more modern and socially just food policy. However, it could have a negative impact on dairy milk sales if consumers decide to switch to plant-based alternatives.

In a significant move towards food sovereignty, the Mexican government has announced a historic plan to reduce its heavy reliance on milk powder imports from the US by establishing a national processing plant. This initiative is designed to bolster the domestic dairy industry by creating a stable, internal market for raw milk, thereby boosting local production and enhancing farmer confidence. While the project faces considerable challenges, including significant initial investment and complex logistics, the long-term benefits are substantial. A domestic plant is expected to stabilize prices, create jobs, and strengthen Mexico's entire agro-industrial value chain. This strategic shift will gradually alter the dairy trade relationship with the US, positioning Mexico for greater economic resilience and self-sufficiency in a key food sector.

New Zealand's dairy sector is navigating a period of precarious prosperity, with farmers capitalizing on the USD 5.96 (NZD 10) per kilogram of milk solids (kgMS) price to significantly reduce debt rather than expand operations. Despite record export returns, rising on-farm costs, including dramatic increases in fertilizer and fuel prices, have pushed the breakeven milk price up to an estimated USD 5.18/kgMS (NZD 8.68/kgMS) for the upcoming 2025/26 season against an estimated payout of USD 6.09/kgMS (NZD 10.21/kgMS). In a notable shift towards financial consolidation, farmers have repaid over USD 890 million (NZD 1.5 billion) in debt over the last 12 months, the largest annual reduction since 2010. Marked by reduced on-farm investment and a focus on efficiency, this conservative approach highlights a strategic move to build resilience against global market volatility and ensure long-term sustainability for the industry.

Paraguay's dairy sector has experienced a significant downturn in the first half of 2025, with export revenues falling by 48% to USD 21.5 million. The volume of dairy products shipped, primarily powdered milk, dropped by an even steeper 57% to 5,150 metric tons (mt) compared to the same period last year. This sharp decline in exports is a direct result of a domestic production shortfall. Industry leaders report that the expected seasonal increase in milk output for June and July has failed to materialize, with daily production estimated to be down by as much as 5%, or 125,000 liters (L). While powdered milk remains the dominant export, constituting 90% of shipments to key markets like Brazil and Bolivia, the current production challenges are hampering the sector's ambitions to consolidate and expand its international presence.

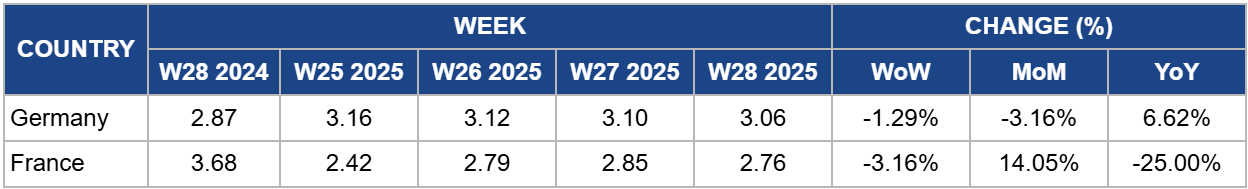

In Germany, milk prices decreased by 1.29% in W27 to USD 3.06/kg. This results in a decrease of 3.16% over the past month. However, prices are still up 6.62% since the same time last year. The recent weekly and monthly price dips indicate a short-term softening. This is likely due to the market moving past the seasonal peak in milk production that typically occurs in late spring. Furthermore, underlying consumer demand may be weakening, a trend highlighted by the major push from retailers and brands to lower the VAT on plant-based milk alternatives, which are gaining significant traction in the German market. Furthermore, the fear of further US tariffs in Aug-25 is potentially adding downward pressure on prices across the EU, including Germany. The 6.62% year-on-year price increase is a direct consequence of reduced milk supply across the EU, including in Germany. This fundamental supply shortage is the primary driver keeping current prices well above last year's levels.

In France, milk prices dipped by 3.16% in W28 to USD 2.76/kg. Despite the recent dip, milk prices are still up 14.05% over the past month but are down 25% compared to the same time last year. The minor weekly price dip appears to be a short-term correction after the sharp monthly rally and could also be short-term softening following seasonal peak production. The dramatic 14.05% month-on-month (MoM) increase is the most critical trend, driven by the EU-wide milk production crisis. Widespread bluetongue disease and drought have reduced cattle herds and constrained milk yields across the EU, including in France, where production is forecast to fall. This supply squeeze is being compounded by a recent LSD outbreak, which has led to UK import restrictions on certain French raw-milk cheeses.

The escalating trade tensions between the US and EU, coupled with Mexico's strategic move towards self-sufficiency, underscore the immense risk of relying on a few key export markets. Dairy exporters, particularly in Europe and New Zealand, must accelerate diversification efforts to build resilience. This requires a proactive strategy to identify and cultivate relationships in emerging and high-growth regions such as Southeast Asia, the Middle East, and Africa, where demand for dairy protein is rising. Companies should invest in understanding local consumer preferences, navigating regulatory landscapes, and potentially establishing regional partnerships for packaging or distribution. By building a broader, more balanced portfolio of export destinations, the industry can better absorb the shock of sudden tariffs or policy shifts in any single market, ensuring more stable and predictable revenue streams for the future.

The production shortfalls seen in the EU and Paraguay highlight the vulnerability of processors to raw material supply shocks. To mitigate this, large-scale dairy processors should prioritize investments that enhance supply chain resilience and control. This could involve following Mexico's lead by investing in domestic processing infrastructure, like milk powder plants, to create a stable internal demand for local farmers and reduce dependence on volatile global commodity markets. Furthermore, processors should consider deeper partnerships or direct investment at the farm level, providing financial and technical support to producers in exchange for a more secure and predictable milk supply. This strategy of vertical integration strengthens the entire value chain, making it less susceptible to disruptions from disease, climate events, or geopolitical instability.

The current economic climate of high input costs and market volatility makes financial discipline a critical priority for farmers. The strategy adopted by New Zealand farmers—using strong payouts to aggressively pay down debt rather than chase expansion—serves as a prudent model for producers globally. Farmers should focus on strengthening their balance sheets to create a buffer against future price downturns or unexpected cost spikes. This conservative financial approach should be paired with targeted investments in on-farm technology and efficiency improvements. Adopting new technologies for herd management, feed optimization, and automation can help lower the breakeven cost of production, ensuring profitability even in less favorable market conditions and making farms more resilient in the long term.

Sources: Tridge, Agro Meat, Dairy News Today, Australian Competition & Consumer Commission, UK Government, Green Queen, The Dairy Site, Association of Milk Producers

Read more relevant content

Recommended suppliers for you

What to read next