OPINIO

Original content

The United States (US) tariff hikes were initiated in Feb-25 and revised over the past six months, with the latest adjustment in Aug-25. They have significantly disrupted and realigned trade flows across various sectors, including agricultural trade. Among the products most impacted is beef, following the imposition of a 50% tariff on Brazilian beef. Given Brazil's position as one of the world’s leading beef producers and exporters, this move has significant implications. The elevated tariff is expected to prompt a realignment of global beef trade, creating opportunities for other major exporters aiming to fill the supply gap in the US. However, it will also pose challenges for other market players competing in alternative markets where Brazil may redirect its exports.

It is worth noting that the US hiked tariffs on key beef trading partners at a time when it is grappling with a domestic beef supply shortage caused by a shrinking cattle herd and prolonged drought conditions. According to the United States Department of Agriculture (USDA), the total US cattle inventory stood at 94.2 million heads as of July 1, 2025, including 28.7 million heads of beef cattle. While this represents a slight recovery from the Jan-25 figures, where total population stood at 86.7 million heads and 27.9 million beef cattle, the numbers remain 1% lower compared to the Jul-23 inventory.

This limited supply has contributed to historically high beef prices throughout 2025. For instance, according to Tridge data, US wholesale lean beef (92% to 94% lean) averaged USD 9.52 per kilogram (kg) in Jul-25, reflecting a 6.61% month-on-month (MoM) increase and an 11.61% year-on-year (YoY) rise, with the highest weekly price of USD 9.72/kg recorded in W28. These elevated prices are largely driven by tight supply conditions coupled with strong seasonal demand during the summer. Similarly, US beef export prices climbed to USD 9.72/kg in Jul-25, up 2.21% MoM and 2.10% YoY, due to limited exportable volumes.

Figure 1: US Export and Wholesale Price Trends from 2023 to 2025

In response to ongoing supply constraints, US beef imports in 2025 are projected to reach record-high levels, estimated at 5.38 billion pounds (lbs). Between Jan-25 and May-25, US beef imports totaled 2.51 billion lbs, representing a 34.22% increase compared to the same period in 2024. Brazil emerged as the leading supplier during this period, exporting 665.7 million lbs to the US, marking a significant 108.87% YoY growth. Other notable suppliers included Australia (+34.74% YoY), New Zealand (+13.56% YoY), and Mexico (+9.06% YoY), while shipments from Canada declined by 9.13% YoY. This sharp increase in beef imports highlights the strong and growing demand in the US market, particularly for lean beef, which is commonly used in hamburger production.

However, the recent tariffs introduced in Aug-25, including a 50% increase on Brazilian beef and a 35% tariff on Canadian goods not covered by the US-Mexico-Canada Trade Agreement (USMCA), are expected to impact beef trade flows. Additionally, ongoing border closures with Mexico due to the screw worm outbreak are likely to further disrupt beef supply to the US market. Despite these challenges, the situation presents opportunities for alternative suppliers such as Argentina, Australia, Paraguay, and Uruguay, which continue to operate under a 10% baseline tariff implemented in Apr-25. Exporters from these countries looking to enter or expand their presence in the US market are recommended to adopt a strategic approach. Leveraging data-driven platforms like Tridge Eye can help monitor market trends, identify buyers, and respond effectively to the rising demand for beef in the US.

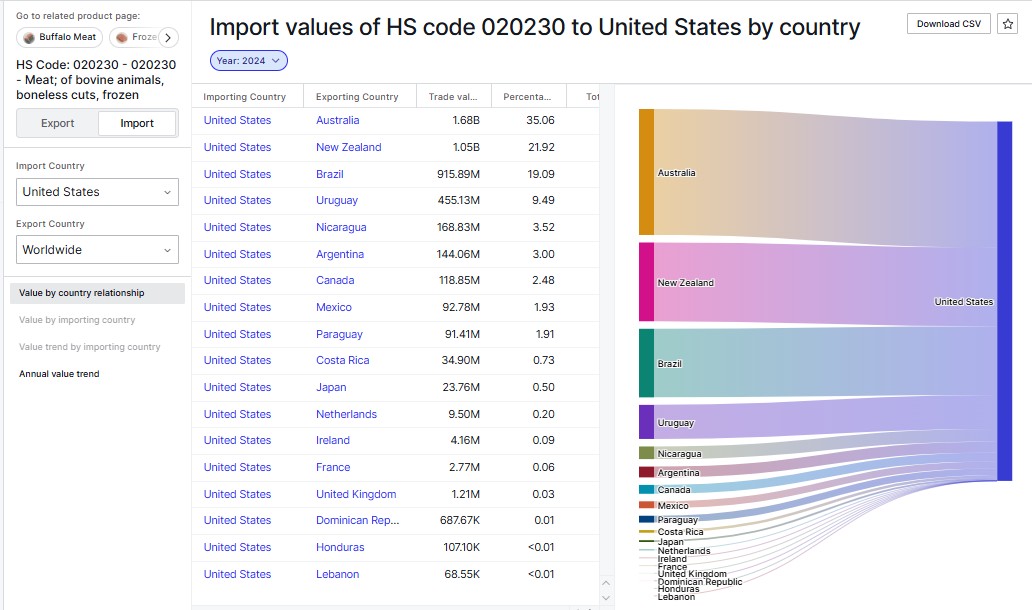

Figure 2: Beef Export Flows to the US in 2024

Source: Tridge Eye

Brazil’s Export Shift Sparks New Rivalries in Asia and Beyond

In Brazil, the 50% tariff is expected to significantly hinder its beef trade with the US and may also have broader implications for global beef markets. According to the Brazilian Association of Meat Exporting Industries (Abiec), the additional tariff raises the total duties on Brazilian beef exports to the US to 76.4%, potentially resulting in an estimated loss of USD 1 billion. Despite these challenges, Brazil’s beef exports reached a record high in Jul-25, totaling 276.9 thousand metric tons (mt) and valued at USD 1.54 billion. This represents a 14.85% MoM growth and 16.74% YoY increase in volume, with export value rising 17.56% MoM and 46.67% YoY. China remains Brazil’s top destination, followed by the US. However, the steep US tariff is likely to weaken Brazil’s export momentum to the American market by increasing costs and reducing the price competitiveness of its beef products.

In response to the elevated US tariffs, Brazil is expected to shift its export focus away from the US and redirect beef shipments primarily to China and other Asian markets, where demand remains strong. Brazil can also shift to the European Union (EU), leveraging the anticipated EU-Mercosur trade agreement. Fortunately, China has extended its investigation into beef imports, originally launched in Dec-24, by an additional three months. This extension offers temporary relief for major exporters such as Brazil, Argentina, and Australia, which had been concerned about potential trade restrictions. At the same time, China’s decision to revoke tariff exemptions on US meat products, particularly beef and pork, is likely to strain the US-China trade relations and erode the competitiveness of US meat exports in the Chinese market. This shift creates an opportunity for Brazil to expand its market share in China as US exporters lose ground. However, a surge in redirected Brazilian beef could lead to oversupply in the Chinese market, potentially depressing prices and impacting other exporters, particularly Argentina, the country's largest beef export destination.

Meanwhile, Australia and Uruguay are poised to benefit from the elevated US tariff on Brazilian beef. Both countries continue to enjoy preferential export terms to the US, with beef shipments subject to a relatively low 10% tariff. In particular, Australia has seen a sharp increase in exports to the US, reaching 43.06 thousand mt in Jul-25, a 22% MoM rise, driven by strong demand and reduced Brazilian supply. The sharp decline in Brazilian beef exports to the US over the past two months, triggered by the new tariff measures, has further boosted Australia’s trade opportunities. While Uruguay may not significantly expand its export volumes to the US, it stands to gain from higher prices due to tighter supplies of lean beef. Argentina is also well-positioned to increase its market share in the US, especially amid ongoing discussions around expanded quotas and potential tariff reductions.

Looking ahead, the recent US tariff hike is expected to significantly reshape global beef trade dynamics, particularly the 50% tariff imposed on Brazil, one of the world's largest beef exporters. While the Brazilian government has made it clear that it will neither retaliate immediately nor abandon cabinet-level talks, it has formally escalated the dispute by filing a World Trade Organization (WTO) request for consultations on August 6, arguing that the US measure violates WTO rules. Given the far-reaching economic implications, it is recommended that the governments involved seek amicable resolutions through diplomatic trade negotiations to avoid further disruptions. Meanwhile, beef exporters should adopt a proactive, data-driven strategy to capitalize on shifting market dynamics. Leveraging trade intelligence platforms such as Tridge Eye will enable them to monitor price trends, identify high-potential buyers, and assess competitor activity in real time. Through this, the potential US partners will gain a competitive edge in the evolving landscape.

Read more relevant content

Recommended suppliers for you

What to read next